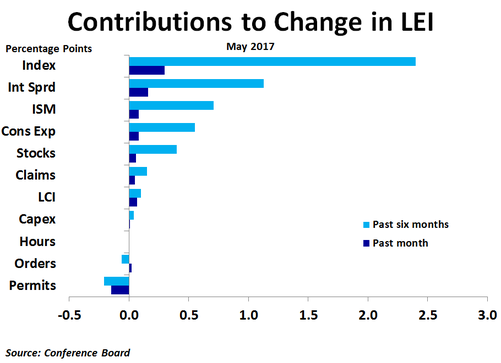

The biggest negative contribution once again came from building permits, the third time in the last four months this has been the case. Permits took 0.15 percentage points away from growth in the index as permits fell to 1.168 million units on an annualized basis in May from 1.228 million units in April.

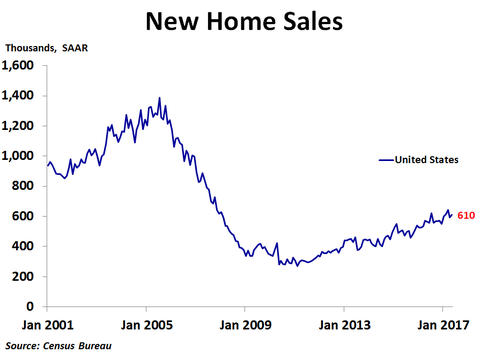

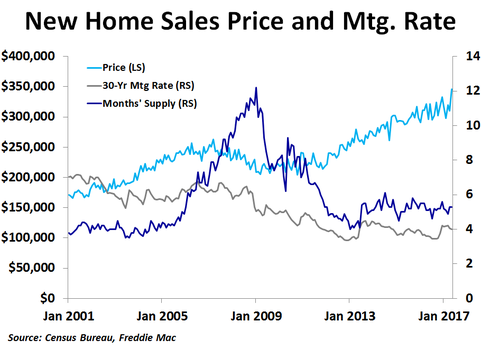

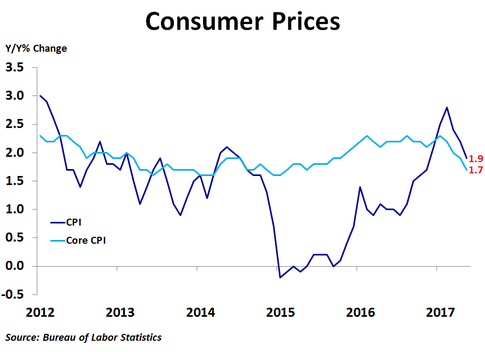

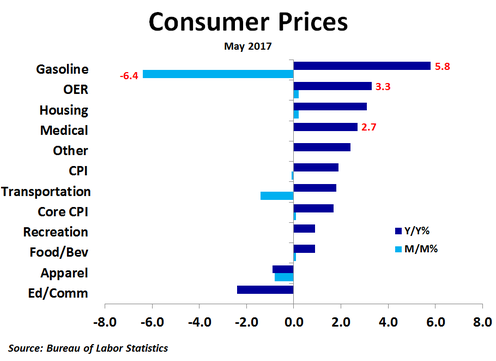

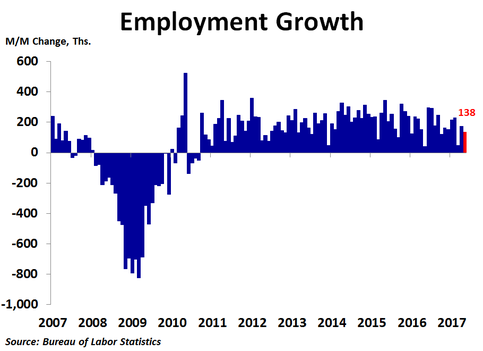

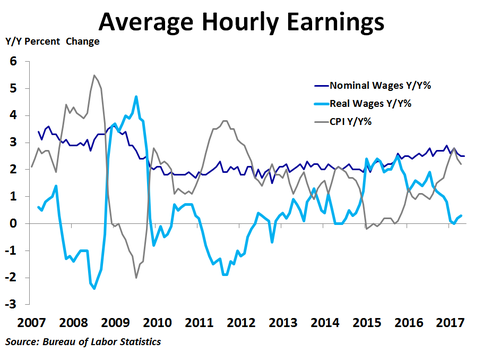

Given slowing inflation, weak wage and job growth and signs of a possible top in housing, the Fed’s June rate hike appears a bit misplaced. Talk of trimming its balance sheet also seems to be coming at the wrong time.

RSS Feed

RSS Feed