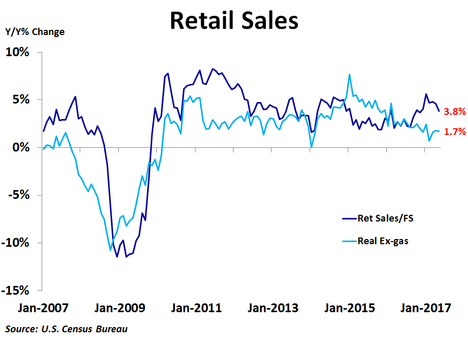

Retail sales fell 0.3% in May from the prior month, missing the consensus forecast of a 0.1% increase, following a 0.4% increase in April. Sales excluding autos and gas also missed expectations, coming in unchanged versus the 0.3% forecast. On a year-over-year basis, sales were up 3.8%, down noticeably from the recent peak growth rate of 5.6% reached in January.

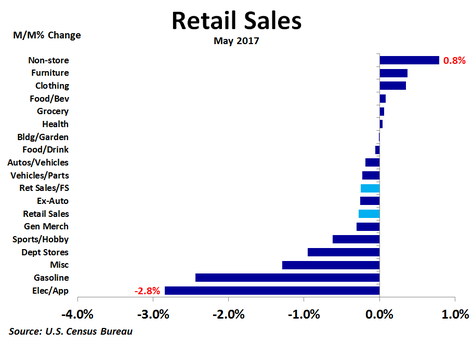

This was a very weak report as the only real strength was seen in non-store sales, which increased by $405 million, or 0.8%, and led the way on both a dollar and percent growth basis. The next biggest increase by dollar value was a $75 million, or 0.3%, increase in clothing. Food and beverage stores saw sales rise by $47 million, or 0.1%. Furniture sales rose by $35 million, or 0.4%, which was the second best percentage increase. In all, only six of sixteen categories saw higher sales compared to April. The biggest decline on a dollar basis was seen in gasoline station sales, which plunged by $923 million, or 2.4%, as both prices and gallons purchased dropped. Electronics and appliances sales fell by $237 million, or 2.8%, following a very strong April. Vehicles and parts sales, an important economic driver, fell by $224 million, or 0.2%, as the downturn in the vehicle market resumed after an uptick in April. The miscellaneous category also saw lower sales, falling by $141 million, or 1.3%.

Sales were higher on a year-over-year basis, led by a $4.8 billion, or 10.2%, increase in non-store sales. Vehicles and parts were a close second with a $3.5 billion, or 3.7%, rise in sales, followed by a $3.0 billion, or 10.8%, increase in building and garden supplies sales . Thus, non-store sales were a major driver in sales on both a month-ago and year-ago basis, but vehicles and parts, although strong year-over-year, have been weak on a monthly basis recently. The largest dollar decline in sales was seen in department stores, where sales were down $487 million, or 3.7%. However, the biggest percentage decline was in sports and hobby stores sales, down 4.7% from a year ago.

Sales were higher on a year-over-year basis, led by a $4.8 billion, or 10.2%, increase in non-store sales. Vehicles and parts were a close second with a $3.5 billion, or 3.7%, rise in sales, followed by a $3.0 billion, or 10.8%, increase in building and garden supplies sales . Thus, non-store sales were a major driver in sales on both a month-ago and year-ago basis, but vehicles and parts, although strong year-over-year, have been weak on a monthly basis recently. The largest dollar decline in sales was seen in department stores, where sales were down $487 million, or 3.7%. However, the biggest percentage decline was in sports and hobby stores sales, down 4.7% from a year ago.

If we take out the impact of gasoline sales, which are not really an indication of stronger or weaker economic growth but rather due to changing gas prices, ex-gas retail sales were up only 3.6% from a year ago in May. If we also adjust for inflation, we see that real ex-gas retail sales were up just 1.7% in May, and the growth rate has been trending down.

Despite this weak report, along with other weak May data, the Federal Reserve raised interest rates. It may be a costly move.

Despite this weak report, along with other weak May data, the Federal Reserve raised interest rates. It may be a costly move.

RSS Feed

RSS Feed