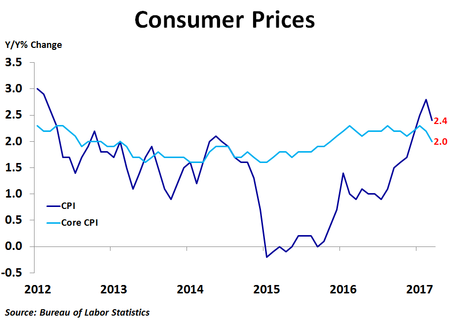

Consumer prices fell 0.3% in March from the previous month, missing the consensus forecast of no change, following a 0.1% increase in February. Compared to a year ago, prices were up 2.4%, down from February’s 2.8% pace. Core prices, which exclude food and energy, fell 0.1%, missing the forecast of a 0.2% increase, and were up 2.0% on a year-over-year basis, the lowest since November 2015.

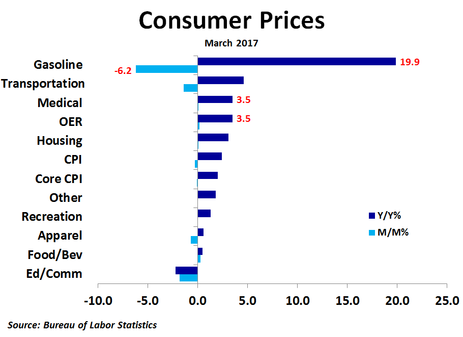

Compared to a month ago, prices rose the most for fruits and vegetables (+1.6%), motor vehicle insurance (+1.2%), tobacco and smoking products (+0.5%), hospital services (+0.4%) and airline fares (+0.4%). Prices fell the most for gasoline (-6.2%), used cars and trucks (-0.9%), piped gas (-0.8%), fuel oil (-0.8%) and apparel (-0.7%). Thus, while air travel became more expensive, road travel became less expensive. Gasoline accounted for two-thirds of the overall decline in prices, while information, education and wireless phone services also had significant negative impacts. These declines were somewhat offset by a 0.2% rise in owners’ equivalent rent of primary residence.

Compared to a year ago, prices were up the most for fuel oil (+24.9%), gasoline (+19.9%), piped gas service (+10.3%), motor vehicle insurance (+8.1%) and hospital services (+4.7%). Prices were down the most for used cars and trucks (-4.7%), meats and poultry (-2.6%), fruits and vegetables (-1.8%) and cereals and bakery products (-0.4%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the increase.

Compared to a year ago, prices were up the most for fuel oil (+24.9%), gasoline (+19.9%), piped gas service (+10.3%), motor vehicle insurance (+8.1%) and hospital services (+4.7%). Prices were down the most for used cars and trucks (-4.7%), meats and poultry (-2.6%), fruits and vegetables (-1.8%) and cereals and bakery products (-0.4%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the increase.

This report breaks the consistent accelerating trend that has been in place since last summer. Along with a weak jobs report and a decline in retail sales, economic data for March may give the Fed something to think about at its next meeting in May. With core inflation slowing down there does not appear to be an urgent need to raise interest rates further. It might be a good idea to wait and see if the soft data for March is a sign of a weakening economy or just a bad month. Even though the Fed raised rates last month, the 10-year Treasury yield has fallen amid weaker economic data and geopolitical tensions, helping to bring down mortgage rates as well. This should help to keep the all-important housing market going for a little while longer.

RSS Feed

RSS Feed