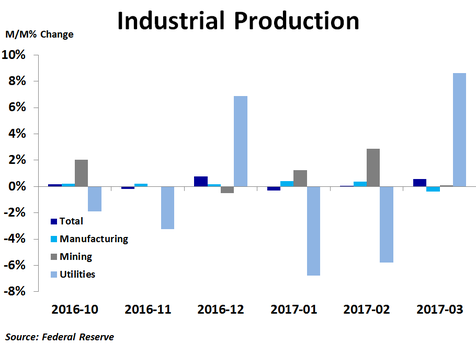

Industrial production rose 0.5% in March, slightly better than the 0.4% consensus forecast and much better than February’s 0.1% increase, which was revised up from no change. The increase was driven by an 8.6% jump in utility output after two months of big declines. This was offset by a 0.4% decline in manufacturing output. Mining output was little changed. Overall production was up 1.5% on a year-ago basis, the strongest in two years.

In manufacturing, production was led by a 1.5% increase in petroleum and coal products and a 0.9% increase in computer and electronic products. On the downside, production of motor vehicles and parts fell 3.0%, in line with plunging vehicle sales, while production of apparel and leather goods fell 1.6% and production of electrical equipment, appliances and components fell 1.6%.

Compared to a year ago, production was up 26.5% for natural gas distribution, the most by far, as furnaces kicked into gear with a return to more seasonable temperatures. Machinery production was up 4.5%, while computer and electronic products production was up 3.9%. Conversely, the worst performance was in apparel and leather goods, production of which was down 6.4%, and aerospace and miscellaneous transportation equipment, which was down 2.5%.

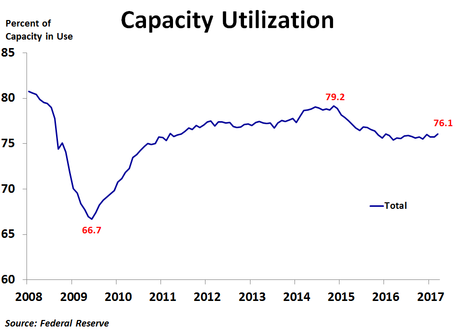

Capacity utilization increased from 75.7% to 76.1%, but was still below the recent peak of 78.9% back in November 2014. This has helped to keep inflation largely subdued outside of energy for the last two years. The utilization rate has been fairly steady since reaching a recent low of 75.4% in March 2016. The most pressure is currently seen in oil and gas extraction, where 95.7% of capacity is in use. Nonmetallic mineral mining and quarrying and plastic materials and resin utilization is also high, at 90.7% and 88.6%, respectively. On the flip side, support activities for mining are currently only using 48.1% of capacity.

Compared to a year ago, production was up 26.5% for natural gas distribution, the most by far, as furnaces kicked into gear with a return to more seasonable temperatures. Machinery production was up 4.5%, while computer and electronic products production was up 3.9%. Conversely, the worst performance was in apparel and leather goods, production of which was down 6.4%, and aerospace and miscellaneous transportation equipment, which was down 2.5%.

Capacity utilization increased from 75.7% to 76.1%, but was still below the recent peak of 78.9% back in November 2014. This has helped to keep inflation largely subdued outside of energy for the last two years. The utilization rate has been fairly steady since reaching a recent low of 75.4% in March 2016. The most pressure is currently seen in oil and gas extraction, where 95.7% of capacity is in use. Nonmetallic mineral mining and quarrying and plastic materials and resin utilization is also high, at 90.7% and 88.6%, respectively. On the flip side, support activities for mining are currently only using 48.1% of capacity.

Survey data for manufacturing has been quite strong recently, so the decline in manufacturing output in March is a bit of a surprise. It appears as though higher vehicle loan rates, which followed the rise in the 10-year yield due to increased optimism about the economy after the presidential election, have weighed on vehicle sales and production recently. This is a major reason why first quarter economic growth is expected to be quite weak. In turn, interest rates have been falling, which will hopefully revive the vehicle industry a bit.

RSS Feed

RSS Feed