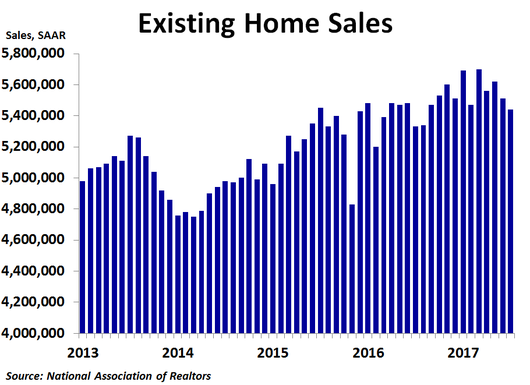

Existing home sales fell in July to 5.44 million units on a seasonally adjusted annualized basis, down from June’s 5.51 million units, less than the consensus forecast of 5.57 million units and the lowest reading since last August. Sales were down 1.3% from the prior month but were up 2.1% from a year ago.

By region, sales increased 5.0% from the prior month in the West and 2.2% in the South, but fell 5.3% in the Midwest and plunged 14.5% in the Northeast. Compared to a year ago, sales were up the most in the West at 5.0% and were up 3.6% in the South. Sales were down 1.5% in the Northeast and 1.6% in the Midwest. For the Midwest, it was the fourth straight month without an increase in sales from the prior year. Median prices were up the most in the West at 7.6% compared to a year ago, while they were up 6.7% in the South, 5.9% in the Midwest and 4.1% in the Northeast. The national median price was up 6.2%, down slightly from June’s 6.3% rate of growth.

By type, sales were down 0.8% compared to the prior month for single-family homes and down 4.8% for condos and co-ops. On a year-ago basis, sales were up 5.3% for condos and co-ops and just 1.7% for single-family homes. Prices were up 6.3% for single-family homes and 5.3% for condos and co-ops.

By type, sales were down 0.8% compared to the prior month for single-family homes and down 4.8% for condos and co-ops. On a year-ago basis, sales were up 5.3% for condos and co-ops and just 1.7% for single-family homes. Prices were up 6.3% for single-family homes and 5.3% for condos and co-ops.

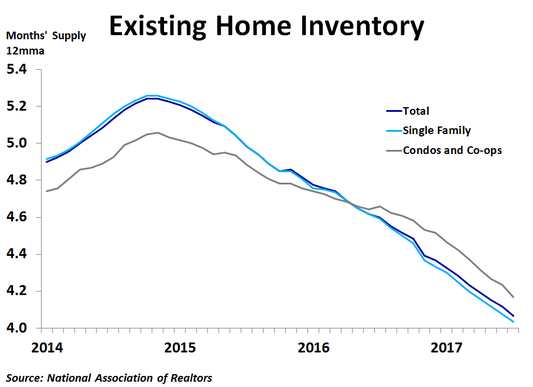

Inventory continues to be a big story right now. In July, inventories fell 1.0%. However, since sales fell a slightly larger 1.3%, the ratio of inventories to sales, or the months’ supply, held steady at 4.2 for the third straight month. The 12-month moving average also held steady at 4.1 months, down significantly from a couple years ago. One big reason that inventories are so low is that some people who bought homes at the peak of the bubble in 2006 still have not recuperated all of their losses. On the other hand, many who would like to upgrade are finding prices too high so they are staying in their current home, preventing others from buying their house and keeping supply limited. What homes do get listed are often scooped up quickly, and sellers are getting multiple offers that in some cases are above the asking price. This suggests we may be getting very close to a cyclical a peak in prices.

Sales fell in July despite mortgage rates staying below 4.0% for a second straight month. With inflation below the Fed’s target of 2.0% and political uncertainty weighing on bond yields, mortgage rates remain very favorable. When the Fed starts to trim its balance sheet, mortgage rates could start to rise. Stay tuned!

Sales fell in July despite mortgage rates staying below 4.0% for a second straight month. With inflation below the Fed’s target of 2.0% and political uncertainty weighing on bond yields, mortgage rates remain very favorable. When the Fed starts to trim its balance sheet, mortgage rates could start to rise. Stay tuned!

RSS Feed

RSS Feed