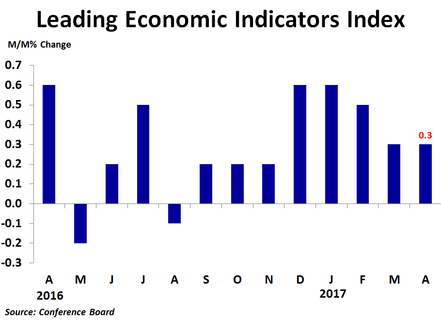

The leading economic indicators index rose 0.3% in April from the prior month following a downwardly revised 0.3% increase in March. The increase matched the consensus forecast. Compared to a year ago, the index was up 2.4%, less than March’s 2.7% pace. Over the six month period ending in April, the index was up 2.4%, up slightly from the 2.3% rate of growth in the six months to March.

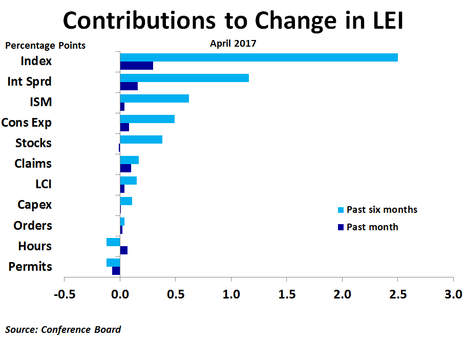

The interest rate spread between the 10-year Treasury yield and the Federal Funds rate led the way in April, contributing 0.16 percentage points to the growth in the index. Although this is the smallest contribution from this component since October as the spread has narrowed, this component has still contributed the most to the rise in the index over the past six months. Jobless claims contributed 0.10 percentage points in April as average weekly claims fell to 243,000 from 250,200 in a sign of continued labor market strength. Consumer expectations of business conditions added 0.08 percentage points in the fifth straight solid month for this component. Average weekly hours contributed 0.07 percentage points as weekly hours rose slightly during the month. Following four very strong months, the ISM new orders index cooled and only added 0.04 percentage points. Recent strength in this component finally showed up in real production data for April as reported yesterday, so this pullback suggests real manufacturing activity could cool as we head into the early Fall.

The biggest negative contribution came from building permits, which took 0.07 percentage points away from growth in the index as permits fell to 1.229 million units on an annualized basis in April from 1.260 million units in March. The stock market took away 0.01 percentage points as the S&P 500 fell to 2,359 from 2,367 amid rising political chaos and uncertainty emanating from the White House.

The biggest negative contribution came from building permits, which took 0.07 percentage points away from growth in the index as permits fell to 1.229 million units on an annualized basis in April from 1.260 million units in March. The stock market took away 0.01 percentage points as the S&P 500 fell to 2,359 from 2,367 amid rising political chaos and uncertainty emanating from the White House.

Although the interest rate spread is often among the largest contributors, its contribution has been trending slightly lower over the last few months as investors have been turning back to bonds as initial optimism about the new administration’s economic policies has been followed by some doubt about the chances for successful implementation and the possible impacts on the economy and earnings.

First quarter GDP growth was a very weak 0.7%, which was predicted by the stalling in the LEI in the second half of last year. The rise in the LEI over the last few months suggests that growth should pick up by the summer.

First quarter GDP growth was a very weak 0.7%, which was predicted by the stalling in the LEI in the second half of last year. The rise in the LEI over the last few months suggests that growth should pick up by the summer.

RSS Feed

RSS Feed