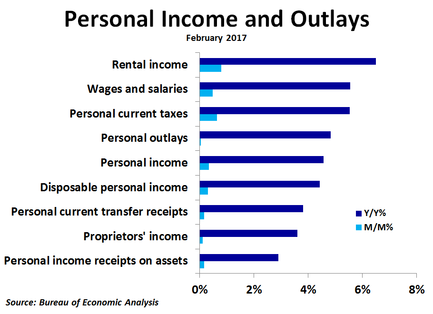

Personal current transfer receipts, such as Social Security, Medicare, Medicaid and unemployment insurance, also rose 0.2%, as Medicare payments increased while unemployment insurance payments fell again. Proprietors’ income rose just 0.1%.

Compared to a year ago, rental income also topped the charts, rising by a very strong 6.5%, as high home prices are pushing up rents. Wages and salaries were up 5.5%, with private industry wage growth of 6.0% far outpacing government wage growth of just 3.4%. Personal current transfer receipts were up 3.8%, with the strongest growth coming from Medicaid at 5.6%, while unemployment insurance was down 9.4%. Proprietors’ income was up just 3.6%, weighed down by a huge 51% drop in farm income. Income on assets was up just 2.9%, driven almost entirely by interest income.

Wages and salaries accounted for over half of the total increase in personal income on both a monthly and yearly basis in February, which mostly came from private industry wages. Rental income and supplements to wages and salaries, such as for pension and social insurance, each accounted for 10% of the monthly increase in income. Personal current transfer receipts only accounted for 8% of the increase in income in February after accounting for almost half of the increase in January.

RSS Feed

RSS Feed