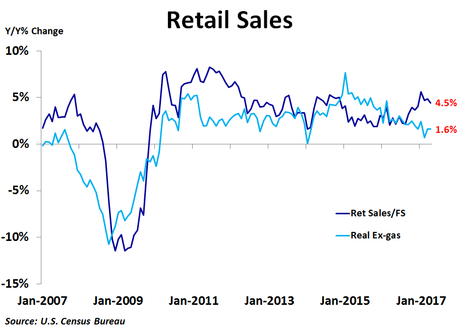

Retail sales rose 0.4% in April from the prior month, missing the consensus forecast of a 0.6% increase, following a 0.1% increase in March, which was revised up from a 0.2% decline. Sales excluding autos and gas also missed expectations, rising just 0.3% versus the 0.4% forecast. On a year-over-year basis, sales were up 4.5%, down noticeably from the recent peak of 5.6% reached in January.

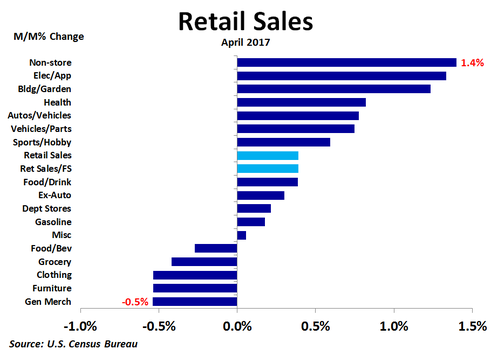

Vehicles and parts sales rose the most in dollars from the prior month, increasing by $720 million, or 0.7%. Non-store sales came in a close second, rising by $709 million, or 1.4%, as purchasing online continues to be a more common way to shop. Building and garden store sales followed with a $381 million increase. Non-store sales led the way on a percentage basis, followed closely by electronics and appliances (+1.3%) and building and garden stores (+1.2%). The biggest decline in dollars came from general merchandise store sales, which fell by $304 million, or 0.5%. Grocery store sales followed with a $223 million, or 0.4%, decline, while food and beverage sales fell by $161 million, or 0.3%. Furniture and clothing also saw 0.5% declines.

Sales were higher on a year-over-year basis, led by a $5.5 billion, or 11.9%, increase in non-store sales. Gasoline sales were a close second with a $4.2 billion, or 12.3%, rise in sales, followed by a $4.1 billion, or 4.4%, increase in vehicles and parts sales . Thus, non-store sales and vehicles and parts were major drivers in sales on both a month-ago and year-ago basis. The largest dollar decline in sales was seen in department stores, where sales were down $478 million, or 3.7%, which was also the biggest percentage decline of any category. This is also taking a toll on department store stocks as earnings continue to disappoint investors.

Sales were higher on a year-over-year basis, led by a $5.5 billion, or 11.9%, increase in non-store sales. Gasoline sales were a close second with a $4.2 billion, or 12.3%, rise in sales, followed by a $4.1 billion, or 4.4%, increase in vehicles and parts sales . Thus, non-store sales and vehicles and parts were major drivers in sales on both a month-ago and year-ago basis. The largest dollar decline in sales was seen in department stores, where sales were down $478 million, or 3.7%, which was also the biggest percentage decline of any category. This is also taking a toll on department store stocks as earnings continue to disappoint investors.

If we take out the impact of gasoline sales, which are not really an indication of stronger or weaker economic growth but rather due to changing gas prices, ex-gas retail sales were up only 3.8% from a year ago in April. If we also adjust for inflation, we see that real ex-gas retail sales were up just 1.6% in April, the same as in March. This measure of retail sales growth, which went negative a year before the headline number leading up to the Great Recession, has been trending down over the last two years and remained weak in April.

This report, along with slowing wage growth and overall and core inflation in April, may once again give the Fed some pause at its next rate setting meeting in June. Stay tuned!

This report, along with slowing wage growth and overall and core inflation in April, may once again give the Fed some pause at its next rate setting meeting in June. Stay tuned!

RSS Feed

RSS Feed