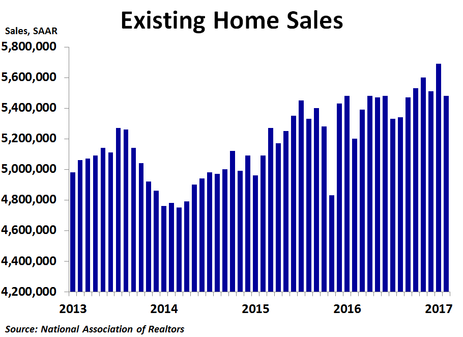

Existing home sales fell in February to 5.48 million units on a seasonally adjusted annualized basis, less than January’s 5.69 million units and less than the consensus forecast of 5.55 million units. Sales were down 3.7% from the prior month but up 5.4% from a year ago, besting January’s 3.8% growth rate.

By region, sales rose 1.3% from the prior month in the South. Sales fell in all the other regions, including a 3.1% decline in the West, a 7.0% drop in the Midwest and a 13.8% plunge in the Northeast. Compared to a year ago, sales were up a strong 9.6% in the West, 5.9% in the South, 2.6% in the Midwest and 1.5% in the Northeast. Median prices were up the most in the West and the South at 9.6% compared to a year ago, while they were up 6.1% in the Midwest and 4.5% in the Northeast.

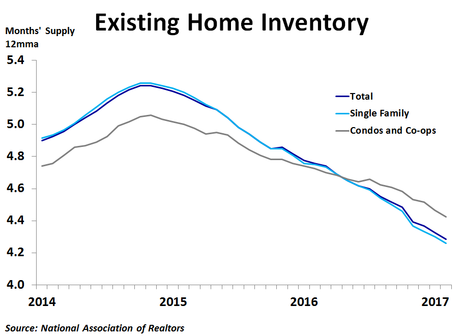

By type, sales fell 3.0% from January for single-family homes and plunged 9.2% for condos and co-ops. On a year-ago basis, sales were up 5.8% for single-family homes and 1.7% for condos and co-ops. Prices were up 8.2% from a year earlier for condos and co-ops and 7.6% for single-family homes. Inventory was down 10.6% y/y for condos and co-ops and down 11.6% y/y for single-family homes.

Inventory continues to be the big story right now. In February, there was only 3.8 months’ worth of supply available. While that was a slight up-tick from January, the 12-month moving average was just 4.3 months, down significantly from a couple years ago. One big reason that inventories are so low is that some people who bought homes at the peak of the bubble in 2006 still have not recuperated all of their losses, so they are reluctant to sell, choosing instead to wait for prices to go even higher. In addition, an improving economy has helped to open up job opportunities for many people, some of whom had to move. Thus, it could be that many people simply don’t want to or need to sell their home, even though prices have reached pre-crash peaks in some places.

By type, sales fell 3.0% from January for single-family homes and plunged 9.2% for condos and co-ops. On a year-ago basis, sales were up 5.8% for single-family homes and 1.7% for condos and co-ops. Prices were up 8.2% from a year earlier for condos and co-ops and 7.6% for single-family homes. Inventory was down 10.6% y/y for condos and co-ops and down 11.6% y/y for single-family homes.

Inventory continues to be the big story right now. In February, there was only 3.8 months’ worth of supply available. While that was a slight up-tick from January, the 12-month moving average was just 4.3 months, down significantly from a couple years ago. One big reason that inventories are so low is that some people who bought homes at the peak of the bubble in 2006 still have not recuperated all of their losses, so they are reluctant to sell, choosing instead to wait for prices to go even higher. In addition, an improving economy has helped to open up job opportunities for many people, some of whom had to move. Thus, it could be that many people simply don’t want to or need to sell their home, even though prices have reached pre-crash peaks in some places.

Although mortgage rates were largely unchanged in February, the lagged effects of the big jump after the presidential election may be starting to take root. February’s sales miss could also be payback for a very strong January. Where the market goes from here will largely depend on the success or failure of the new administration to follow through on promises of pro-growth policies, which have been the catalyst for a jump in confidence, as well as higher interest rates. With prices already high, higher rates will likely weigh on housing.

RSS Feed

RSS Feed