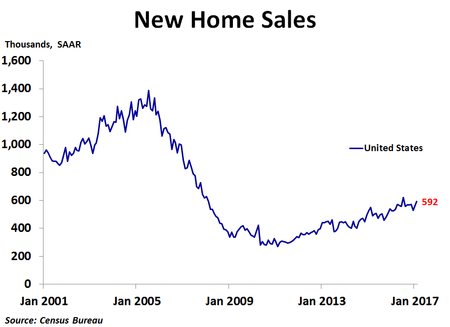

New home sales rose in February to 592K units on a seasonally adjusted annualized basis, an improvement on January’s 558K units, and far better than the consensus forecast of 565K units. Sales were up 6.1% from the prior month and 12.8% from a year ago.

Sales rose the most in the Midwest, which saw a 30.9% increase from the prior month. Sales rose 7.5% in the West and 3.6% in the South, but declined 21.4% in the Northeast. Compared to a year ago, sales were up a strong 50.8% in the Midwest, 13.8% in the Northeast, 7.9% in the South and 6.8% in the West.

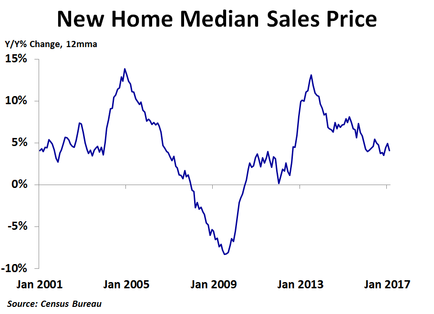

In the fourth quarter, median prices were up 1.6% y/y in the Midwest, but were down 2.0% in the South, 2.5% in the West and 16.7% in the Northeast. The Census Bureau does not report regional median prices by month, only quarterly and annually. The national median price fell 3.9% in February to $296,200. The 12-month moving average trend of price growth has been slowing over the last couple of years, suggesting we may be near a peak in prices for new homes.

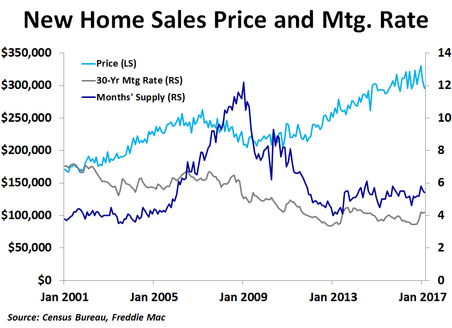

As with the existing home market, inventory continues to be a big story right now. In February, there was only 5.4 months’ worth of supply available. While this is a bit higher than the 5.3 month average over the past year, it is still far below the supply levels of the previous boom, and not enough to meet torrid demand. Fortunately, the number of new homes for sale has jumped in the last few months, which should bring some relief to frustrated buyers. Builders are likely reluctant to ramp up construction too much partly due to the risk of overbuilding and causing another crash, and partly because current demand is being driven by ultra-low mortgage rates, which are not only unsustainable, but have risen since the election. Mortgage rates have levelled of over the last couple months as investors have become more uncertain about the success or impacts of pro-growth policies under the new administration. Still, accelerating inflation suggests interest rate risk is to the upside.

In the fourth quarter, median prices were up 1.6% y/y in the Midwest, but were down 2.0% in the South, 2.5% in the West and 16.7% in the Northeast. The Census Bureau does not report regional median prices by month, only quarterly and annually. The national median price fell 3.9% in February to $296,200. The 12-month moving average trend of price growth has been slowing over the last couple of years, suggesting we may be near a peak in prices for new homes.

As with the existing home market, inventory continues to be a big story right now. In February, there was only 5.4 months’ worth of supply available. While this is a bit higher than the 5.3 month average over the past year, it is still far below the supply levels of the previous boom, and not enough to meet torrid demand. Fortunately, the number of new homes for sale has jumped in the last few months, which should bring some relief to frustrated buyers. Builders are likely reluctant to ramp up construction too much partly due to the risk of overbuilding and causing another crash, and partly because current demand is being driven by ultra-low mortgage rates, which are not only unsustainable, but have risen since the election. Mortgage rates have levelled of over the last couple months as investors have become more uncertain about the success or impacts of pro-growth policies under the new administration. Still, accelerating inflation suggests interest rate risk is to the upside.

Interestingly, the path of home price growth during this housing cycle is nearly a mirror image of the path during the last cycle when viewed on a year-over-year percent change, 12-month moving average basis. If supply or mortgage rates move up, prices will likely fall. If they both move up, prices could fall significantly. With inflation on the rise and the Fed hinting at further rate hikes, this housing cycle may be reaching its peak. Stay tuned!

RSS Feed

RSS Feed