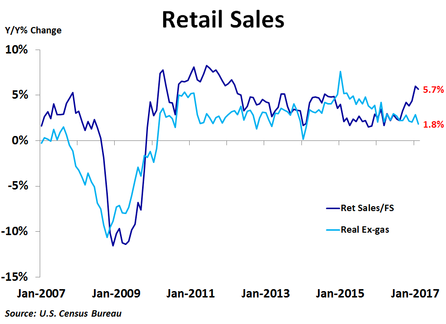

Retail sales rose 0.1% in February from the prior month, in line with expectations, but far less than the 0.6% increase in January. Sales excluding autos rose 0.2%, also in line with expectations, while sales excluding autos and gas rose 0.2%, slightly less than expected. On a year-over-year basis, sales were up 5.7%, down slightly from January’s 6.0% pace.

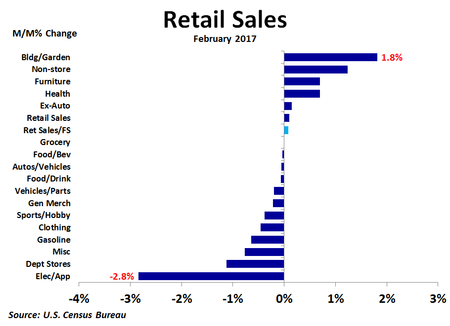

Non-store sales rose the most in dollars from the prior month, increasing by $610 million, or 1.2%, as purchasing online continues to be a more common way to shop. Building and garden supply stores led the way on a percentage basis, as sales rose $561 million, or 1.8%. Health stores and furniture stores were the only other categories to see monthly gains. The biggest decline in dollars came from gasoline sales, which fell $236 million, or 0.6%. Close behind was a $234 million drop in sales of electronics and appliances, which saw the biggest percentage drop of 2.9%. Vehicles and parts also had a weak month as sales fell $197 million, or 0.2%.

Sales were higher on a year-over-year basis, led by a $6.0 billion, or 19.6%, increase in gasoline station sales. Non-store sales were a close second with a $5.7 billion, or 13.0%, rise in sales. The largest dollar decline in sales was seen in department stores, where sales were down $751 million, or 5.6%. The biggest percentage decline was in electronics and appliances, where sales were down $514 million, or 6.0%. Thus, while lower gasoline sales were a major factor in weak overall sales in February, they were a big factor in the yearly increase. At the same time, electronics and appliance store sales were weak on both a month-ago and a year-ago basis.

Sales were higher on a year-over-year basis, led by a $6.0 billion, or 19.6%, increase in gasoline station sales. Non-store sales were a close second with a $5.7 billion, or 13.0%, rise in sales. The largest dollar decline in sales was seen in department stores, where sales were down $751 million, or 5.6%. The biggest percentage decline was in electronics and appliances, where sales were down $514 million, or 6.0%. Thus, while lower gasoline sales were a major factor in weak overall sales in February, they were a big factor in the yearly increase. At the same time, electronics and appliance store sales were weak on both a month-ago and a year-ago basis.

If we take out the large impact of gasoline sales, which are not really an indication of stronger economic growth but rather due to higher gas prices, ex-gas retail sales were up only 4.6% from a year ago in February. If we also adjust for inflation, we see that real ex-gas retail sales were up only 1.8% in February. This measure of retail sales growth, which went negative a year before the headline number leading up to the Great Recession, has been trending down over the last two years.

Just as the Fed looks at prices excluding gasoline to determine the underlying trend of inflation, doing the same thing for retail sales gives us a better look at the underlying trend of retail sales. With this measure of sales growing slower, today’s rate increase may a bigger thorn than many think.

Just as the Fed looks at prices excluding gasoline to determine the underlying trend of inflation, doing the same thing for retail sales gives us a better look at the underlying trend of retail sales. With this measure of sales growing slower, today’s rate increase may a bigger thorn than many think.

RSS Feed

RSS Feed