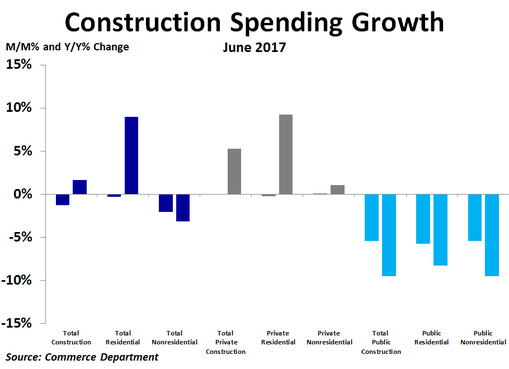

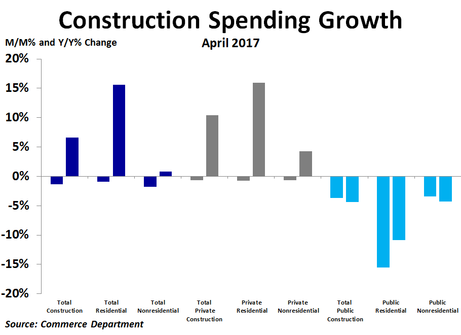

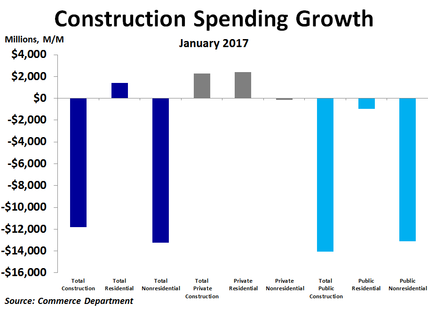

For non-residential spending, only two of fifteen categories saw spending increases. Spending on office projects rose by $1.4 billion, or 1.9%, and spending on communications projects rose by $612 million, or 2.8%. Every other category saw spending fall, led by a huge $5.7 billion, or 6.4%, decline in spending on highways and streets, which took the level of spending down to the lowest in over three years. Other notable declines were a $3.9 billion, or 4.3%, decline in education spending and a $1.2 billion, or 1.8%, decline in manufacturing. The biggest percentage declines came in conservation and development, where spending dropped 7.3%, and public safety, where spending fell 6.5% from the prior month.

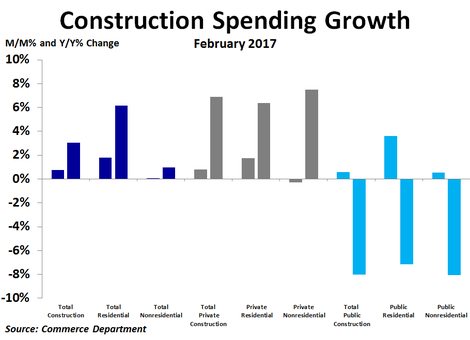

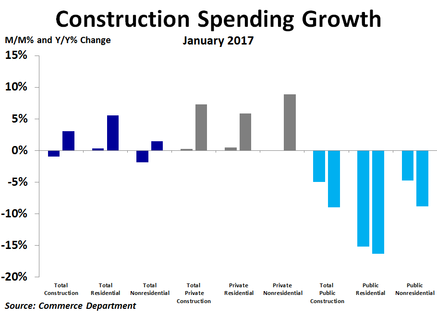

Private spending only fell by $573 million, or 0.1%, with all of the decline coming from residential projects. Although non-residential spending rose by $503 million, or 0.1%, that included a $1.8 billion, or 2.9%, increase in spending on office projects and a $1.3 billion, or 1.9%, decrease in manufacturing. Meanwhile, public spending cratered by $15.2 billion, or 5.4%, half of which came from just two categories, with highway and street projects falling by $5.8 billion, or 6.6%, and education spending dropping by $3.9 billion, or 5.5%. Thus, 94% of the drop in total spending came from public non-residential projects.

Last week the Federal Reserve held the Fed Funds rate steady. Today’s very weak report suggests that was a wise move. With inflation slowing, Treasury yields and mortgage rates have been trending down, which should help to support the construction industry.

RSS Feed

RSS Feed