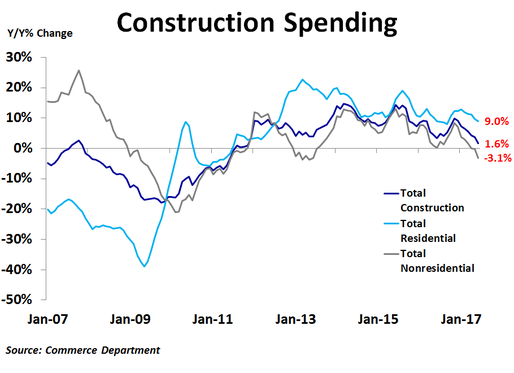

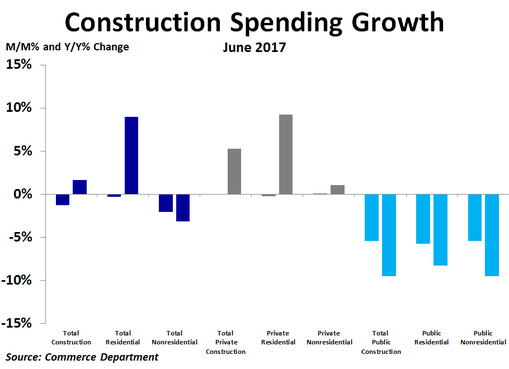

According to the Commerce Department, total construction spending plunged by $15.8 billion, or 1.3%, in June to $1.21 trillion, widely missing the consensus forecast of a 0.5% increase. This follows a 0.3% increase in May that was revised up from no change. Compared to a year ago, spending was up just 1.6%, the least since November 2011.

Weakness was widespread in June. Residential spending fell by $1.4 billion, or 0.3%, from the prior month but was up 9.0% from the prior year. Non-residential spending plunged by $14.4 billion, or 2.0%, and was down 3.1% from the prior year, the worst in four years.

For non-residential spending, only two of fifteen categories saw spending increases. Spending on office projects rose by $1.4 billion, or 1.9%, and spending on communications projects rose by $612 million, or 2.8%. Every other category saw spending fall, led by a huge $5.7 billion, or 6.4%, decline in spending on highways and streets, which took the level of spending down to the lowest in over three years. Other notable declines were a $3.9 billion, or 4.3%, decline in education spending and a $1.2 billion, or 1.8%, decline in manufacturing. The biggest percentage declines came in conservation and development, where spending dropped 7.3%, and public safety, where spending fell 6.5% from the prior month.

Private spending only fell by $573 million, or 0.1%, with all of the decline coming from residential projects. Although non-residential spending rose by $503 million, or 0.1%, that included a $1.8 billion, or 2.9%, increase in spending on office projects and a $1.3 billion, or 1.9%, decrease in manufacturing. Meanwhile, public spending cratered by $15.2 billion, or 5.4%, half of which came from just two categories, with highway and street projects falling by $5.8 billion, or 6.6%, and education spending dropping by $3.9 billion, or 5.5%. Thus, 94% of the drop in total spending came from public non-residential projects.

For non-residential spending, only two of fifteen categories saw spending increases. Spending on office projects rose by $1.4 billion, or 1.9%, and spending on communications projects rose by $612 million, or 2.8%. Every other category saw spending fall, led by a huge $5.7 billion, or 6.4%, decline in spending on highways and streets, which took the level of spending down to the lowest in over three years. Other notable declines were a $3.9 billion, or 4.3%, decline in education spending and a $1.2 billion, or 1.8%, decline in manufacturing. The biggest percentage declines came in conservation and development, where spending dropped 7.3%, and public safety, where spending fell 6.5% from the prior month.

Private spending only fell by $573 million, or 0.1%, with all of the decline coming from residential projects. Although non-residential spending rose by $503 million, or 0.1%, that included a $1.8 billion, or 2.9%, increase in spending on office projects and a $1.3 billion, or 1.9%, decrease in manufacturing. Meanwhile, public spending cratered by $15.2 billion, or 5.4%, half of which came from just two categories, with highway and street projects falling by $5.8 billion, or 6.6%, and education spending dropping by $3.9 billion, or 5.5%. Thus, 94% of the drop in total spending came from public non-residential projects.

Compared to a year ago, the strongest growth in total construction spending has come from residential, office and commercial projects. Conversely, the biggest declines have been seen in conservation/development, sewage and waste disposal and water supply.

Last week the Federal Reserve held the Fed Funds rate steady. Today’s very weak report suggests that was a wise move. With inflation slowing, Treasury yields and mortgage rates have been trending down, which should help to support the construction industry.

Last week the Federal Reserve held the Fed Funds rate steady. Today’s very weak report suggests that was a wise move. With inflation slowing, Treasury yields and mortgage rates have been trending down, which should help to support the construction industry.

RSS Feed

RSS Feed