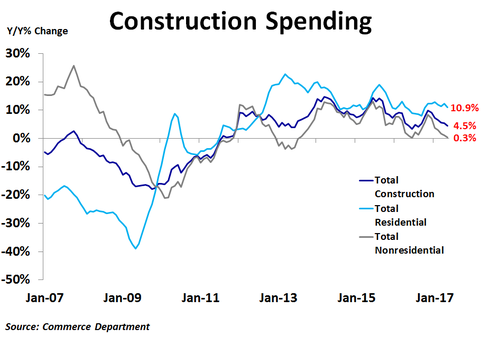

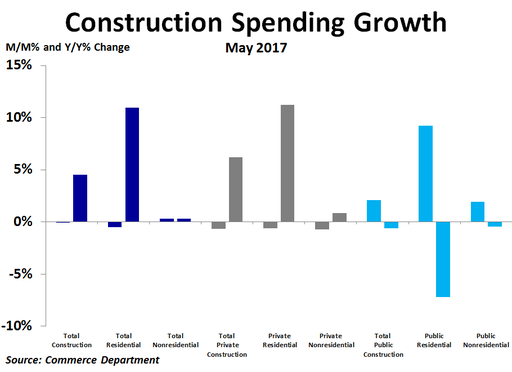

According to the Commerce Department, total construction spending fell by $287 million, or 0.02%, in May to $1.23 trillion, widely missing the consensus forecast of a 0.5% increase. This follows a 0.7% drop in April that was revised up from a 1.4% decline. Compared to a year ago, spending was up 4.5%, less than April’s 5.5% pace and the slowest since August.

May was one of those rare months when public and non-residential spending rose while private and residential spending fell. While residential spending dropped by $2.5 billion, or 0.5%, from the prior month, non-residential spending increased by $2.3 billion, or 0.3%. These measures were up 10.9% and 0.3% compared to a year ago, respectively.

Non-residential spending growth was led by educational facilities, which rose by $2.6 billion, or 2.8%. Office projects saw a $1.1 billion, or 1.6%, increase in spending. Power projects came in third, spending on which rose $702 million, or 0.7%. Conservation and development and religious projects both saw a 3.7% increase in spending, tied for the largest increase on a percentage basis. The biggest decline in non-residential spending was in manufacturing, which fell by $1.2 billion, or 1.7%. Highway and street projects saw an $876 million, or 1.0%, decline, while commercial spending dropped by $552 million, or 0.7%. The biggest percentage decline came in communications, where spending fell 1.9%. Transportation spending also fell by 1.2%.

Private spending plunged by $6.1 billion, or 0.6%, half of which came from residential projects, where the $3.1 billion decline was the largest in nearly three years. On the non-residential side, weakness was seen in manufacturing, which fell by $1.2 billion, and educational facilities, which dropped by $1.0 billion. Meanwhile, public spending rose by $5.9 billion, or 2.1%, driven largely by a big $3.6 billion increase in spending on educational facilities, the most in nearly a year.

Non-residential spending growth was led by educational facilities, which rose by $2.6 billion, or 2.8%. Office projects saw a $1.1 billion, or 1.6%, increase in spending. Power projects came in third, spending on which rose $702 million, or 0.7%. Conservation and development and religious projects both saw a 3.7% increase in spending, tied for the largest increase on a percentage basis. The biggest decline in non-residential spending was in manufacturing, which fell by $1.2 billion, or 1.7%. Highway and street projects saw an $876 million, or 1.0%, decline, while commercial spending dropped by $552 million, or 0.7%. The biggest percentage decline came in communications, where spending fell 1.9%. Transportation spending also fell by 1.2%.

Private spending plunged by $6.1 billion, or 0.6%, half of which came from residential projects, where the $3.1 billion decline was the largest in nearly three years. On the non-residential side, weakness was seen in manufacturing, which fell by $1.2 billion, and educational facilities, which dropped by $1.0 billion. Meanwhile, public spending rose by $5.9 billion, or 2.1%, driven largely by a big $3.6 billion increase in spending on educational facilities, the most in nearly a year.

Compared to a year ago, the strongest growth in total construction spending has come from residential, office and commercial projects. Conversely, the biggest declines have been seen in sewage and waste disposal, conservation/development and manufacturing.

The residential sector of the U.S. economy has been a pillar of strength over the last several years. Thus, the recent spike in interest rates amid talk of the Fed shrinking its balance sheet is cause for concern, for the construction industry and the overall economy.

The residential sector of the U.S. economy has been a pillar of strength over the last several years. Thus, the recent spike in interest rates amid talk of the Fed shrinking its balance sheet is cause for concern, for the construction industry and the overall economy.

RSS Feed

RSS Feed