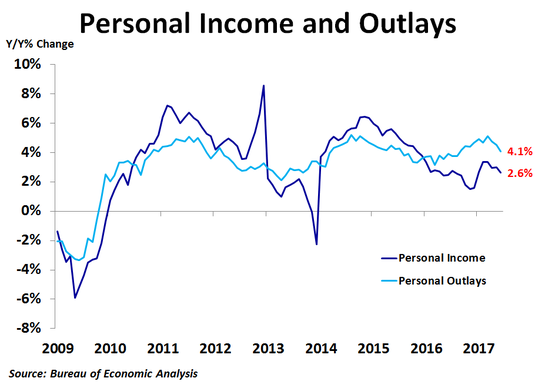

Personal income was flat in June compared to May, much less than the consensus forecast of a 0.4% increase, and was up 2.6% from a year ago. Personal spending rose just 0.1%, matching the consensus forecast, and was up 4.1% from a year ago, the slowest rate of growth since August. The personal savings rate fell slightly to 3.8%.

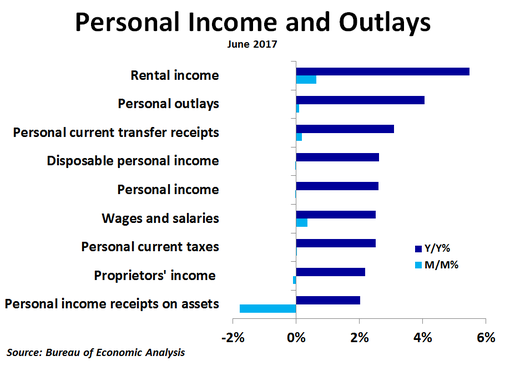

Compared to a month ago, rental income led the way with a 0.6% increase. Wages and salaries followed with a 0.4% increase, with both private and government wages rising at about the same rate. Personal current transfer receipts rose 0.2% as veterans’ benefits rose 1.2% and unemployment insurance increased 1.1%, the first increase since December. On the downside, proprietors’ income slipped 0.1% as farm income fell for the third straight month. Personal income receipts on assets plunged 1.8% as dividend income fell 3.0% following a big 4.8% jump in May.

Compared to a year ago, rental income topped the charts, up 5.5%, as high home prices are pushing up rents. Personal current transfer receipts were up 3.1%, led by a sharp 6.1% increase in veterans’ benefits. Wages and salaries were up 2.5%, with private and government wages up by pretty much the same percentage. Proprietors’ income was up 2.2% as non-farm income was up 3.6% while farm income was down 40.1%. Income on assets was up just 2.0%, driven largely by interest income.

Wages and salaries accounted for just under half of the total increase in personal income on a year-ago basis, most of which came from private industry wages. On a month-ago basis, wages and salaries rose by $30.9 billion, but that was more than offset by the $43.8 billion decline in income on assets.

The growth rate of personal tax payments slowed to 2.5% from a year ago, leaving disposable income up 2.6%. After factoring in inflation, real personal disposable income growth dipped from 1.4% to 1.2%, and real spending slowed from 3.0% to 2.7%.

Compared to a year ago, rental income topped the charts, up 5.5%, as high home prices are pushing up rents. Personal current transfer receipts were up 3.1%, led by a sharp 6.1% increase in veterans’ benefits. Wages and salaries were up 2.5%, with private and government wages up by pretty much the same percentage. Proprietors’ income was up 2.2% as non-farm income was up 3.6% while farm income was down 40.1%. Income on assets was up just 2.0%, driven largely by interest income.

Wages and salaries accounted for just under half of the total increase in personal income on a year-ago basis, most of which came from private industry wages. On a month-ago basis, wages and salaries rose by $30.9 billion, but that was more than offset by the $43.8 billion decline in income on assets.

The growth rate of personal tax payments slowed to 2.5% from a year ago, leaving disposable income up 2.6%. After factoring in inflation, real personal disposable income growth dipped from 1.4% to 1.2%, and real spending slowed from 3.0% to 2.7%.

With inflation and real income and spending growth slowing, the Federal Reserve’s decision to leave the Fed Funds rate unchanged at last week’s FOMC meeting looks like a wise decision. In fact, there really was no reason to raise it in June either, but they did. They may now be regretting that move. The market has certainly changed its tune as Treasury yields have declined after the late June spike. The market is telling the Fed that inflation is not a concern. The Fed should listen.

RSS Feed

RSS Feed