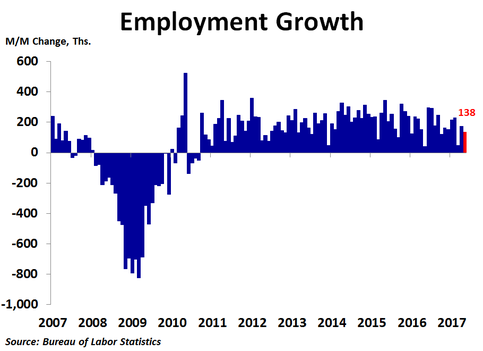

Job growth slowed in May as the economy generated just 138K new jobs, down from the 174K increase in April, and much less than the 185K consensus forecast. Even worse, revisions showed 29K fewer jobs were created in March and 37K fewer jobs were created in April than previously reported. Still, the rate of job growth inched up to 1.6% year-over-year, but this was due to a very weak May a year ago, making year-ago comparisons more favorable.

Professional and business services led the way in May with a 38K increase in payrolls, equal to April’s growth. Healthcare added 32K new jobs, but this was far less than the 45K added in April. Leisure and hospitality services put 31K people back to work, but this was also far less than April’s reading. Temporary help services increased staff by 13K. Following a couple weak months, construction employment rebounded by 11K, but even that was still much weaker than the first couple months of the year, in line with the recent slowing in home building and sales. Financial services added 11K new jobs and mining put 6K more people to work, the seventh straight positive month.

On the downside, government saw the biggest decline as a net 9K people lost their jobs, with the losses coming at the state and local levels. Retail trade lost another 6K positions, bringing total losses to 80K over the last four months as the industry continues to struggle with competition from online retailers. Manufacturing lost 1K jobs as the motor vehicle industry slump continues. Information services employment cut another 2K jobs, the eighth straight decline as the sector’s worst slump since the recession continues.

The 36K difference in job growth in May versus April was largely due to much less hiring in leisure and hospitality services, healthcare, manufacturing and government.

On the downside, government saw the biggest decline as a net 9K people lost their jobs, with the losses coming at the state and local levels. Retail trade lost another 6K positions, bringing total losses to 80K over the last four months as the industry continues to struggle with competition from online retailers. Manufacturing lost 1K jobs as the motor vehicle industry slump continues. Information services employment cut another 2K jobs, the eighth straight decline as the sector’s worst slump since the recession continues.

The 36K difference in job growth in May versus April was largely due to much less hiring in leisure and hospitality services, healthcare, manufacturing and government.

Although the unemployment rate fell from 4.4% to 4.3%, it was because 429K people left the labor force, 234K of which were previously employed and 195K of which were previously unemployed. Thus, the decline in the unemployment rate was for the wrong reasons.

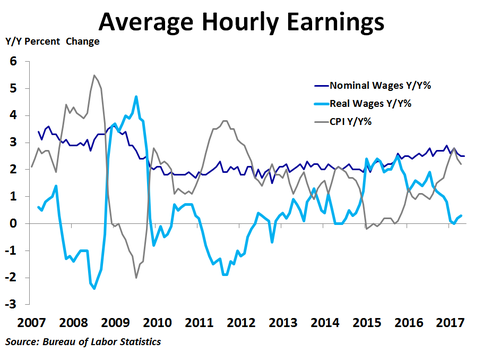

Average hourly earnings rose 0.2% and were up 2.5% from a year ago, down a bit from the 2.9% pace back in December. With inflation cooling recently, real wage growth has rebounded slightly but remains very weak.

Today’s report, along with weak housing data, a slowing vehicle market and softening inflation, gives more credence to a call for no Fed rate hike in June.

Average hourly earnings rose 0.2% and were up 2.5% from a year ago, down a bit from the 2.9% pace back in December. With inflation cooling recently, real wage growth has rebounded slightly but remains very weak.

Today’s report, along with weak housing data, a slowing vehicle market and softening inflation, gives more credence to a call for no Fed rate hike in June.

RSS Feed

RSS Feed