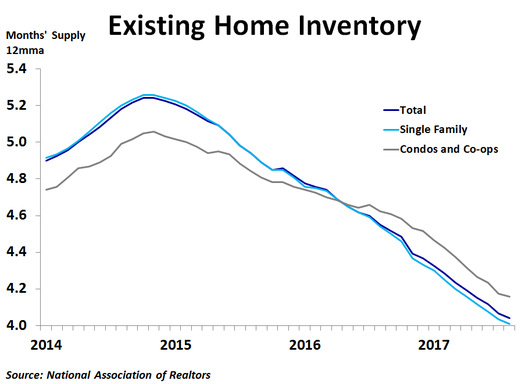

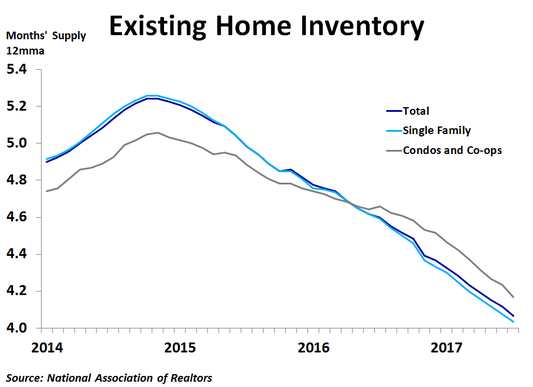

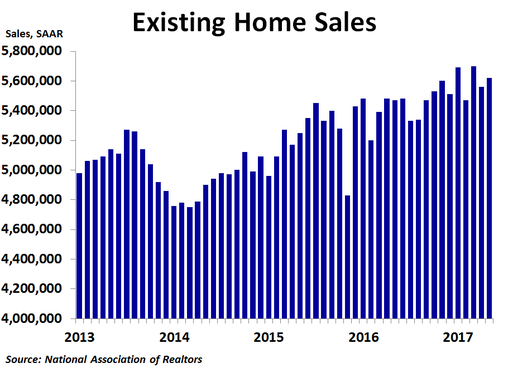

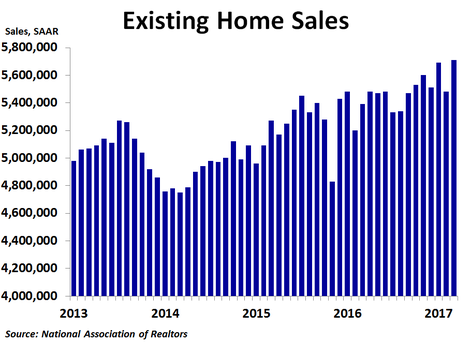

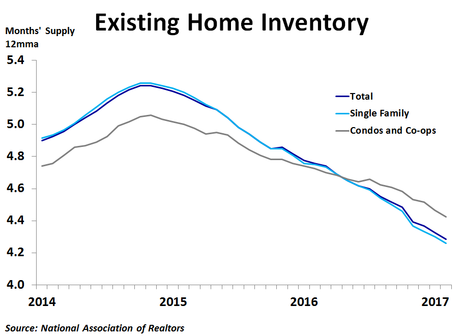

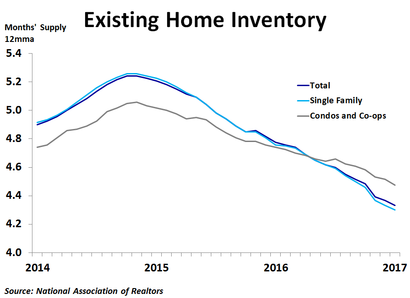

By type, sales were up 1.7% compared to the prior month for condos and co-ops but down 2.1% for single-family homes. On a year-ago basis, sales were up 0.4% for single-family homes but down 1.6% for condos and co-ops. Prices were up 5.6% for single-family homes and 5.4% for condos and co-ops.

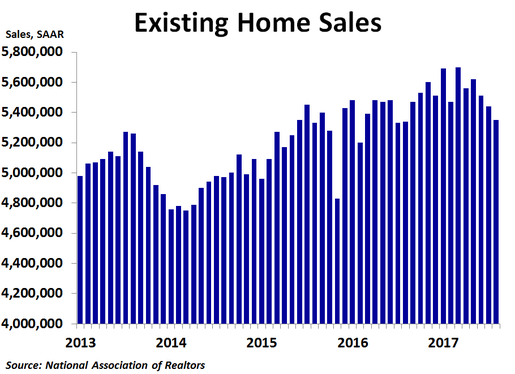

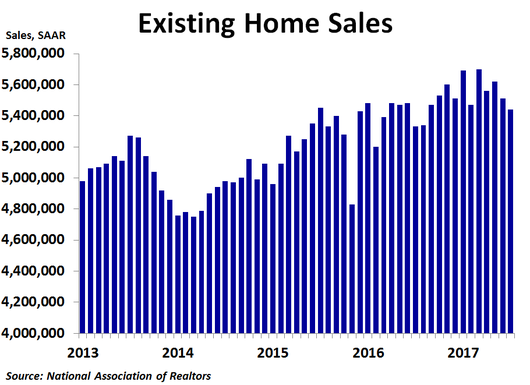

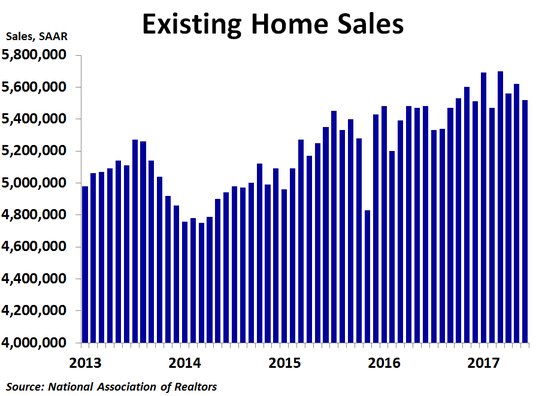

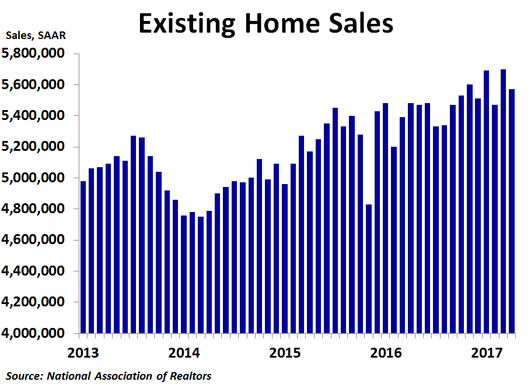

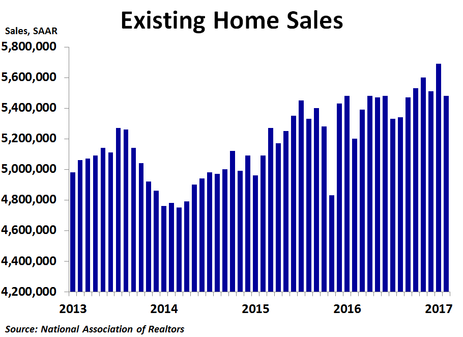

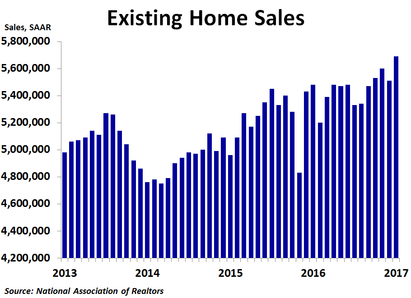

Sales fell in August despite mortgage rates staying below 4.0% for a third straight month. With inflation below the Fed’s target of 2.0%, the Fed held rates steady at last week’s meeting. However, they finally gave the market a start date of October for unwinding their balance sheet. This could send mortgage rates higher, but inflation will also be a big factor.

RSS Feed

RSS Feed