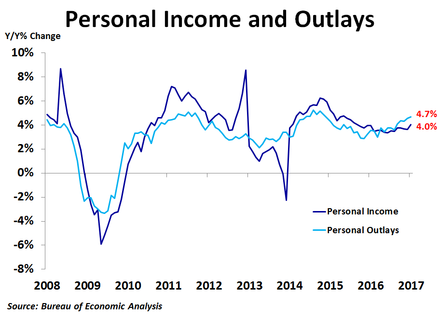

Personal income rose 0.4% in January from the prior month, beating the 0.3% consensus forecast, and was up 4.0% from a year ago, the strongest growth since December 2015. Personal spending rose just 0.2%, less than the 0.3% forecast, but was up 4.7% from a year ago, the strongest growth since November 2014. With income growing faster than spending, the personal savings rate inched up to 5.5% of personal disposable income.

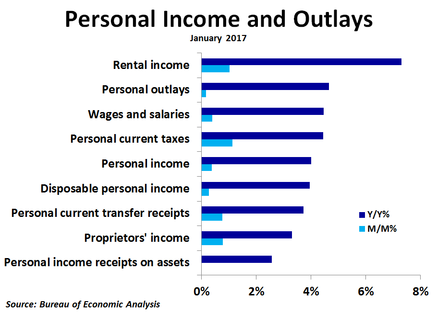

Compared to a month ago, rental income led the way with a 1.0% increase. Personal current transfer receipts, such as social security, Medicare, Medicaid and unemployment insurance, rose 0.8%, as did proprietors’ income, thanks in part to the first increase in farm income in several months. The all-important wages and salaries component increased by 0.4%, with both private industry and government wages seeing healthy gains. Meanwhile, income on assets, such as interest and dividends, were flat on the month.

Compared to a year ago, rental income also topped the charts, rising by a very strong 7.3%, as high home prices are pushing up rents. Wages and salaries were up 4.5%, with private industry wage growth of 4.8% far outpacing government wage growth of just 3.0%. Personal current transfer receipts were up 3.7%, with the strongest growth coming from Medicaid at 6.2%, followed closely by veterans’ benefits at 6.1%, while unemployment insurance was down 9.1%. Proprietors’ income was up just 3.3%, weighed down by a huge 42% drop in farm income from the prior year. Income on assets was up just 2.6%, driven almost entirely by interest income as dividends were virtually flat.

Wages and salaries accounted for over half of the total increase in personal income on both a monthly and yearly basis in January, which mostly came from private industry wages. A third of the monthly increase came from personal current transfer receipts, primarily due to a large 1.0% increase in social security.

Compared to a year ago, rental income also topped the charts, rising by a very strong 7.3%, as high home prices are pushing up rents. Wages and salaries were up 4.5%, with private industry wage growth of 4.8% far outpacing government wage growth of just 3.0%. Personal current transfer receipts were up 3.7%, with the strongest growth coming from Medicaid at 6.2%, followed closely by veterans’ benefits at 6.1%, while unemployment insurance was down 9.1%. Proprietors’ income was up just 3.3%, weighed down by a huge 42% drop in farm income from the prior year. Income on assets was up just 2.6%, driven almost entirely by interest income as dividends were virtually flat.

Wages and salaries accounted for over half of the total increase in personal income on both a monthly and yearly basis in January, which mostly came from private industry wages. A third of the monthly increase came from personal current transfer receipts, primarily due to a large 1.0% increase in social security.

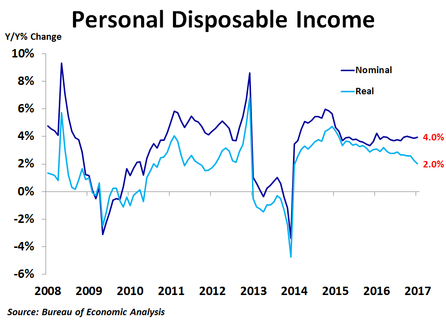

Despite a big 4.5% increase in tax payments from the prior year, personal disposable income was up 4.0% from a year ago, in line with recent trends. However, when inflation is taken into account, real personal disposable income was up just 2.0% and the rate of growth has been slowing. With inflation expected to accelerate in the coming months, real economic growth may not be too impressive, especially if a Fed rate increase starts to take a bite out of the housing market.

RSS Feed

RSS Feed