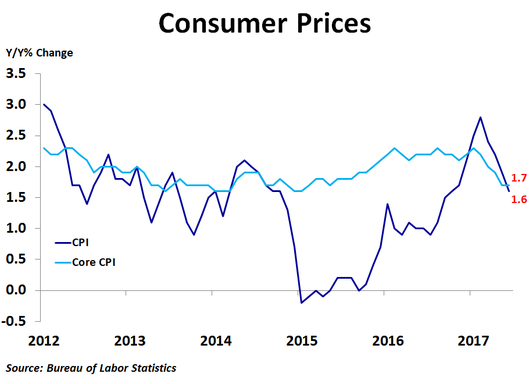

Consumer prices were unchanged in June from the previous month, missing the consensus forecast of a 0.1% increase, following a 0.1% decrease in May. Compared to a year ago, prices were up just 1.6%, down from May’s 1.9% pace and the lowest since October. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.7% on a year-ago basis, matching May for the slowest rate of growth in two years.

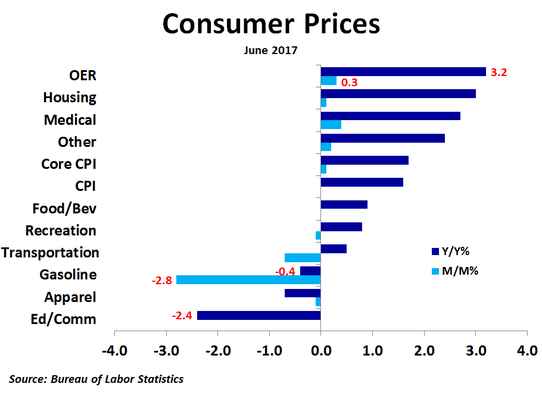

Compared to a month ago, prices rose the most for motor vehicle insurance (+1.0%), hospital services (+0.9%), medical care commodities (+0.7%), meats and poultry (+0.6%) and owners’ equivalent rent of primary residences (+0.3%). Prices fell the most for fuel oil (-3.7%), gasoline (-2.8%), airline fares (-2.7%), used cars and trucks (-0.7%) and electricity (-0.6%). Thus, air and road travel both became less expensive, but it became more expensive to insure a vehicle. Owners’ equivalent rent, motor vehicle insurance and hospital services had the largest positive effects on the price index, while the biggest negative effects came from gasoline, household energy and other lodging away from home.

Compared to a year ago, prices were up the most for piped gas service (+12.8%), motor vehicle insurance (+7.7%), tobacco and smoking products (+6.8%), hospital services (+5.7%) and fuel oil (+4.3%). Prices were down the most for used cars and trucks (-4.3%), airline fares (-4.3%), meats and poultry (-0.9%), apparel (-0.7%) and gasoline (-0.4%). Yes, you heard right, gasoline prices are now down from a year ago after being up a whopping 31% from the prior year back in February. The biggest positive effects on a year-ago basis came from owners’ equivalent rent, motor vehicle insurance and hospital services, while the biggest negative effects came from wireless phone services, education and communication services and used cars and trucks.

Compared to a year ago, prices were up the most for piped gas service (+12.8%), motor vehicle insurance (+7.7%), tobacco and smoking products (+6.8%), hospital services (+5.7%) and fuel oil (+4.3%). Prices were down the most for used cars and trucks (-4.3%), airline fares (-4.3%), meats and poultry (-0.9%), apparel (-0.7%) and gasoline (-0.4%). Yes, you heard right, gasoline prices are now down from a year ago after being up a whopping 31% from the prior year back in February. The biggest positive effects on a year-ago basis came from owners’ equivalent rent, motor vehicle insurance and hospital services, while the biggest negative effects came from wireless phone services, education and communication services and used cars and trucks.

Despite a slew of weak economic data in May, the Fed raised interest rates anyway at the June FOMC meeting, citing a low unemployment rate and expected improvement in inflation and job growth. Since then, we have been treated to another month of weak wage growth, retail sales, producer price data and consumer price data. Although employment growth is strong and unemployment is low, inflation is starting to cool again. This would suggest no rate hike at the Fed’s July meeting, but that’s what we thought last time. If inflation is their priority, a rate hike is not needed.

RSS Feed

RSS Feed