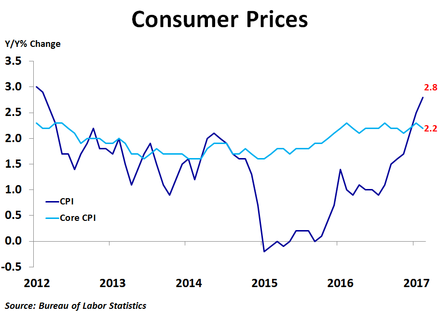

Consumer prices rose 0.1% in February from the previous month, in line with expectations, but far less than the 0.6% jump in January. Compared to a year ago, prices were up 2.8%, up from January’s 2.5% pace. Core prices, which exclude food and energy, rose 0.2%, also in line with expectations, and were up 2.2% on a year-over-year basis.

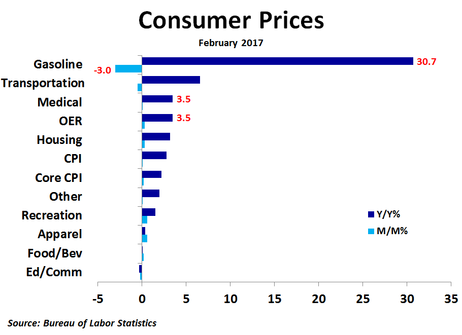

Compared to a month ago, prices rose the most for airline fares (+2.4%), non-alcoholic beverages and materials (+1.5%), piped gas service (+1.5%), dairy and related products (+0.8%) and electricity (+0.8%). Prices fell the most for gasoline (-3.0%), used cars and trucks (-0.6%), fuel oil (-0.4%), cereals and bakery products (-0.4%) and medical care commodities (-0.2%). Thus, while air travel became more expensive, road travel became less expensive. While the 0.3% rise in owners’ equivalent rent of primary residence didn’t crack the top five, it did account for 60% of the overall increase in the price index when the category weight, which is the largest, is taken into account.

Compared to a year ago, prices were up the most for gasoline (+30.7%), fuel oil (+28.0%), piped gas service (+10.9%), motor vehicle insurance (+7.6%) and hospital services (+4.3%). Prices were down the most for fruits and vegetables (-4.7%), used cars and trucks (-4.3%), meats and poultry (-3.3%), airline fares (-1.1%) and cereals and bakery products (-1.1%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together comprising almost 2/3 of the increase.

Compared to a year ago, prices were up the most for gasoline (+30.7%), fuel oil (+28.0%), piped gas service (+10.9%), motor vehicle insurance (+7.6%) and hospital services (+4.3%). Prices were down the most for fruits and vegetables (-4.7%), used cars and trucks (-4.3%), meats and poultry (-3.3%), airline fares (-1.1%) and cereals and bakery products (-1.1%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together comprising almost 2/3 of the increase.

The noticeable acceleration of inflation over the last several months, along with a quickening pace of wage growth, led the Federal Reserve to raise the Federal Funds rate range to 0.75%-1.00% today. While the move was widely anticipated, it did not come without some questions. One of the biggest sources of confusion is why the Fed is raising rates even though they only expect 2.0% economic growth over the next couple of years, a forecast which has not changed much recently. In addition, while wages are rising, the pace of growth is fairly gradual and remains far slower than wage growth prior to the recession. Despite these concerns, with inflation measures at or above the Fed’s target, they felt it was necessary to raise rates now to prevent faster tightening down the road, which could cause a recession.

RSS Feed

RSS Feed