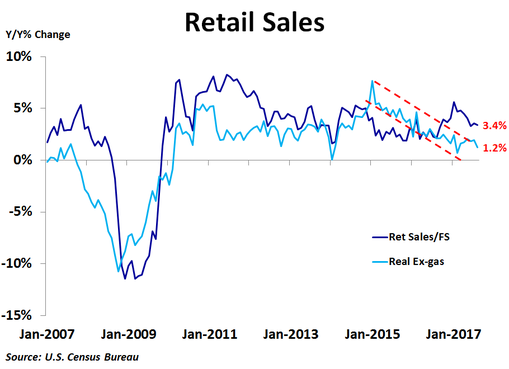

Retail sales fell 0.2% in August from the prior month, missing the consensus forecast of a 0.1% increase, following a 0.3% increase in July that was revised down from 0.6%. Sales excluding autos and gas also missed expectations, falling 0.1% compared to expectations of a 0.3% increase. On a year-over-year basis, sales were up 3.4%, less than the 3.5% pace in July and on the low end of the recent range after peaking in January.

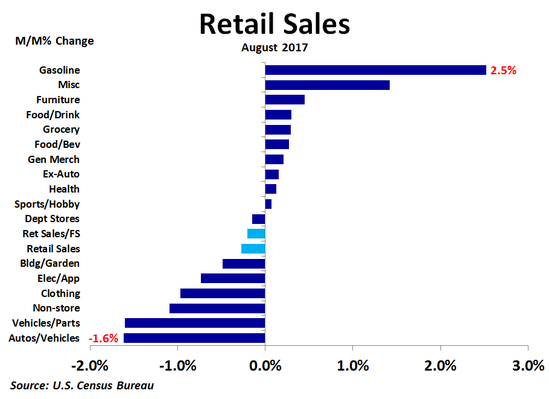

The biggest monthly increase in dollar terms was a $900 million, or 2.5%, increase in gasoline sales, largely driven by a surge in gas prices and heavy demand at the end of the month in the wake of Hurricane Harvey. There was not much strength anywhere else as sales at food and drinking places and food and beverage sales came in a distant second and third, rising by $167 million, or 0.3%, and $162 million, or 0.3%, respectively. The miscellaneous category saw a nice 1.4% increase in sales, while furniture sales rose a decent 0.4%. The biggest decline in sales came from motor vehicles and parts, which plunged by $1.6 billion, or 1.6%, which was also the biggest percentage decline. This followed several months of strength after a rough start to the year for the industry. Following a jump in July, non-store sales fell by $573 million, or 1.1%. Clothing also had a weak month, as sales declined by $211 million, or 1.0%.

Sales were higher on a year-over-year basis, led by a $4.2 billion, or 8.9%, increase in non-store sales. Gasoline sales were up by $2.3 billion, or 6.8%, and building and garden supply sales were up by $2.1 billion, or 7.4%. On the downside, sales at electronics and appliance stores were down by $264 million, or 3.2%, department store sales were down by $147 million, or 1.1%, while sales at sports and hobby stores were down by $130 million, or 1.8%. Although department store sales are still down from a year ago, the decline has slowed noticeably since the end of last year.

Sales were higher on a year-over-year basis, led by a $4.2 billion, or 8.9%, increase in non-store sales. Gasoline sales were up by $2.3 billion, or 6.8%, and building and garden supply sales were up by $2.1 billion, or 7.4%. On the downside, sales at electronics and appliance stores were down by $264 million, or 3.2%, department store sales were down by $147 million, or 1.1%, while sales at sports and hobby stores were down by $130 million, or 1.8%. Although department store sales are still down from a year ago, the decline has slowed noticeably since the end of last year.

If we take out the impact of gasoline sales, which are not really an indication of stronger or weaker economic growth but rather due to changing gas prices, ex-gas retail sales were up 3.1% from a year ago in August, the least since February 2014. If we also adjust for inflation, we see that real ex-gas retail sales were up 1.2%, the least since February.

Today’s report is further justification for no rate hike tomorrow. It will be interesting to see what the Fed says about winding down its balance sheet and when they plan to begin.

Today’s report is further justification for no rate hike tomorrow. It will be interesting to see what the Fed says about winding down its balance sheet and when they plan to begin.

RSS Feed

RSS Feed