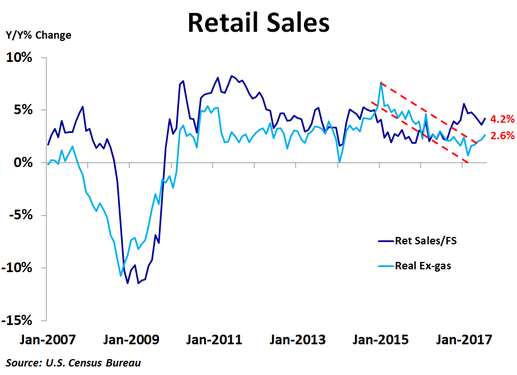

Retail sales rose 0.6% in July from the prior month, twice as much as the consensus forecast of a 0.3% increase, following a 0.3% increase in June that was revised up from a 0.2% decline. Sales excluding autos and gas also beat expectations, rising 0.5% compared to expectations of a 0.4% increase. On a year-over-year basis, sales were up 4.2%, better than the 3.6% pace in June but still below the recent peak growth rate of 5.6% reached in January.

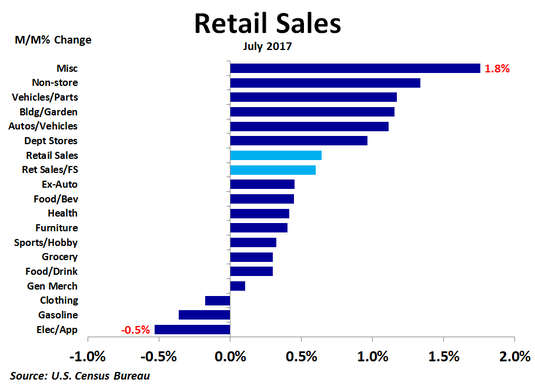

The biggest monthly increase in dollar terms was a $1.2 billion, or 1.2%, increase in motor vehicles and parts. Non-store sales followed with a $696 million, or 1.3%, increase. Building and garden supply stores took the third spot with a $359 million, or 1.2%, increase. On a percentage basis, the strongest growth was seen in the miscellaneous category, where sales rose 1.8%. The biggest decline in sales came from gasoline stations, where sales fell by $130 million, or 0.4%, as gasoline prices declined. Sales at electronics and appliance stores fell by $43 million, or 0.5%, which was the biggest percentage decline. The only other decline was a $38 million, or 0.2%, drop in clothing sales.

Sales were higher on a year-over-year basis, led by a $5.3 billion, or 11.2%, increase in non-store sales. Vehicles and parts sales were close behind, up by $5.2 billion, or 5.5%. Building and garden supply stores sales were up by $2.3 billion, or 7.9%. On the downside, sales at sports and hobby stores were down by $282 million, or 3.8%. Department store sales were down by $238 million, or 1.8%, amid a struggle against online competition, while electronics and appliance store sales were down by $85 million, or 1.0%, from the prior year.

Sales were higher on a year-over-year basis, led by a $5.3 billion, or 11.2%, increase in non-store sales. Vehicles and parts sales were close behind, up by $5.2 billion, or 5.5%. Building and garden supply stores sales were up by $2.3 billion, or 7.9%. On the downside, sales at sports and hobby stores were down by $282 million, or 3.8%. Department store sales were down by $238 million, or 1.8%, amid a struggle against online competition, while electronics and appliance store sales were down by $85 million, or 1.0%, from the prior year.

If we take out the impact of gasoline sales, which are not really an indication of stronger or weaker economic growth but rather due to changing gas prices, ex-gas retail sales were up 4.3% from a year ago in July, the most since January. If we also adjust for inflation, we see that real ex-gas retail sales were up 2.6% in July. Not only was this the best growth since June 2016, but it was strong enough to break out of the two-year-long downward trend, a welcome development for consumer spending.

Despite all of the weak May data, the Federal Reserve raised interest rates in June but finally took a breather in July. Today’s retail sales report, along with upward revisions in the last couple months, paints a brighter picture for consumer spending. Even so, inflation remains at bay and wage growth remains tepid. This bodes well for no rate hike in September.

Despite all of the weak May data, the Federal Reserve raised interest rates in June but finally took a breather in July. Today’s retail sales report, along with upward revisions in the last couple months, paints a brighter picture for consumer spending. Even so, inflation remains at bay and wage growth remains tepid. This bodes well for no rate hike in September.

RSS Feed

RSS Feed