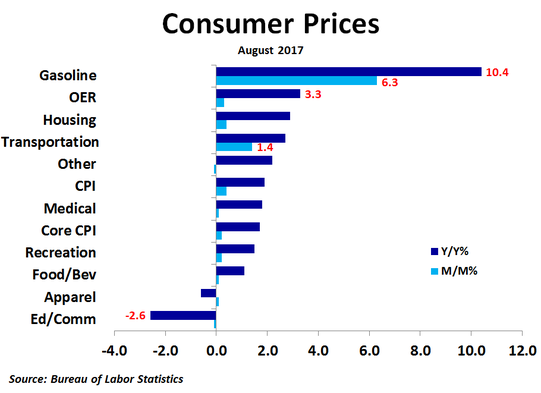

Compared to a year ago, prices were up the most for gasoline (+10.4%), fuel oil (+9.4%), motor vehicle insurance (+8.1%), tobacco and smoking products (+6.3%) and piped gas service (+5.4%). Prices were down the most for used cars and trucks (-3.8%), airline fares (-3.2%), physicians’ services (-0.8%), new vehicles (-0.7%) and apparel (-0.6%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, gasoline and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and recreation.

|

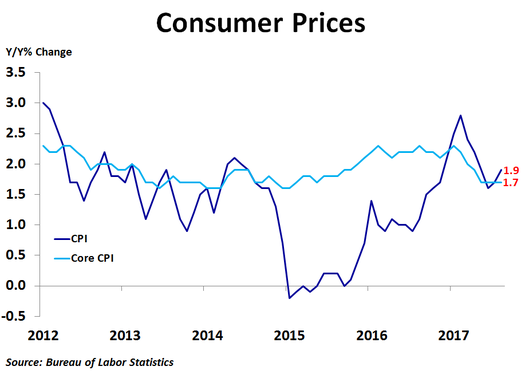

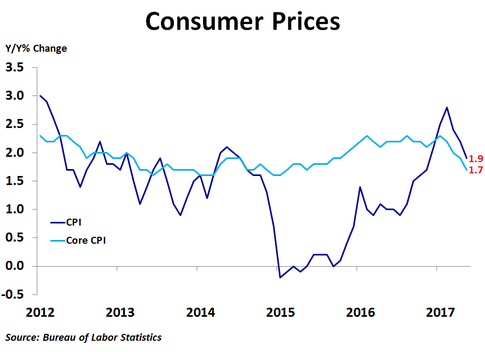

Consumer prices rose 0.4% in August from the previous month, topping the consensus forecast of a 0.3% increase, following a 0.1% increase in July. Compared to a year ago, prices were up 1.9%, up slightly from July’s 1.7% pace. Core prices, which exclude food and energy, rose 0.2%, in line with expectations, and were up 1.7% on a year-ago basis, matching May, June and July for the slowest rate of year-over-year growth since May 2015. Compared to a month ago, prices rose the most for gasoline (+6.3%), fuel oil (+2.9%), motor vehicle insurance (+1.0%), physicians’ services (+0.4%) and owners’ equivalent rent of primary residences (+0.3%). Prices fell the most for airline fares (-1.0%), piped gas service (-0.5%), nonalcoholic beverages and materials (-0.4%), dairy and related products (-0.4%) and used cars and trucks (-0.2%). Gasoline prices accounted for half of the overall increase in the index, while owners’ equivalent rent and lodging away from home also had big positive impacts. Domestically produced farm food, food at home and women’s apparel had the biggest negative effects on the overall price index. Compared to a year ago, prices were up the most for gasoline (+10.4%), fuel oil (+9.4%), motor vehicle insurance (+8.1%), tobacco and smoking products (+6.3%) and piped gas service (+5.4%). Prices were down the most for used cars and trucks (-3.8%), airline fares (-3.2%), physicians’ services (-0.8%), new vehicles (-0.7%) and apparel (-0.6%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, gasoline and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and recreation. Even though employment growth was strong in June, the Federal Reserve held the Fed Funds rate steady at its July meeting as wage growth remained subdued and inflation slowed. Since then job growth has slowed a bit and wage growth has not improved. Even though inflation came in stronger than expected in August, the core rate remains below the Fed’s target of 2.0%, both for the consumer price index and the Fed’s preferred measure, the personal consumption expenditures price index. In addition, the sharp increase in gas prices in August was in part driven by a month-end spike due to Hurricane Harvey’s impact on oil refineries. With gas price increases likely temporary, a nation rebuilding from storms and fires and continued geopolitical tensions, the Fed is expected to hold rates steady tomorrow.

0 Comments

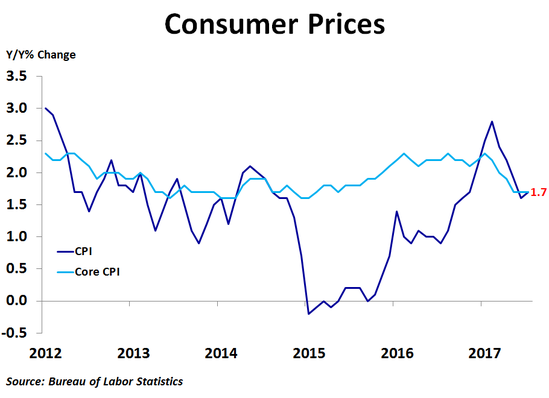

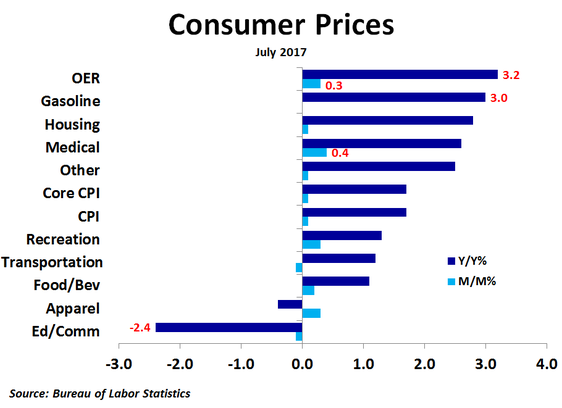

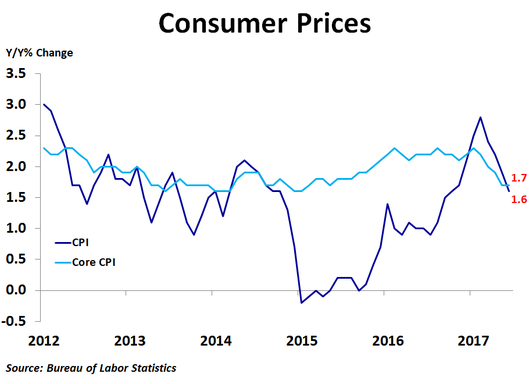

Consumer prices rose 0.1% in July from the previous month, missing the consensus forecast of a 0.2% increase, following no change in June. Compared to a year ago, prices were up 1.7%, up slightly from June’s 1.6% pace, which was the lowest since October. Core prices, which exclude food and energy, also rose 0.1%, missing the forecast of a 0.2% increase, and were also up 1.7% on a year-ago basis, matching May and June for the slowest rate of year-over-year growth since May 2015. Compared to a month ago, prices rose the most for medical care commodities (+1.0%), meats and poultry (+0.7%), airline fares (+0.7%), fruits and vegetables (+0.5%) and hospital services (+0.5%). In a rare occurrence, owners’ equivalent rent of primary residences did not make the top five. Prices fell the most for piped gas service (-2.3%), fuel oil (-2.0%), used cars and trucks (-0.5%), new vehicles (-0.5%) and cereals and bakery products (-0.4%). Gasoline prices were unchanged on the month. Owners’ equivalent rent, medical care and recreation services had the largest positive effects on the price index, while the biggest negative effects came from other lodging away from home, piped gas service and new vehicles. Compared to a year ago, prices were up the most for motor vehicle insurance (+7.6%), piped gas service (+7.5%), tobacco and smoking products (+7.1%), hospital services (+5.7%) and rent of primary residence (+3.8%). Gasoline prices were up 3.0% from a year ago, but that is only because prices tumbled last July. Prices were down the most for used cars and trucks (-4.1%), airline fares (-2.5%), physicians’ services (-0.6%), new vehicles (-0.6%) and cereals and bakery products (-0.5%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, medical care and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and household furnishings and supplies. Even though employment growth was strong in June, the Federal Reserve held the Fed Funds rate steady at its July meeting as wage growth remained subdued and inflation slowed. With inflation still below the Fed’s target of 2.0% for the personal consumption expenditures index, its preferred measure of inflation, it is very likely that the Fed will choose to leave the Fed Funds rate unchanged again in September. Throw in rapidly mounting tensions with North Korea, and the Fed just might remain on the sidelines for the rest of this year.

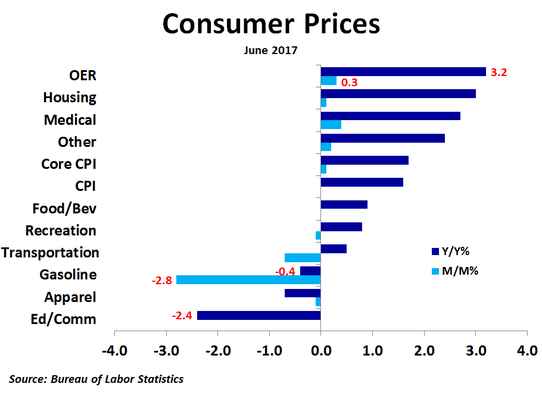

Consumer prices were unchanged in June from the previous month, missing the consensus forecast of a 0.1% increase, following a 0.1% decrease in May. Compared to a year ago, prices were up just 1.6%, down from May’s 1.9% pace and the lowest since October. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.7% on a year-ago basis, matching May for the slowest rate of growth in two years. Compared to a month ago, prices rose the most for motor vehicle insurance (+1.0%), hospital services (+0.9%), medical care commodities (+0.7%), meats and poultry (+0.6%) and owners’ equivalent rent of primary residences (+0.3%). Prices fell the most for fuel oil (-3.7%), gasoline (-2.8%), airline fares (-2.7%), used cars and trucks (-0.7%) and electricity (-0.6%). Thus, air and road travel both became less expensive, but it became more expensive to insure a vehicle. Owners’ equivalent rent, motor vehicle insurance and hospital services had the largest positive effects on the price index, while the biggest negative effects came from gasoline, household energy and other lodging away from home. Compared to a year ago, prices were up the most for piped gas service (+12.8%), motor vehicle insurance (+7.7%), tobacco and smoking products (+6.8%), hospital services (+5.7%) and fuel oil (+4.3%). Prices were down the most for used cars and trucks (-4.3%), airline fares (-4.3%), meats and poultry (-0.9%), apparel (-0.7%) and gasoline (-0.4%). Yes, you heard right, gasoline prices are now down from a year ago after being up a whopping 31% from the prior year back in February. The biggest positive effects on a year-ago basis came from owners’ equivalent rent, motor vehicle insurance and hospital services, while the biggest negative effects came from wireless phone services, education and communication services and used cars and trucks. Despite a slew of weak economic data in May, the Fed raised interest rates anyway at the June FOMC meeting, citing a low unemployment rate and expected improvement in inflation and job growth. Since then, we have been treated to another month of weak wage growth, retail sales, producer price data and consumer price data. Although employment growth is strong and unemployment is low, inflation is starting to cool again. This would suggest no rate hike at the Fed’s July meeting, but that’s what we thought last time. If inflation is their priority, a rate hike is not needed.

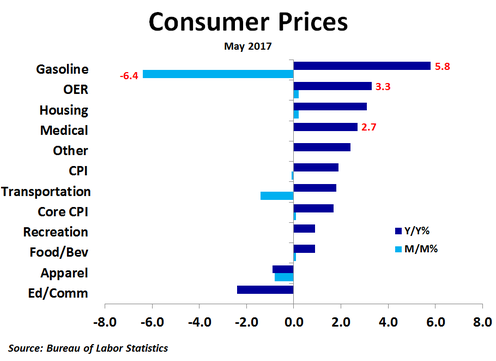

Consumer prices fell 0.1% in May from the previous month, missing the consensus forecast of no change, following a 0.2% increase in April. Compared to a year ago, prices were up 1.9%, down from April’s 2.2% pace. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.7% on a year-over-year basis, the slowest rate of growth since May 2015. Compared to a month ago, prices rose the most for piped gas service (+1.9%), non-alcoholic beverages (+1.1%), motor vehicle insurance (+1.1%), medical care commodities (+0.4%) and cereals and bakery products (+0.3%). Prices fell the most for gasoline (-6.4%), fuel oil (-2.8%), airline fares (-2.7%), apparel (-0.8%) and fruits and vegetables (-0.6%). Thus, air and road travel both became less expensive, but it became more expensive to insure a vehicle. Owners’ equivalent rent, motor vehicle insurance and piped gas service had the largest positive effects on the price index, while the biggest negative effects came from gasoline, apparel and airline fares. Compared to a year ago, prices were up the most for piped gas service (+12.8%), fuel oil (+11.9%), tobacco and smoking products (+7.6%), motor vehicle insurance (+7.0%) and gasoline (+5.8%). It is notable that gasoline is up only 5.8% from a year ago after being up 30.7% back in February. Prices were down the most for used cars and trucks (-4.3%), airline fares (-2.9%), meats and poultry (-2.1%), apparel (-0.9%) and cereals and bakery products (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest positive effects on a year-ago basis came from owners’ equivalent rent of primary residence, medical care and gasoline, while the biggest negative effects came from wireless phone services, used cars and trucks and meats. With May data showing weak job growth, slowing wage growth, flat producer prices, a decline in consumer prices and weaker than expected retail sales, one would think the Fed would have held rates steady at today’s FOMC meeting. However, they raised interest rates anyway, citing a low unemployment rate and expected improvement in inflation and job growth. Although core producer prices are accelerating on a year-ago basis, consumer price growth is slowing. Thus, either the Fed is concerned about producer price inflation passing through soon, or they are more focused on policy normalization, or most likely, both.

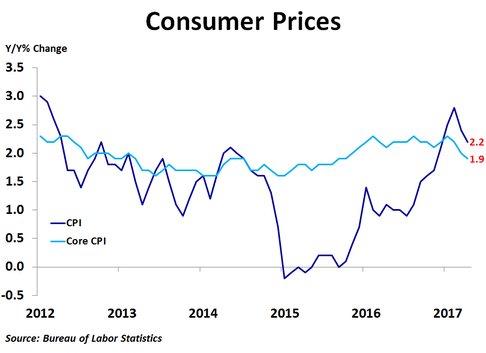

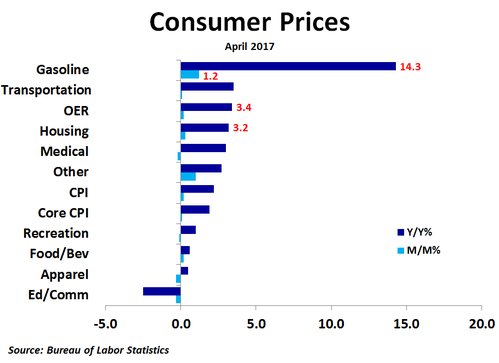

Consumer prices rose 0.2% in April from the previous month, matching the consensus forecast, following a 0.3% drop in March. Compared to a year ago, prices were up 2.2%, down from March’s 2.4% pace. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.9% on a year-over-year basis, the lowest since October 2015. Compared to a month ago, prices rose the most for tobacco and smoking products (+4.2%), fruits and vegetables (+2.2%), piped gas service (+2.2%), gasoline (+1.2%) and hospital services (+1.0%). Prices fell the most for physicians’ services (-1.2%), medical care commodities (-0.8%), airline fares (-0.6%), meats and poultry (-0.6%) and used cars and trucks (-0.5%). Thus, while air travel became less expensive, road travel became more expensive. Owners’ equivalent rent accounted for a quarter of the overall increase in prices, while gasoline accounted for one-fifth of the increase. The biggest negative contributions to the index came from physicians’ services, medicinal drugs and men’s apparel. Compared to a year ago, prices were up the most for fuel oil (+22.1%), gasoline (+14.3%), piped gas service (+12.0%), tobacco and smoking products (+7.7%) and motor vehicle insurance (+6.7%). Prices were down the most for used cars and trucks (-4.6%), meats and poultry (-3.0%), cereals and bakery products (-0.8%), airline fares (-0.6%) and nonalcoholic beverages (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the overall increase in the index. Although job growth bounced back in April, today’s inflation report, along with a slight slowdown in wage growth and weaker than expected retail sales growth, point to the possibility that the Fed may hold off again at its next meeting in June. Although a June rate hike seemed like it was almost a certainty after the jobs report, the lowest core inflation rate in a year and a half suggests the Fed has a bit more wiggle room than thought a week ago. There appears to be a little inflation in the pipeline for producers in the early stages of the supply chain, so we’ll need to watch that. Inflation, retail sales and political uncertainty will likely keep interest rates near current levels in May.

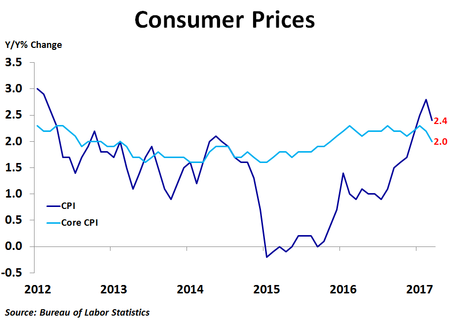

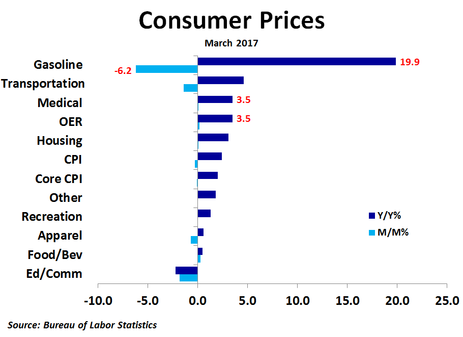

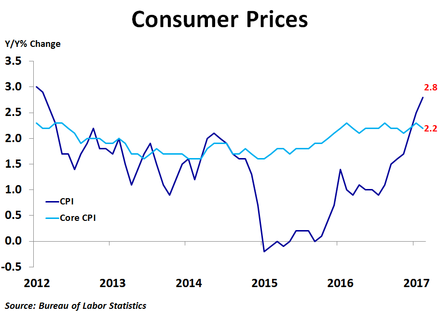

Consumer prices fell 0.3% in March from the previous month, missing the consensus forecast of no change, following a 0.1% increase in February. Compared to a year ago, prices were up 2.4%, down from February’s 2.8% pace. Core prices, which exclude food and energy, fell 0.1%, missing the forecast of a 0.2% increase, and were up 2.0% on a year-over-year basis, the lowest since November 2015. Compared to a month ago, prices rose the most for fruits and vegetables (+1.6%), motor vehicle insurance (+1.2%), tobacco and smoking products (+0.5%), hospital services (+0.4%) and airline fares (+0.4%). Prices fell the most for gasoline (-6.2%), used cars and trucks (-0.9%), piped gas (-0.8%), fuel oil (-0.8%) and apparel (-0.7%). Thus, while air travel became more expensive, road travel became less expensive. Gasoline accounted for two-thirds of the overall decline in prices, while information, education and wireless phone services also had significant negative impacts. These declines were somewhat offset by a 0.2% rise in owners’ equivalent rent of primary residence. Compared to a year ago, prices were up the most for fuel oil (+24.9%), gasoline (+19.9%), piped gas service (+10.3%), motor vehicle insurance (+8.1%) and hospital services (+4.7%). Prices were down the most for used cars and trucks (-4.7%), meats and poultry (-2.6%), fruits and vegetables (-1.8%) and cereals and bakery products (-0.4%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the increase. This report breaks the consistent accelerating trend that has been in place since last summer. Along with a weak jobs report and a decline in retail sales, economic data for March may give the Fed something to think about at its next meeting in May. With core inflation slowing down there does not appear to be an urgent need to raise interest rates further. It might be a good idea to wait and see if the soft data for March is a sign of a weakening economy or just a bad month. Even though the Fed raised rates last month, the 10-year Treasury yield has fallen amid weaker economic data and geopolitical tensions, helping to bring down mortgage rates as well. This should help to keep the all-important housing market going for a little while longer.

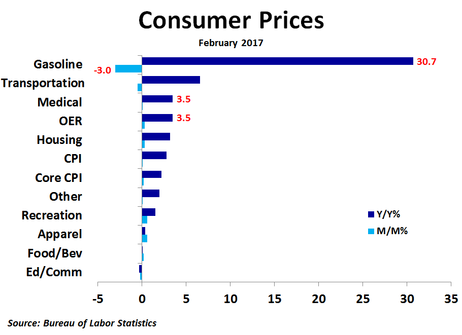

Consumer prices rose 0.1% in February from the previous month, in line with expectations, but far less than the 0.6% jump in January. Compared to a year ago, prices were up 2.8%, up from January’s 2.5% pace. Core prices, which exclude food and energy, rose 0.2%, also in line with expectations, and were up 2.2% on a year-over-year basis. Compared to a month ago, prices rose the most for airline fares (+2.4%), non-alcoholic beverages and materials (+1.5%), piped gas service (+1.5%), dairy and related products (+0.8%) and electricity (+0.8%). Prices fell the most for gasoline (-3.0%), used cars and trucks (-0.6%), fuel oil (-0.4%), cereals and bakery products (-0.4%) and medical care commodities (-0.2%). Thus, while air travel became more expensive, road travel became less expensive. While the 0.3% rise in owners’ equivalent rent of primary residence didn’t crack the top five, it did account for 60% of the overall increase in the price index when the category weight, which is the largest, is taken into account. Compared to a year ago, prices were up the most for gasoline (+30.7%), fuel oil (+28.0%), piped gas service (+10.9%), motor vehicle insurance (+7.6%) and hospital services (+4.3%). Prices were down the most for fruits and vegetables (-4.7%), used cars and trucks (-4.3%), meats and poultry (-3.3%), airline fares (-1.1%) and cereals and bakery products (-1.1%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together comprising almost 2/3 of the increase. The noticeable acceleration of inflation over the last several months, along with a quickening pace of wage growth, led the Federal Reserve to raise the Federal Funds rate range to 0.75%-1.00% today. While the move was widely anticipated, it did not come without some questions. One of the biggest sources of confusion is why the Fed is raising rates even though they only expect 2.0% economic growth over the next couple of years, a forecast which has not changed much recently. In addition, while wages are rising, the pace of growth is fairly gradual and remains far slower than wage growth prior to the recession. Despite these concerns, with inflation measures at or above the Fed’s target, they felt it was necessary to raise rates now to prevent faster tightening down the road, which could cause a recession.

|

Archives

September 2017

Categories

All

|

RSS Feed

RSS Feed