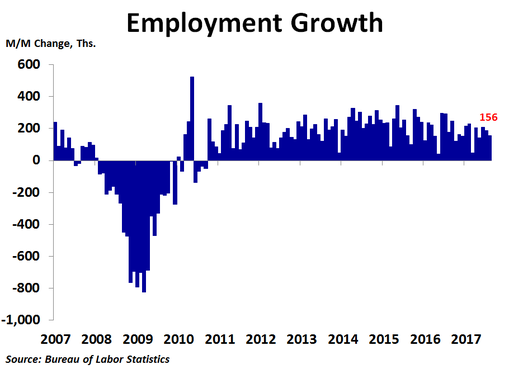

Job growth slowed in August as the economy added 156K new jobs, less than July’s 189K increase and far below the 180K consensus forecast. Revisions showed 41K fewer jobs were created in June and July than previously reported. The year-ago rate of job growth slipped to 1.4%, the lowest in six years.

Professional and business services led the way in August, putting 40K more people to work. Manufacturing had a very good month, creating 36K new positions, the most in four years, due in part to a rise in motor vehicle and parts manufacturing. Construction also had a solid month as 28K workers found new jobs, the most since February. Healthcare services had a very weak month, adding just 17K new jobs, far less than the 44K increase in July and the least in over four years. The weakness was primarily due to a slight decline in home healthcare services following a big spike in July. Leisure and hospitality services only put 4K more people to work, a huge drop from July’s 58K increase. It was the industry’s worst month in over five years and was due to a big slowdown in hiring at food services and drinking places following a huge jump in July. Retail trade had another weak month, creating only 800 new jobs.

On the downside, information services continued to struggle, cutting 8K more jobs, the eleventh straight monthly decline during which 75K jobs have been eliminated. Government also lost 9K jobs, almost all of which came at the state and local levels.

The 33K decline in job growth in August versus July was largely due to much less hiring in leisure and hospitality services and healthcare. These slowdowns came after big spikes in certain areas, suggesting the weakness in August was payback for those recent jumps.

On the downside, information services continued to struggle, cutting 8K more jobs, the eleventh straight monthly decline during which 75K jobs have been eliminated. Government also lost 9K jobs, almost all of which came at the state and local levels.

The 33K decline in job growth in August versus July was largely due to much less hiring in leisure and hospitality services and healthcare. These slowdowns came after big spikes in certain areas, suggesting the weakness in August was payback for those recent jumps.

The unemployment rate rose from 4.3% to 4.4% as the household survey showed that the labor force increased by 77K while employment declined by 74K. Thus, not only did new entrants not find jobs, some people previously employed lost their jobs. This is certainly not a good sign for the labor market.

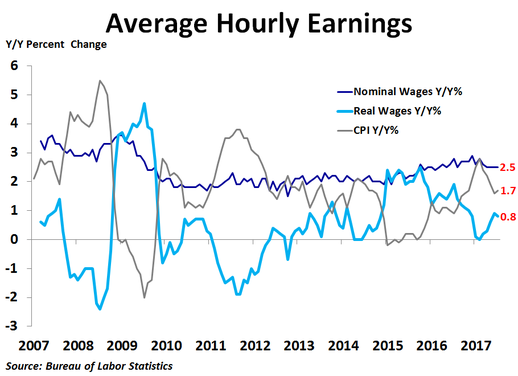

Average hourly earnings rose just 0.1% and were up 2.5% from a year ago for the fifth straight month. With inflation cooling recently, real wage growth has rebounded slightly but remains fairly weak at just 0.8%.

Today’s weak jobs report, combined with weak inflation, rising tensions with North Korea and the impacts of natural disasters, suggests the Fed will almost certainly not raise interest rates any time soon.

Average hourly earnings rose just 0.1% and were up 2.5% from a year ago for the fifth straight month. With inflation cooling recently, real wage growth has rebounded slightly but remains fairly weak at just 0.8%.

Today’s weak jobs report, combined with weak inflation, rising tensions with North Korea and the impacts of natural disasters, suggests the Fed will almost certainly not raise interest rates any time soon.

RSS Feed

RSS Feed