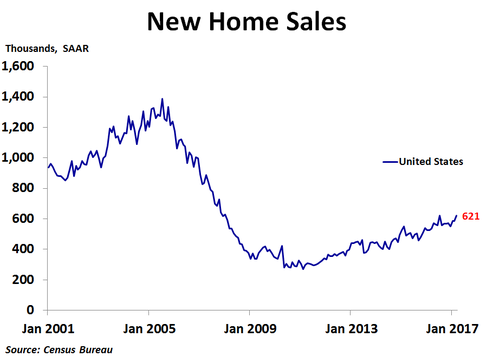

New home sales soared in March to 621K units on a seasonally adjusted annualized basis, an improvement on February’s 587K units, far better than the consensus forecast of 588K units and just shy of the post-recession high of 622K units reached in July 2016. Sales were up a very strong 5.8% from the prior month and 15.6% from a year ago.

Sales rose the most in the Northeast, which saw a 25.8% increase from the prior month. Sales rose 16.7% in the West and 1.6% in the South, but declined 4.5% in the Midwest. Compared to a year ago, sales were up 32.6% in the West, 23.5% in the Midwest, 21.9% in the Northeast and just 5.9% in the South.

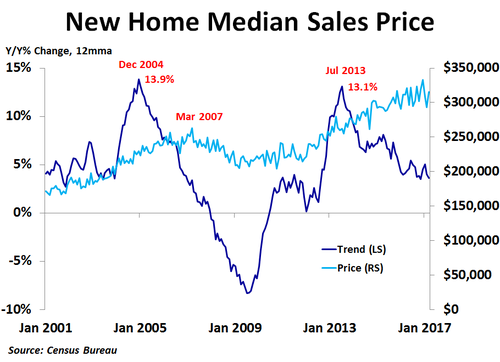

In the first quarter, the national median price was down 2.2% from the prior year, the first decline since the fourth quarter of 2011. Prices were up a sharp 32.6% in the Northeast and a scant 1.2% in the West, but were down 3.7% in the Midwest and 6.0% in the South. The Census Bureau does not report regional median prices by month, only quarterly and annually. In March, the national median price rose 7.5% from the prior month but was up just 1.2% from the prior year. The 12-month moving average trend of price growth has been slowing over the last couple of years and is currently the slowest in four and a half years, suggesting new home prices may be near a peak.

In the first quarter, the national median price was down 2.2% from the prior year, the first decline since the fourth quarter of 2011. Prices were up a sharp 32.6% in the Northeast and a scant 1.2% in the West, but were down 3.7% in the Midwest and 6.0% in the South. The Census Bureau does not report regional median prices by month, only quarterly and annually. In March, the national median price rose 7.5% from the prior month but was up just 1.2% from the prior year. The 12-month moving average trend of price growth has been slowing over the last couple of years and is currently the slowest in four and a half years, suggesting new home prices may be near a peak.

As with the existing home market, inventory continues to be a big story right now. In March, there was only 5.2 months’ worth of supply available, down from 5.4 months in February, far below the supply levels of the previous boom and not nearly enough to meet torrid demand. Fortunately, the number of new homes for sale has jumped in the last few months and are at the highest level since July 2009, which should bring some relief to frustrated buyers. Mortgage rates have declined noticeably over the last few weeks as investors have become more uncertain about the success or impacts of pro-growth policies under the new administration. In addition, inflation slowed in March, suggesting interest rates may stay fairly low in the near term.

The path of home price growth during this housing cycle is nearly a mirror image of the path during the last cycle when viewed on a year-over-year percent change, 12-month moving average basis. If supply or mortgage rates move up, prices will likely fall, but big upside movements for either do not appear likely in the near term.

The path of home price growth during this housing cycle is nearly a mirror image of the path during the last cycle when viewed on a year-over-year percent change, 12-month moving average basis. If supply or mortgage rates move up, prices will likely fall, but big upside movements for either do not appear likely in the near term.

RSS Feed

RSS Feed