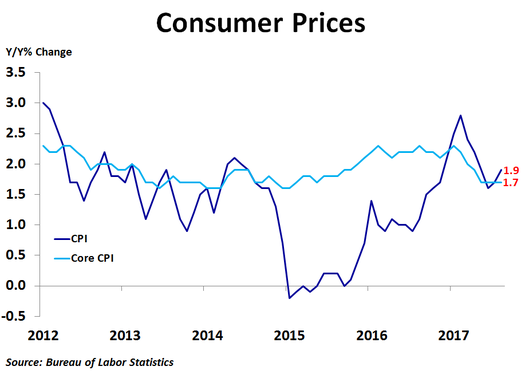

Consumer prices rose 0.4% in August from the previous month, topping the consensus forecast of a 0.3% increase, following a 0.1% increase in July. Compared to a year ago, prices were up 1.9%, up slightly from July’s 1.7% pace. Core prices, which exclude food and energy, rose 0.2%, in line with expectations, and were up 1.7% on a year-ago basis, matching May, June and July for the slowest rate of year-over-year growth since May 2015.

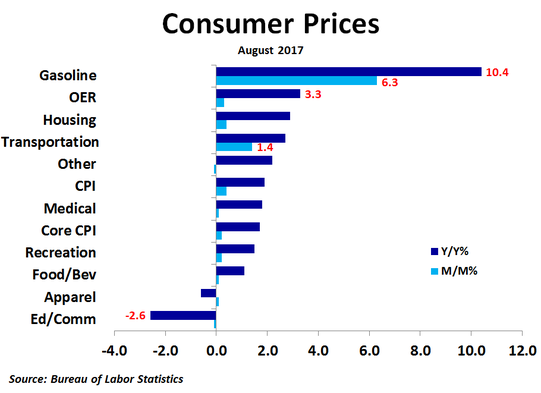

Compared to a month ago, prices rose the most for gasoline (+6.3%), fuel oil (+2.9%), motor vehicle insurance (+1.0%), physicians’ services (+0.4%) and owners’ equivalent rent of primary residences (+0.3%). Prices fell the most for airline fares (-1.0%), piped gas service (-0.5%), nonalcoholic beverages and materials (-0.4%), dairy and related products (-0.4%) and used cars and trucks (-0.2%). Gasoline prices accounted for half of the overall increase in the index, while owners’ equivalent rent and lodging away from home also had big positive impacts. Domestically produced farm food, food at home and women’s apparel had the biggest negative effects on the overall price index.

Compared to a year ago, prices were up the most for gasoline (+10.4%), fuel oil (+9.4%), motor vehicle insurance (+8.1%), tobacco and smoking products (+6.3%) and piped gas service (+5.4%). Prices were down the most for used cars and trucks (-3.8%), airline fares (-3.2%), physicians’ services (-0.8%), new vehicles (-0.7%) and apparel (-0.6%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, gasoline and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and recreation.

Compared to a year ago, prices were up the most for gasoline (+10.4%), fuel oil (+9.4%), motor vehicle insurance (+8.1%), tobacco and smoking products (+6.3%) and piped gas service (+5.4%). Prices were down the most for used cars and trucks (-3.8%), airline fares (-3.2%), physicians’ services (-0.8%), new vehicles (-0.7%) and apparel (-0.6%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, gasoline and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and recreation.

Even though employment growth was strong in June, the Federal Reserve held the Fed Funds rate steady at its July meeting as wage growth remained subdued and inflation slowed. Since then job growth has slowed a bit and wage growth has not improved. Even though inflation came in stronger than expected in August, the core rate remains below the Fed’s target of 2.0%, both for the consumer price index and the Fed’s preferred measure, the personal consumption expenditures price index. In addition, the sharp increase in gas prices in August was in part driven by a month-end spike due to Hurricane Harvey’s impact on oil refineries. With gas price increases likely temporary, a nation rebuilding from storms and fires and continued geopolitical tensions, the Fed is expected to hold rates steady tomorrow.

RSS Feed

RSS Feed