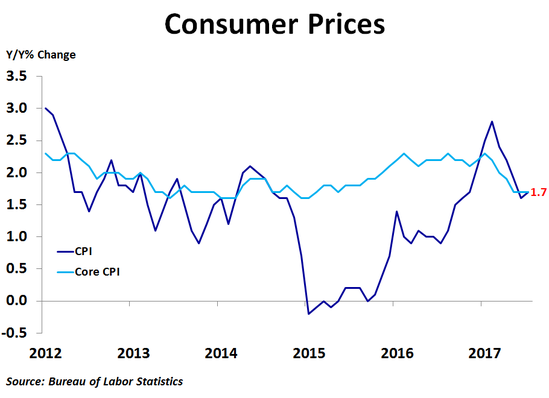

Consumer prices rose 0.1% in July from the previous month, missing the consensus forecast of a 0.2% increase, following no change in June. Compared to a year ago, prices were up 1.7%, up slightly from June’s 1.6% pace, which was the lowest since October. Core prices, which exclude food and energy, also rose 0.1%, missing the forecast of a 0.2% increase, and were also up 1.7% on a year-ago basis, matching May and June for the slowest rate of year-over-year growth since May 2015.

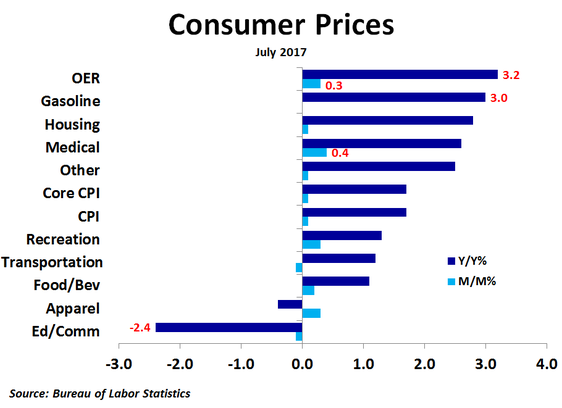

Compared to a month ago, prices rose the most for medical care commodities (+1.0%), meats and poultry (+0.7%), airline fares (+0.7%), fruits and vegetables (+0.5%) and hospital services (+0.5%). In a rare occurrence, owners’ equivalent rent of primary residences did not make the top five. Prices fell the most for piped gas service (-2.3%), fuel oil (-2.0%), used cars and trucks (-0.5%), new vehicles (-0.5%) and cereals and bakery products (-0.4%). Gasoline prices were unchanged on the month. Owners’ equivalent rent, medical care and recreation services had the largest positive effects on the price index, while the biggest negative effects came from other lodging away from home, piped gas service and new vehicles.

Compared to a year ago, prices were up the most for motor vehicle insurance (+7.6%), piped gas service (+7.5%), tobacco and smoking products (+7.1%), hospital services (+5.7%) and rent of primary residence (+3.8%). Gasoline prices were up 3.0% from a year ago, but that is only because prices tumbled last July. Prices were down the most for used cars and trucks (-4.1%), airline fares (-2.5%), physicians’ services (-0.6%), new vehicles (-0.6%) and cereals and bakery products (-0.5%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, medical care and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and household furnishings and supplies.

Compared to a year ago, prices were up the most for motor vehicle insurance (+7.6%), piped gas service (+7.5%), tobacco and smoking products (+7.1%), hospital services (+5.7%) and rent of primary residence (+3.8%). Gasoline prices were up 3.0% from a year ago, but that is only because prices tumbled last July. Prices were down the most for used cars and trucks (-4.1%), airline fares (-2.5%), physicians’ services (-0.6%), new vehicles (-0.6%) and cereals and bakery products (-0.5%). The biggest positive effects on a year-ago basis came from owners’ equivalent rent, medical care and motor vehicle insurance, while the biggest negative effects came from wireless phone services, used cars and trucks and household furnishings and supplies.

Even though employment growth was strong in June, the Federal Reserve held the Fed Funds rate steady at its July meeting as wage growth remained subdued and inflation slowed. With inflation still below the Fed’s target of 2.0% for the personal consumption expenditures index, its preferred measure of inflation, it is very likely that the Fed will choose to leave the Fed Funds rate unchanged again in September. Throw in rapidly mounting tensions with North Korea, and the Fed just might remain on the sidelines for the rest of this year.

RSS Feed

RSS Feed