The Federal Reserve's quantitative easing program has kept mortgage rates near record lows, although they have begun to creep up lately, helping to propel the housing recovery, which has become a bright spot in an otherwise weak economy. The big question on everyone's mind is how long will this rebound last? There are still plenty of would-be sellers that are holding out for higher prices that cannot currently sell due to being underwater on their mortgage. If and when prices rise enough, more supply will come on the market, helping to limit further price increases. In addition, while rising mortgage rates may get some people off the fence to go buy a home, that spurt will likely be short lived, until a point is reached when higher prices and mortgage rates start to price some buyers out of the market. Thus, while times are good right now in housing, the industry faces headwinds of rising mortgage rates and more supply coming on the market if and when more homeowners are able to sell.

|

The National Association of Home Builders/Wells Fargo Housing Market Index rose to 52 in June, crossing the demarcation line between a good market and a poor market for the first time since April 2006, suggesting builders expect the housing rebound to continue. All three subcomponents also saw increases, with current sales conditions rising 8 points to 56, prospective buyer traffic rising 7 points to 40, and future sales expectations jumping 9 points to 61, the highest level since March 2006. The overall index has nearly doubled from a year ago, when it stood at just 29, as the housing market has improved noticeably.

The Federal Reserve's quantitative easing program has kept mortgage rates near record lows, although they have begun to creep up lately, helping to propel the housing recovery, which has become a bright spot in an otherwise weak economy. The big question on everyone's mind is how long will this rebound last? There are still plenty of would-be sellers that are holding out for higher prices that cannot currently sell due to being underwater on their mortgage. If and when prices rise enough, more supply will come on the market, helping to limit further price increases. In addition, while rising mortgage rates may get some people off the fence to go buy a home, that spurt will likely be short lived, until a point is reached when higher prices and mortgage rates start to price some buyers out of the market. Thus, while times are good right now in housing, the industry faces headwinds of rising mortgage rates and more supply coming on the market if and when more homeowners are able to sell.

0 Comments

Industrial production was unchanged in May, weighed down by a second straight monthly decline in utility output. A cooler than normal May could have been a culprit in the drop in utility output, which fell 1.8% following a 3.2% decline in April. Mining also saw a pullback to 0.7% from 1.1%. Meanwhile, manufacturing output remained soft, scratching out a 0.1% gain following two months of declines.

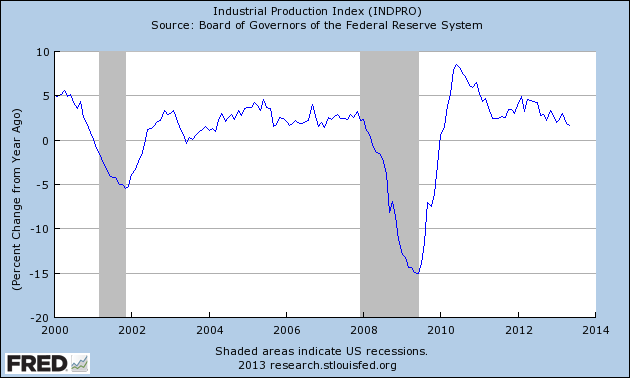

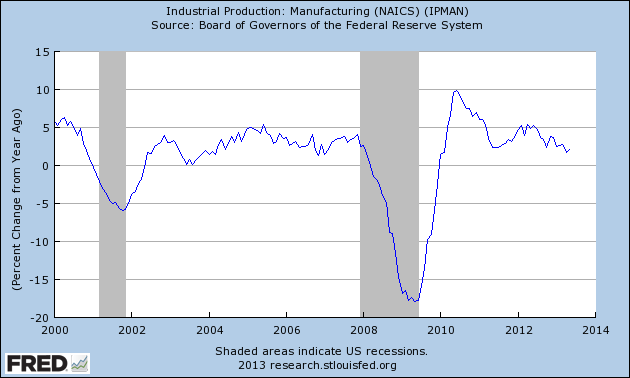

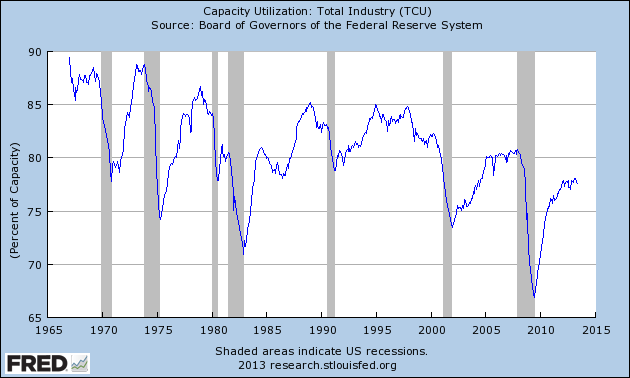

Production of consumer goods was soft again, falling 0.1% on the month after dropping 0.7% in April, as production of foods, tobacco products, paper and consumer energy products fell. Business equipment production increased 0.2% following a 0.3% decline in April, led by increases in electrical instruments and medium and heavy duty trucks. It is clear that industrial production is weakening, as production was only 1.6% higher than a year ago in May, the lowest rate of growth since February 2010 (chart 1). Although utility production has been very weak lately, the much larger manufacturing component also remains subdued (chart 2). In addition, capacity utilization, while much improved since the depths of the recession, appears to be leveling off at levels not much higher than the troughs of past business cycles (chart 3). This report, along with the softness in core producer inflation, will allow the Fed to continue its accommodative monetary stance with little concern about inflation for the time being. Producer prices rose 0.5% in May from the prior month, much more than the 0.2% expected increase. Prices were up 1.8% from a year ago (chart 1), more than double the 0.7% pace in April. Excluding food and energy, prices were up 0.1% from April and 1.6% from a year ago (chart 2), in line with expectations.

The increase in prices was largely attributed to a 0.4% rise in prices for light trucks. Food and energy prices also contributed. Food prices rose 0.6%, driven primarily by a 41% surge in egg prices. Meanwhile, gas prices rose 1.5% in May following a 6.0% decline in April, helping to push up energy prices by 1.3%. While less benign than the import price report, the fact that core producer inflation remains well contained and is still trending downward (chart 2) will ease any inflationary concerns the Fed may have, suggesting business as usual for monetary policy. Still, the markets eagerly await Bernanke's comments at next week's FOMC meeting. Import prices fell 0.6% in May from the prior month, the third straight decline, led by a 1.9% drop in fuel prices. Compared to a year ago, prices were down 1.9%, the eleventh month in the past twelve that prices have been lower than the prior year (see chart below). From a year ago, fuel prices were down 4.4%, thanks to a 6.2% drop in petroleum prices. The rise in the dollar since February, along with slowing growth in China and emerging markets, has helped to push oil prices moderately lower. Rising concerns about a pullback in Fed stimulus has led to a sharp decline in the dollar over the past few weeks, however, and this has pushed up oil prices in turn. Therefore, we could see a backup in petroleum prices when the June report comes out.

Still, the continued downtrend in overall import prices is helping to keep inflation in check, which is good for consumers, fixed income investors and domestic firms who import crude and intermediate goods for use in manufacturing. On the other hand, deflation in import prices is a concern for the Fed, even more so than inflation. This is one reason to keep the spigots open. However, the quantitative easing program is doing little to foster price growth because most of the newly printed money is being held in bank accounts at the Fed rather than entering the broader economy as loans (see my post General Thoughts on the Economy). For bond investors and cash holders, this muted import price growth and low inflation environment is good news as, despite very low returns, there is not much loss in purchasing power. For fixed income investors, the bigger worry is a possible pullback in Fed stimulus. When that happens, which it eventually will, interest rates will most likely rise, leading to losses for bond holders. If the economy remains weak at that point, rising interests could dampen the recovery, which will weigh on stocks as well. Retail sales rose 0.6% in May from the prior month, better than the expected 0.5% increase and a nice rebound from the meager 0.1% rise in April. Motor vehicle and parts dealers led the way with a 1.8% increase. Excluding autos, sales rose 0.3%, slightly less than the 0.4% consensus. Overall sales were up 4.3% from the prior year, an improvement over the 3.7% pace in April, while sales excluding autos were up 3.4%, also better than April's 2.9% clip.

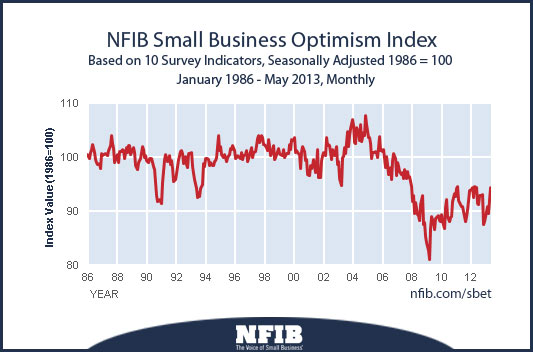

Building and garden supply stores saw sales rise a healthy 0.9%, although this was down sharply from the 3.6% pace in April. The cool and wet weather likely played a role in keeping these sales contained. Strength was also seen in food and beverage stores, with sales rising 0.7% on the month following a 0.6% dip in April as stronger job growth allowed folks to loosen up the purse strings a bit on meals. On the other hand, most of the improvement was for meals at home, as sales at food and drinking places fell 0.4% after a 1.1% increase. It is likely that weather played a role here too as customers desiring to eat at establishments with outdoor seating decided instead to stay home during a cooler-than-average May. Despite the resurgent housing market, sales at furniture and home furnishing stores dropped 0.8% in May following a 0.2% dip in April, and were down 0.5% from the prior year. This is interesting considering both home prices and job growth accelerated during the month. Weather could have played a part here too. Nobody wants to get a new couch delivered when it's pouring rain outside. We may see a rebound in furniture sales in June if the weather turns more seasonal. Overall, the report was a good sign for consumer resilience and economic growth, especially in light of higher payroll taxes. Decent job growth should help to support sales in the near term. However, with savings rates so low (2.5% of personal disposable income as of April) and personal income growth slowing over the past couple of months, it remains to be seen how long consumers can keep up this pace of spending without even stronger job growth or healthier income growth. Without these, we could see a softer spending trajectory in the second half of the year. According to the National Federation of Independent Businesses, small businesses are the most optimistic in a year, as the index rose to 94.4 in May from 92.1 in April (see chart below). The biggest contribution to the increase was a 10 point rise in the share of respondents that expect the economy to improve over the next six months to -5% in May, up from -15% in April. An increase in sales expectations and expansion plans also supported the rise in optimism. Meanwhile, plans to make capital outlays remained unchanged while plans to increase hiring actually deteriorated by five percentage points.

Despite the increase in the overall index, the labor market picture for small businesses remains worrisome. The overall economy added 175K jobs in May, but small business current job openings were virtually unchanged while hiring plans remain muted, with only 5% of small businesses planning to increase employment over the next three months. This is certainly not sitting well with policymakers who have been trying to goose the economy with unprecedented stimulus. The good news is that small business owners see a brighter economic outlook, as the -5% reading for this component was the best since October. Steady, albeit less-than-desired job growth, along with a resurgence in the housing and stock markets, are giving small businesses a boost of confidence. As a result, the outlook for sales has also improved, with 8% of businesses expecting stronger sales over the next three months, the highest reading in over a year. In turn, the outlook for earnings has also improved to the strongest reading in nearly a year, although on net, more firms expect lower earnings in the next three months. At the same time, the share of respondents expecting higher prices over the next three months fell to the lowest level since the end of 2011, suggesting inflation remains a non-issue, justifying the Fed's plan to keep interest rates low. The recent uptrend in compensation plans is good news for employees, but is slight enough that the Fed need not worry about a wage-price spiral at present. Another piece of good news from the report is the fact that credit conditions continue to improve. The share of respondents expecting credit to be harder to obtain fell to just 6%, matching the March reading as the lowest since before the financial crisis. While the balance of firms are still expecting more difficult credit conditions, the decline in the share of firms with such an outlook is very good news because the lack of credit, especially for small businesses, has been a major impediment to economic and job growth during the recovery. Easier access to credit will help to grease the wheels of the small business sector, which accounts for a significant share of job creation. Still, small businesses continue to worry about taxes and healthcare reform. Many are still holding the line until the tax situation becomes more clear and there is more clarity on all of the new laws, regulations and health plan premium costs. The implementation of the Affordable Care Act is likely to be rather turbulent for a time. This could throw a wrench into the recovery for a little while, and it must be kept in mind as small businesses and all decision makers plan their strategies for the next few years. The U.S. economy added 175K jobs in May, better than the 149K added in April, which was revised downward from 165K, and better than the 159K consensus expectation. Total downward revisions for March and April showed 12K fewer jobs than previously thought. Still, the rate of job growth ticked up to 1.6% year-over-year from 1.5% in April (chart 1 below). Even so, the trend of job growth has slowed, and we are still 2.4 million jobs short of the January 2008 peak (chart 2). The unemployment rate ticked up to 7.6% as labor force expansion outpaced household job growth (chart 3).

Professional and business services led the way, creating 57K jobs on the month. However, half of those jobs came from temporary help services. Again, this is good news because a rise in temp jobs generally precedes a rise in permanent jobs. On the flip side, continued reliance on temp services suggests companies are not totally convinced of the sustainability and strength of the recovery to add to full-time staff. Part of the hesitance in hiring is coming from uncertainty surrounding the healthcare overhaul, which is making it difficult for firms to plan their budgets and benefits coverage. Leisure and hospitality services also saw a pickup in job growth to 43K in May from 39K in April as stronger job growth and rising confidence loosened up the purse strings on leisure spending. Retail trade saw a nice bump of 27K jobs, better than the 19K seen in April. Meanwhile, the education and healthcare sector saw weaker job growth than in April as healthcare and social assistance jobs rose at only a third of the previous month's pace. Construction job growth rebounded, adding 7K jobs, following a loss of 2K jobs in April, driven primarily by further increases in residential specialty trade contractors amid continued healing in the housing market. The slowdown in manufacturing was evident in the payroll report as both manufacturing and transportation & warehousing lost jobs in May. The manufacturing sector is reeling from ongoing weakness in Europe and a slowdown in China. Government payrolls also fell during the month, shedding 3K jobs after falling by 8K jobs in April, as government budget cuts continue to weigh on public employment. The unemployment rate rose for the first time since October. While the increase in the unemployment rate may seem like bad news, it is actually good news since it was driven primarily by job seekers returning to the labor force in the hopes of finding work, suggesting workers are feeling more optimistic about their prospects. The workweek held steady at 34.5 hours, while average hourly earnings growth held at 2.0% year-over-year. This is a much weaker pace than prior to the recession, which is helping to keep inflation contained. Today's report was about as good as it gets for the stock market. Job growth was decent, but not strong enough to think the Fed might pull back on quantitative easing. Investors are finding themselves in a goldilocks scenario right now, as seemingly nothing is deterring market enthusiasm. Oddly enough, about the only thing that has had any downward influence on the market recently has been good economic news! I expand upon this in my previous blog post, where I suggest that it is imperative to understand what is going on behind the scenes that is causing the stock market to remain so strong despite a continually weak economy. The party can't last forever, and it won't. There is no phrase worth remembering more than this one: There is no free lunch. Sooner or later, the Fed's free money scheme will end, and the reality of a weak domestic and global economy, along with the huge risk being piled up on the Fed's balance sheet, will set in, and the market will get a rude awakening. The stock market is roaring, home prices are jumping, employment growth, though tepid, remains decent, and consumer confidence has rebounded. What's not to like about the current situation?

As always, it is important to understand what is going on behind the scenes as opposed to just looking at the headline numbers, and why things are going the way they are. So let's take a deeper look. In the midst of the worst financial crisis since the Great Depression (dubbed the Great Recession), the Federal Reserve enacted extraordinary measures to save the economy from collapse. It worked. The economy eventually found a bottom and things started to improve. However, they didn't improve enough, as job growth was weak, the unemployment rate didn't come down fast enough and the housing market remained mired in a slump. They then decided to enact even more extraordinary measures. With the Federal Funds rate (the rate at which banks borrow from each other, and the rate which is the basis for all other interest rates in the economy) at basically zero, the Fed couldn't cut rates any lower to drive down other interest rates. So they decided to actually become a buyer of fixed income securities to bring interest rates even lower. To do this, they have been buying trillions of dollars worth of Treasury bonds and mortgage-backed securities (MBS) over the last few years. This is called quantitative easing, basically, printing money. This has had the desired effect of bringing interest rates down to ridiculous levels. Most notably, a 30-year mortgage rate is now at just 3.5%, give or take, which has led to a resurgence in the housing market. As such, home prices have jumped recently, giving current homeowners more financial security since their biggest asset is now worth more. Unfortunately, many homeowners are still reluctant to sell because they are still underwater on their mortgage and need prices to go even higher to break even. This has severely restricted housing supply. Thus, a mix of rising demand due to low interest rates, along with very tight supply due to seller reluctance, has pushed up home prices. The question on the minds of many buyers, and sellers, not to mention anyone involved in the housing industry, is how long will this last? Is this a sustainable recovery? Well, if prices keep going up, eventually more homeowners will put their homes on the market. If there isn't enough demand to absorb that increase in supply, home price growth will likely slow, and prices may actually turn downward again. It is important to keep in mind that there are still millions of homeowners underwater. Thus, even though "listed" supply is very tight right now, the "shadow" supply is very large. So just beware that if prices continue to rise, eventually supply will catch up. Nobody knows what the magic number is, at what price point more homes will come on the market, and that is the tricky part of the whole equation. Of course, the housing rally could stall if prices get so high that buyers are priced out of the market, which could happen even before prices get high enough for underwater sellers to list their homes. The other major factor in determining the sustainability of the housing rebound is interest rates. As previously mentioned, low interest rates, along with stronger job growth, are helping to propel the housing market, and via the feedback loop the stronger housing market is helping to create housing-related jobs, which comprise a significant share of jobs in the economy. The biggest question is how long will rates remain this low? In addition, what will be the impact if interest rates start to rise, either driven by the Fed or the market? With interest rates at record lows, have home buyers become complacent, thinking that this is the new normal? Will the market be able to handle a 5% or 6% mortgage rate? Of course, it depends on the state of the economy when interest rates begin to rise. If interest rates rise because the economy is getting stronger, the housing market, and the overall economy, should remain in decent shape. However, if interest rates start to rise for other reasons besides improving economic growth, we could have a problem. So what are those other reasons that interest rates could rise besides strong economic growth? There are a few. First, if inflation starts to creep higher, the Fed may have to raise interest rates. They have stated that their target on inflation is about 2.0%. In other words, they will not raise interest rates until inflation rises above this number. Inflation could rise even if the economy remains stagnant, which is known in economic parlance as stagflation. A major driver of stagflation is often rising commodity prices. As we all know, with a more globalized economy, commodity prices have become much more volatile in recent years, and can rise, sometimes significantly, even though the U.S. economy is weak. Commodity prices are now more vulnerable to supply shocks from bad weather, natural disasters, geopolitical turmoil and other factors than ever before since there is so much more demand for them. Second, generally speaking, if a country's currency weakens too much, the central bank will usually take measures to increase interest rates in an effort to lure more investors with a higher yield. However, this is not necessarily the case in the U.S. Since the U.S. dollar is the world's reserve currency, investor demand is generally maintained even if the dollar weakens. If the dollar were to fall significantly, however, interest rates could rise noticeably. The other point with the dollar is that a weaker dollar helps U.S. exports as well as overseas profits of U.S. firms. Therefore, over the last few years, we have seen a stronger correlation between a weak dollar and a strong stock market, as more and more companies are doing business overseas. In normal times, when stocks rise, bonds fall, causing interest rates to rise. But, as everyone knows, we are not in normal times. At present, equity prices are at a record high...but so are bond prices! Very abnormal indeed! That brings me to the third reason why interest rates might rise despite a weak economy. That is, the Fed's balance sheet conundrum. Through all the Fed's bond buying over the last few years, its balance sheet has ballooned to over $3 trillion. With the Fed holding such huge amounts of fixed income securities, they are also holding a lot of risk. When interest rates rise, bond prices fall. Therefore, if interest rates rise, the Fed will take losses, possibly substantial, on their holdings of all the securities they have recently purchased. Because of this, rather than selling their holdings in order to push up interest rates, as was previously thought to be the Fed's exit strategy from its massive quantitative easing program, the thought now is that they will just hold those securities until maturity, in which case they will not take any losses. Unfortunately, by continuing to hold these securities, that leaves less room to buy more securities should the need arise. They are currently buying $85 billion per month in Treasuries and mortgage-backed securities (MBS), but this simply cannot go on forever. There has to be a point at which the central bank simply says "we can't do this anymore." How big will the Fed's balance sheet get? $5 trillion? $10 trillion? Most of the money the Fed is printing is not making it into the broader economy right now because it is sitting in electronic bank accounts at the Fed. Basically, the Fed is printing money, using it to buy Treasuries and MBS from banks, and the banks are turning it around and sticking it right back into holding accounts at the Fed, called excess reserves. That is why there is so little inflation, at least as reported by the government, despite all this money printing. Until that money gets unleashed into the broader economy in the form of bank loans, we will not see much of an increase in inflation. Still, if the economy eventually gets to a stronger footing and the risk of default diminishes and lending becomes more profitable, banks will start to lend that money out. The rate at which that money seeps into the economy will determine how fast inflation will rise. Think of it like a dam. The more water there is behind the dam, the greater potential for a flood should the dam break. Similarly, the more money there is stored up in excess reserves, the greater potential there is for a flood of money to flow into the economy, which would push up inflation. How much greater is the potential for crippling inflation if there is $10 trillion in excess reserves down the road versus around $2 trillion today? If that flood scenario does occur, that just means the Fed will have to raise interest rates much faster. The usual way they do this is via open market operations, buying and selling Treasuries and other securities to influence the money supply and, thereby, interest rates. But what happens if the Fed wants to sell fixed income securities in an effort to pull money out of the system to raise interest rates to cool inflation, but nobody (i.e. the banks) wants to buy those securities because prices are falling rapidly, which would happen in a rising rate environment? That would mean prices for those securities would have to come down even further, which would drive up interest rates even further. Thus, there is the potential for a double whammy if excess reserves start to leak out via bank loans: inflation ramps up, and the Fed can't stop it like they normally could without a massive and very quick increase in interest rates. That would almost certainly lead to another recession. Again, it all depends on if, and when, and how fast those excess reserves enter the broader economy. The bottom line is that the more excess reserves that are built up, the greater potential there is for a catastrophe. Thus, at some point, the Fed will need to stop buying bonds. (If the effort to lower interest rates involves printing money and buying Treasuries from banks, one would think in order to raise interest rates they could just reverse the process, and have the banks buy the Treasuries back from the Fed. But in a rising rate environment, banks will have no interest in buying those Treasuries back, especially considering they have record low coupons. They may not even want to buy them at much reduced prices, choosing instead to buy newly issued bonds with higher coupons. It depends if the bank is looking for income (buy higher coupon bonds) or growth (buy the lower coupon bonds at reduced prices from the Fed). At any rate, the Fed would either take heavy losses on their holdings, or they would be handcuffed and unable to raise interest rates to slow down inflation. That is a very scary thought! And what happens if the Fed takes losses? Do the taxpayers have to bail out the Fed?) So what happens when the Fed finally stops buying bonds? It is abundantly clear that the recent stock market rally has been largely driven by the Fed's actions. As the Fed has pushed interest rates to record lows, fixed income investors (especially retired folks) are getting killed. Thus, investors are "reaching for yield" by investing in stocks and high yield corporate bonds, whose yields are also near record lows. This is happening despite only 2% or so GDP growth over the last couple years. Thus, although the economy has improved since the depths of the Great Recession, it is nowhere near strong enough to justify a doubling of the stock market from the March 2009 lows. It is primarily being driven by the Fed's desire to push investors into riskier assets in order to drive up the value of said assets, thereby making people feel wealthier and more willing to spend (the wealth effect). This is all working like a charm, so far. Heck, it's working so well that we have recently been seeing utterly preposterous headlines, such as "Stock market jumps despite weaker-than-expected economic data as investors are hopeful that the Fed will continue its bond buying program." We are seeing these headlines quite often now. As a matter of fact, some experts are even saying that investors don't even want a strong economy, they just want the Fed's sugar pill of more stimulus, more stimulus and more stimulus. It's like a drug addict, the more of a high he gets, the more of the drug he wants. Eventually, he either crashes from the high, or dies. Unfortunately, that is exactly what is happening in the stock market today. It's all a phantom high, driven by the Fed, primarily because, quite frankly, it doesn't appear that they know what else to do. We are in uncharted waters, and they simply are not sure what else to do to stoke stronger economic growth and job creation. So when the Fed finally stops buying bonds, look out. We could see a violent reaction in the stock market. Indeed, we have seen triple digit losses on the Dow a few times recently, and those have come on days when investors have become more concerned that the Fed will end its bond buying program. And those are just concerns. What happens when it finally does end its program? Especially if the economy is still weak? Look out below!!!!! In summary, the economy is on a sugar high of record low interest rates right now, and this is not sustainable. Eventually, the economy will have to find an equilibrium that is not induced by the Fed. The longer this sham continues, the bigger will be the fall. Be careful out there. |

Archives

September 2017

Categories

All

|

RSS Feed

RSS Feed