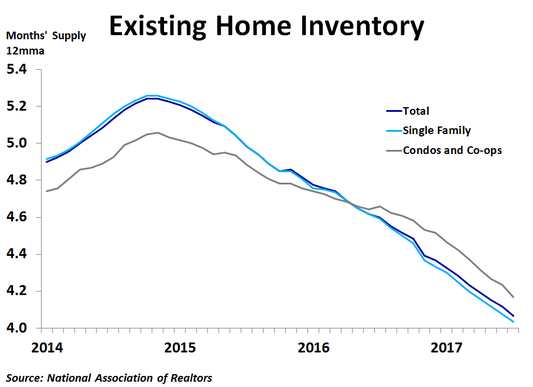

By type, sales were down 0.8% compared to the prior month for single-family homes and down 4.8% for condos and co-ops. On a year-ago basis, sales were up 5.3% for condos and co-ops and just 1.7% for single-family homes. Prices were up 6.3% for single-family homes and 5.3% for condos and co-ops.

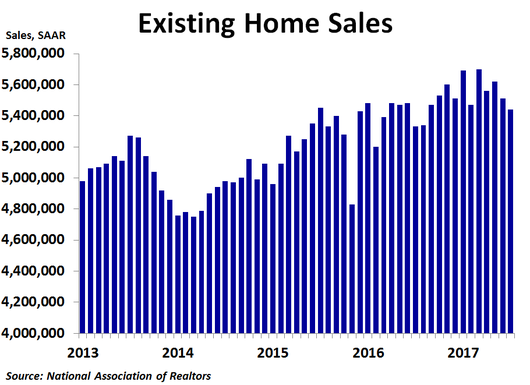

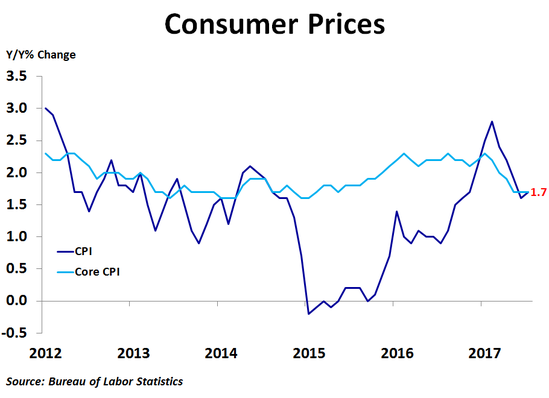

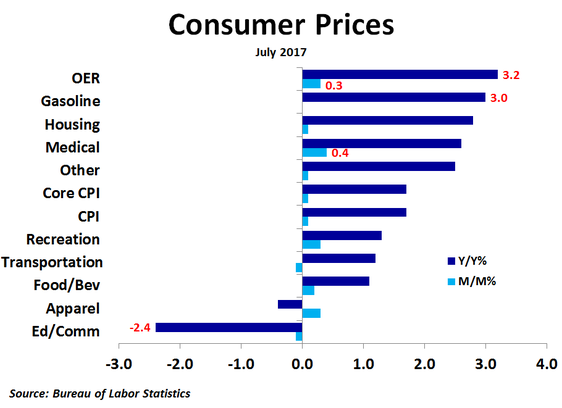

Sales fell in July despite mortgage rates staying below 4.0% for a second straight month. With inflation below the Fed’s target of 2.0% and political uncertainty weighing on bond yields, mortgage rates remain very favorable. When the Fed starts to trim its balance sheet, mortgage rates could start to rise. Stay tuned!

RSS Feed

RSS Feed