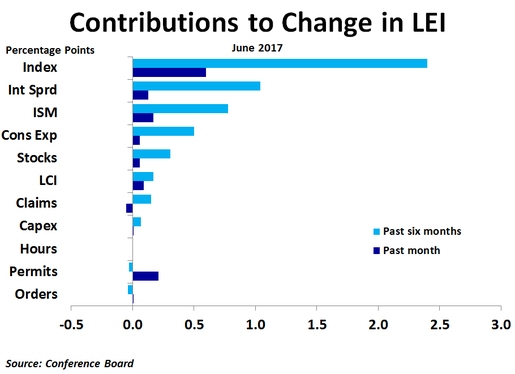

The only negative contribution came from initial jobless claims, as average weekly claims rose to 244K in June from 240K in May.

Given slowing inflation, weak wage growth and signs of a possible top in housing, the Fed’s June rate hike appears a bit misplaced. However, the LEI is suggesting growth should pick up soon. It remains to be seen if inflation, and interest rates, follow suit.

RSS Feed

RSS Feed