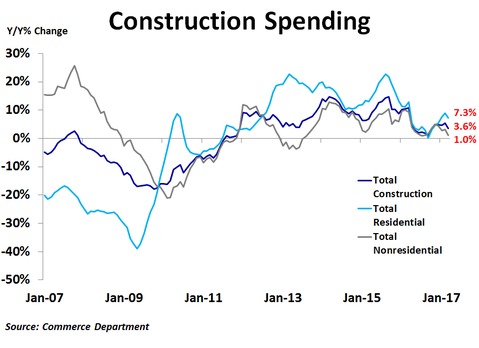

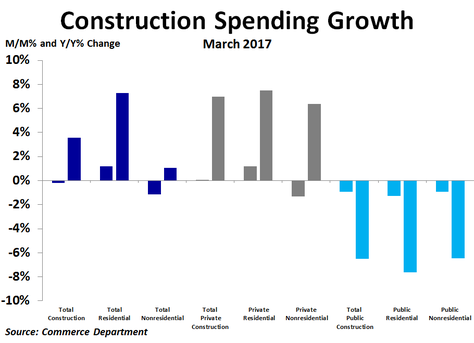

According to the Commerce Department, total construction spending fell by $2.5 billion, or 0.2%, in March to $1.22 trillion, but remained above the peak reached before the recession. Compared to a year ago, spending was up just 3.6%, a noticeable slowdown from February’s 5.4% rate of growth and on the lower end of the growth range seen during the last couple of years.

There was a noticeable difference in spending between the residential and non-residential sectors. While residential spending rose by $5.9 billion, or 1.2%, from the prior month, non-residential spending plunged by $8.4 billion, or 1.2%. These measures were up 7.3% and 1.0% compared to a year ago, respectively.

Non-residential spending strength was led by a $693 million increase in spending on healthcare facilities, a $436 million increase in manufacturing and a $402 million increase in highways and streets. Weakness was led by a $3.2 billion plunge in educational facilities, a $2.8 billion drop in commercial buildings and a $1.9 billion decline in office buildings.

There was also a noticeable difference between private and public spending. Private spending rose by $126 million, driven almost exclusively by residential projects. Non-residential spending fell by $5.9 billion and the weakness was fairly widespread. In contrast, public spending fell by $2.6 billion, almost all of which came in the non-residential category. Public spending on non-residential projects fell by $2.5 billion, driven largely by a $1.4 billion pullback in spending on educational facilities and a $1.2 billion decline in transportation.

Non-residential spending strength was led by a $693 million increase in spending on healthcare facilities, a $436 million increase in manufacturing and a $402 million increase in highways and streets. Weakness was led by a $3.2 billion plunge in educational facilities, a $2.8 billion drop in commercial buildings and a $1.9 billion decline in office buildings.

There was also a noticeable difference between private and public spending. Private spending rose by $126 million, driven almost exclusively by residential projects. Non-residential spending fell by $5.9 billion and the weakness was fairly widespread. In contrast, public spending fell by $2.6 billion, almost all of which came in the non-residential category. Public spending on non-residential projects fell by $2.5 billion, driven largely by a $1.4 billion pullback in spending on educational facilities and a $1.2 billion decline in transportation.

Compared to a year ago, the strongest growth in total construction spending has come from communications, office and commercial projects. Conversely, the biggest declines have been seen in sewage and waste disposal, water supply and transportation projects.

The residential sector of the U.S. economy has been a pillar of strength over the last several years. This has helped to soften the blow from weaker government spending during the same period. Even so, the pace of residential spending growth is down from a peak of nearly 23% year-over-year two years ago to just 7.3% in March. Following very weak economic growth in the first quarter and a decline in the consumer price index in March, the Federal Reserve held interest rates steady at today’s FOMC meeting. This should help to keep residential spending strong.

The residential sector of the U.S. economy has been a pillar of strength over the last several years. This has helped to soften the blow from weaker government spending during the same period. Even so, the pace of residential spending growth is down from a peak of nearly 23% year-over-year two years ago to just 7.3% in March. Following very weak economic growth in the first quarter and a decline in the consumer price index in March, the Federal Reserve held interest rates steady at today’s FOMC meeting. This should help to keep residential spending strong.

RSS Feed

RSS Feed