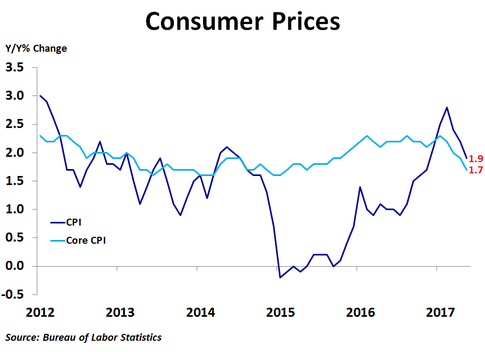

Consumer prices fell 0.1% in May from the previous month, missing the consensus forecast of no change, following a 0.2% increase in April. Compared to a year ago, prices were up 1.9%, down from April’s 2.2% pace. Core prices, which exclude food and energy, rose 0.1%, missing the forecast of a 0.2% increase, and were up 1.7% on a year-over-year basis, the slowest rate of growth since May 2015.

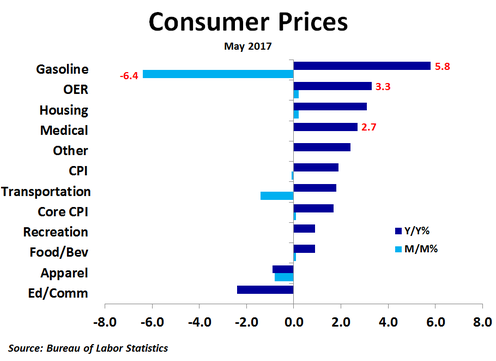

Compared to a month ago, prices rose the most for piped gas service (+1.9%), non-alcoholic beverages (+1.1%), motor vehicle insurance (+1.1%), medical care commodities (+0.4%) and cereals and bakery products (+0.3%). Prices fell the most for gasoline (-6.4%), fuel oil (-2.8%), airline fares (-2.7%), apparel (-0.8%) and fruits and vegetables (-0.6%). Thus, air and road travel both became less expensive, but it became more expensive to insure a vehicle. Owners’ equivalent rent, motor vehicle insurance and piped gas service had the largest positive effects on the price index, while the biggest negative effects came from gasoline, apparel and airline fares.

Compared to a year ago, prices were up the most for piped gas service (+12.8%), fuel oil (+11.9%), tobacco and smoking products (+7.6%), motor vehicle insurance (+7.0%) and gasoline (+5.8%). It is notable that gasoline is up only 5.8% from a year ago after being up 30.7% back in February. Prices were down the most for used cars and trucks (-4.3%), airline fares (-2.9%), meats and poultry (-2.1%), apparel (-0.9%) and cereals and bakery products (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest positive effects on a year-ago basis came from owners’ equivalent rent of primary residence, medical care and gasoline, while the biggest negative effects came from wireless phone services, used cars and trucks and meats.

Compared to a year ago, prices were up the most for piped gas service (+12.8%), fuel oil (+11.9%), tobacco and smoking products (+7.6%), motor vehicle insurance (+7.0%) and gasoline (+5.8%). It is notable that gasoline is up only 5.8% from a year ago after being up 30.7% back in February. Prices were down the most for used cars and trucks (-4.3%), airline fares (-2.9%), meats and poultry (-2.1%), apparel (-0.9%) and cereals and bakery products (-0.2%). Thus, on a year-ago basis, energy has pushed the price index higher while food and vehicles have pushed the index lower. The biggest positive effects on a year-ago basis came from owners’ equivalent rent of primary residence, medical care and gasoline, while the biggest negative effects came from wireless phone services, used cars and trucks and meats.

With May data showing weak job growth, slowing wage growth, flat producer prices, a decline in consumer prices and weaker than expected retail sales, one would think the Fed would have held rates steady at today’s FOMC meeting. However, they raised interest rates anyway, citing a low unemployment rate and expected improvement in inflation and job growth. Although core producer prices are accelerating on a year-ago basis, consumer price growth is slowing. Thus, either the Fed is concerned about producer price inflation passing through soon, or they are more focused on policy normalization, or most likely, both.

RSS Feed

RSS Feed