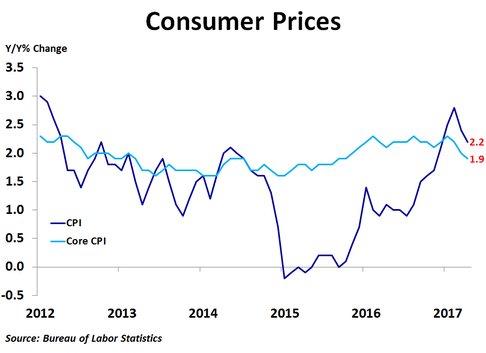

Consumer prices rose 0.2% in April from the previous month, matching the consensus forecast, following a 0.3% drop in March. Compared to a year ago, prices were up 2.2%, down from March’s 2.4% pace. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.9% on a year-over-year basis, the lowest since October 2015.

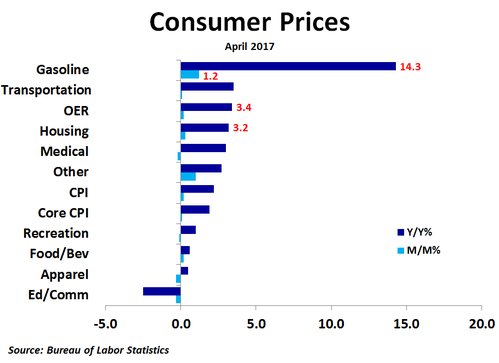

Compared to a month ago, prices rose the most for tobacco and smoking products (+4.2%), fruits and vegetables (+2.2%), piped gas service (+2.2%), gasoline (+1.2%) and hospital services (+1.0%). Prices fell the most for physicians’ services (-1.2%), medical care commodities (-0.8%), airline fares (-0.6%), meats and poultry (-0.6%) and used cars and trucks (-0.5%). Thus, while air travel became less expensive, road travel became more expensive. Owners’ equivalent rent accounted for a quarter of the overall increase in prices, while gasoline accounted for one-fifth of the increase. The biggest negative contributions to the index came from physicians’ services, medicinal drugs and men’s apparel.

Compared to a year ago, prices were up the most for fuel oil (+22.1%), gasoline (+14.3%), piped gas service (+12.0%), tobacco and smoking products (+7.7%) and motor vehicle insurance (+6.7%). Prices were down the most for used cars and trucks (-4.6%), meats and poultry (-3.0%), cereals and bakery products (-0.8%), airline fares (-0.6%) and nonalcoholic beverages (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the overall increase in the index.

Compared to a year ago, prices were up the most for fuel oil (+22.1%), gasoline (+14.3%), piped gas service (+12.0%), tobacco and smoking products (+7.7%) and motor vehicle insurance (+6.7%). Prices were down the most for used cars and trucks (-4.6%), meats and poultry (-3.0%), cereals and bakery products (-0.8%), airline fares (-0.6%) and nonalcoholic beverages (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest contributions to the rise in the index on a year-ago basis came from owners’ equivalent rent of primary residence and gasoline, together accounting for over half of the overall increase in the index.

Although job growth bounced back in April, today’s inflation report, along with a slight slowdown in wage growth and weaker than expected retail sales growth, point to the possibility that the Fed may hold off again at its next meeting in June. Although a June rate hike seemed like it was almost a certainty after the jobs report, the lowest core inflation rate in a year and a half suggests the Fed has a bit more wiggle room than thought a week ago. There appears to be a little inflation in the pipeline for producers in the early stages of the supply chain, so we’ll need to watch that. Inflation, retail sales and political uncertainty will likely keep interest rates near current levels in May.

RSS Feed

RSS Feed