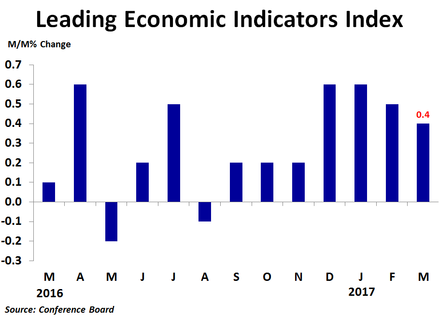

The leading economic indicators index rose 0.4% in March from the prior month following a downwardly revised 0.5% increase in February. The increase was better than the 0.2% consensus forecast. Compared to a year ago, the index was up a solid 2.8%, an improvement over January’s 2.5% pace. Over the six month period ending in March, the index was up 2.4%, up slightly from the 2.3% rate of growth in the six months to February.

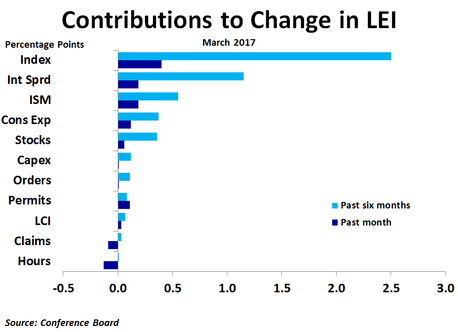

The big story in today’s report was the continued positive contribution from the ISM new orders index, which added 0.19 percentage points to the index, and has seen strong contributions for four straight months. During the last six months, this component has added 0.55 percentage points to the index, or 20% of the total growth. The interest rate spread contributed 0.19 percentage points in March. While its contribution over the last six months was greater than that for the ISM new orders component, it is not really a big story since it is almost always one of the biggest contributors. Another big story is the jump in consumer expectations of business conditions, which contributed 0.12 percentage points in March and has also seen four straight months of very strong contributions. The stock market also added support in March, but not as much as in December and February as investors have become a bit concerned about the probability of getting pro-business policies out of Washington, as well as uncertainty surrounding geopolitical tensions. Building permits increased in March, adding 0.11 percentage points.

The biggest negative contribution came from average hours worked, which took away 0.13 percentage points. Initial jobless claims subtracted 0.09 percentage points from the index as average claims rose to 250K in March from 243K in February.

The biggest negative contribution came from average hours worked, which took away 0.13 percentage points. Initial jobless claims subtracted 0.09 percentage points from the index as average claims rose to 250K in March from 243K in February.

Although the interest rate spread is often among the largest contributors, its contribution has been trending slightly lower over the last few months as investors have been turning back to bonds as initial optimism about the new administration’s economic policies has been followed by some doubt about the chances for successful implementation and the possible impacts on the economy and earnings. Geopolitical tensions have also buoyed bonds.

First quarter GDP is looking to be quite weak, which was predicted by the stalling in the LEI in the second half of last year. The rise in the LEI over the last few months suggests that growth should pick up by the summer.

First quarter GDP is looking to be quite weak, which was predicted by the stalling in the LEI in the second half of last year. The rise in the LEI over the last few months suggests that growth should pick up by the summer.

RSS Feed

RSS Feed