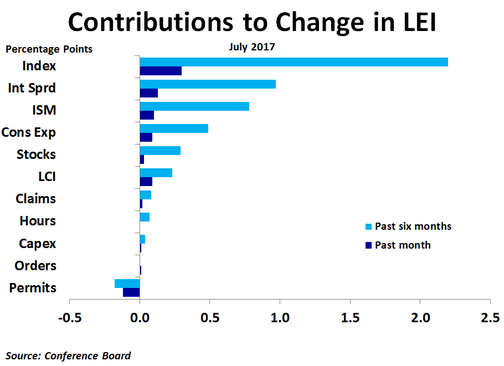

The only negative contribution came from building permits, which took 0.12 percentage points away from growth in the index as permits fell from 1.275 million units at a seasonally adjusted annualized rate in June to 1.223 million units in July.

The 10-year Treasury yield has fallen further in August amid rapidly mounting political tensions both here and abroad. It is becoming increasingly clear that Trump is going to have a very difficult time getting his much sought-after pro-business agenda implemented, which bodes ill for stocks and the economy.

RSS Feed

RSS Feed