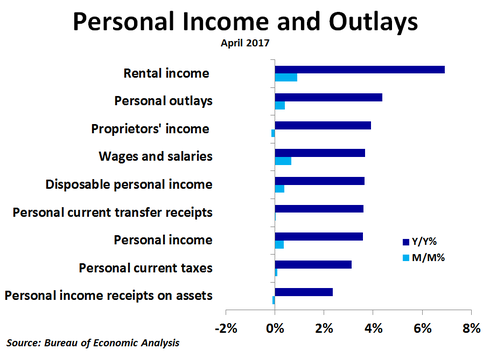

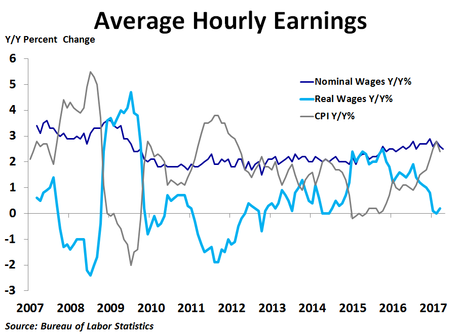

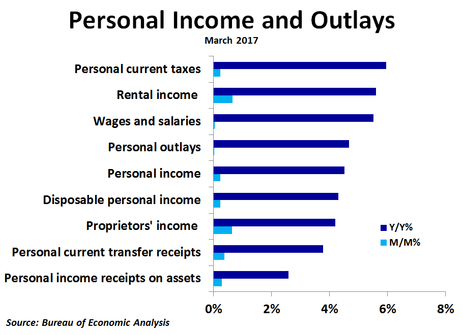

Compared to a year ago, rental income also topped the charts, rising by a very strong 6.9%, as high home prices are pushing up rents. Proprietors’ income was up 3.9% as non-farm income was up 5.0% while farm income was still down 44.1%. Wages and salaries were up 3.7%, with private industry wage growth slipping to 3.7% to almost match government wage growth of 3.5%. Personal current transfer receipts were up 3.6%, with the strongest growth coming from Medicaid at 5.1%, while unemployment insurance was down 9.6%. Income on assets was up just 2.4%, driven primarily by interest income.

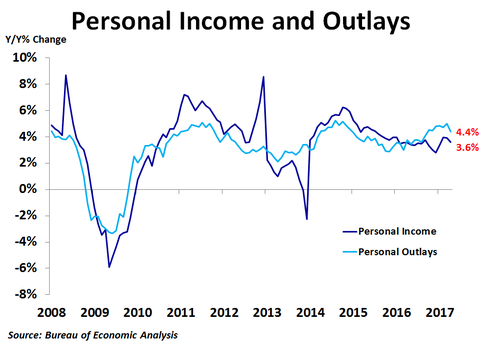

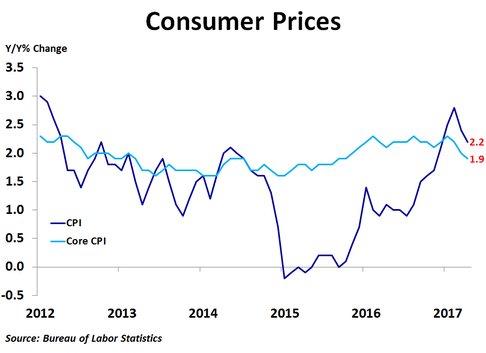

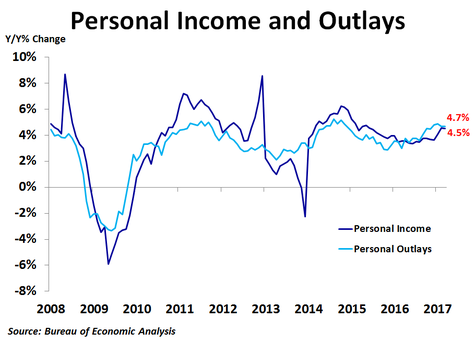

The growth rate of personal tax payments slowed to 3.1% from a year ago, leaving disposable income up 3.7%. After factoring in inflation, real personal disposable income growth dipped from 2.0% to 1.9%, and real spending slowed from 3.1% to 2.7%. With inflation and real income and spending slowing, a Fed rate hike in June is looking less likely.

RSS Feed

RSS Feed