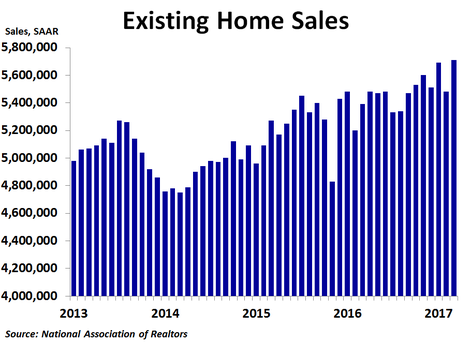

Existing home sales rose in March to 5.71 million units on a seasonally adjusted annualized basis, a big jump from February’s 5.48 million units and more than the consensus forecast of 5.61 million units. Sales were up 4.4% from the prior month and 5.9% from a year ago, besting February’s 5.2% growth rate.

By region, sales jumped 10.1% from the prior month in the Northeast and 9.2% in the Midwest following a fairly weak February for those regions. Sales rose a smaller 3.4% in the South following a strong performance in February. The West was the only region where sales fell, having declined by 1.6%. Compared to a year ago, sales were up a strong 8.5% in the South, 5.2% in the West, 4.1% in the Northeast and 3.1% in the Midwest. Median prices were up the most in the South at 8.6% compared to a year ago, while they were up 8.0% in the West, 6.2% in the Midwest and 2.8% in the Northeast. The national median price was up 6.8%, down from February’s 7.6% rate of growth.

Sales rose 5.0% from February for condos and co-ops and 4.3% for single-family homes. On a year-ago basis, sales were up 6.1% for single-family homes and 5.0% for condos and co-ops. Prices were up 8.0% for condos and co-ops and 6.6% for single-family homes.

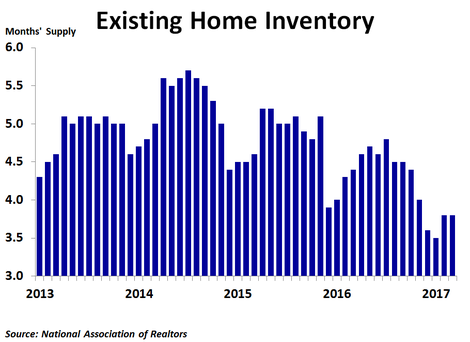

Inventory continues to be the big story right now. In March, inventories jumped 5.8%, the third straight monthly increase and the most in a year. However, sales rose almost as fast, keeping the month’s supply at 3.8. The 12-month moving average fell further to just 4.2 months, down significantly from a couple years ago. One big reason that inventories are so low is that some people who bought homes at the peak of the bubble in 2006 still have not recuperated all of their losses. What homes do get listed are often scooped up quickly, and sellers are getting multiple offers that in some cases are above the asking price. This suggests a market top in prices may be near as buyers will likely not overbid for homes for too long.

Sales rose 5.0% from February for condos and co-ops and 4.3% for single-family homes. On a year-ago basis, sales were up 6.1% for single-family homes and 5.0% for condos and co-ops. Prices were up 8.0% for condos and co-ops and 6.6% for single-family homes.

Inventory continues to be the big story right now. In March, inventories jumped 5.8%, the third straight monthly increase and the most in a year. However, sales rose almost as fast, keeping the month’s supply at 3.8. The 12-month moving average fell further to just 4.2 months, down significantly from a couple years ago. One big reason that inventories are so low is that some people who bought homes at the peak of the bubble in 2006 still have not recuperated all of their losses. What homes do get listed are often scooped up quickly, and sellers are getting multiple offers that in some cases are above the asking price. This suggests a market top in prices may be near as buyers will likely not overbid for homes for too long.

After a big jump following the election, mortgage rates have edged down again over the last couple months as investors have become a bit more concerned about the ability of the new administration to pass pro-growth policies, while geopolitical tensions have mounted. It is likely that the post-election jump in mortgage rates got some people off the fence to buy a house before rates rose further. Those sales may have been pulled forward, so the next couple months may see softer sales despite the recent decline in mortgage rates.

RSS Feed

RSS Feed