Industrial production was unchanged in May, weighed down by a second straight monthly decline in utility output. A cooler than normal May could have been a culprit in the drop in utility output, which fell 1.8% following a 3.2% decline in April. Mining also saw a pullback to 0.7% from 1.1%. Meanwhile, manufacturing output remained soft, scratching out a 0.1% gain following two months of declines.

Production of consumer goods was soft again, falling 0.1% on the month after dropping 0.7% in April, as production of foods, tobacco products, paper and consumer energy products fell. Business equipment production increased 0.2% following a 0.3% decline in April, led by increases in electrical instruments and medium and heavy duty trucks.

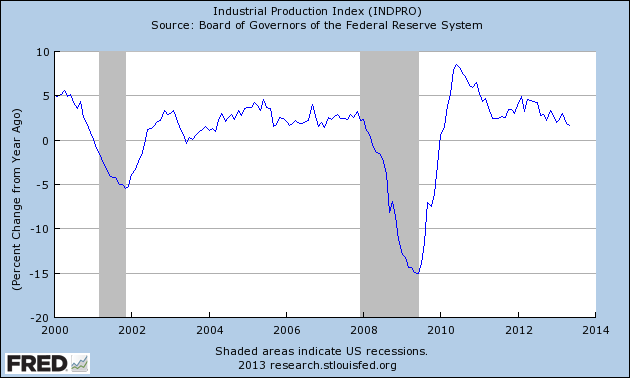

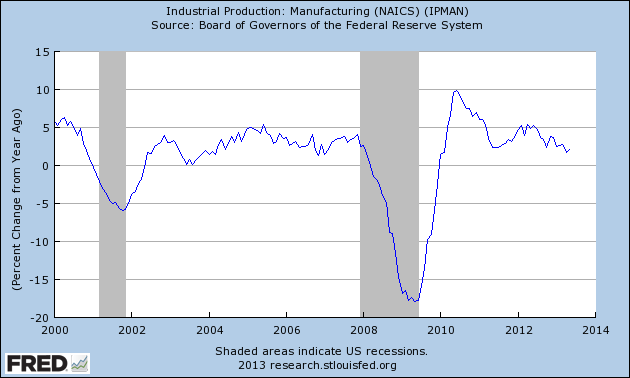

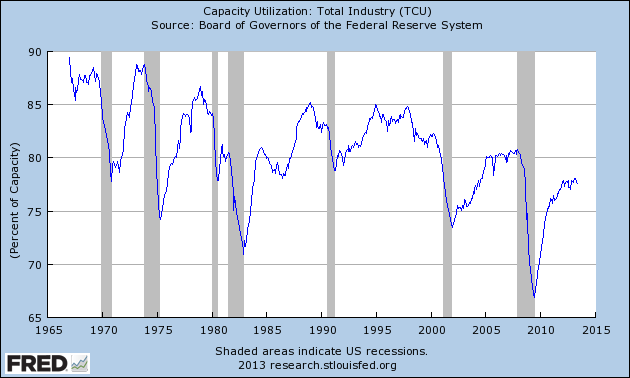

It is clear that industrial production is weakening, as production was only 1.6% higher than a year ago in May, the lowest rate of growth since February 2010 (chart 1). Although utility production has been very weak lately, the much larger manufacturing component also remains subdued (chart 2). In addition, capacity utilization, while much improved since the depths of the recession, appears to be leveling off at levels not much higher than the troughs of past business cycles (chart 3). This report, along with the softness in core producer inflation, will allow the Fed to continue its accommodative monetary stance with little concern about inflation for the time being.

Production of consumer goods was soft again, falling 0.1% on the month after dropping 0.7% in April, as production of foods, tobacco products, paper and consumer energy products fell. Business equipment production increased 0.2% following a 0.3% decline in April, led by increases in electrical instruments and medium and heavy duty trucks.

It is clear that industrial production is weakening, as production was only 1.6% higher than a year ago in May, the lowest rate of growth since February 2010 (chart 1). Although utility production has been very weak lately, the much larger manufacturing component also remains subdued (chart 2). In addition, capacity utilization, while much improved since the depths of the recession, appears to be leveling off at levels not much higher than the troughs of past business cycles (chart 3). This report, along with the softness in core producer inflation, will allow the Fed to continue its accommodative monetary stance with little concern about inflation for the time being.

RSS Feed

RSS Feed