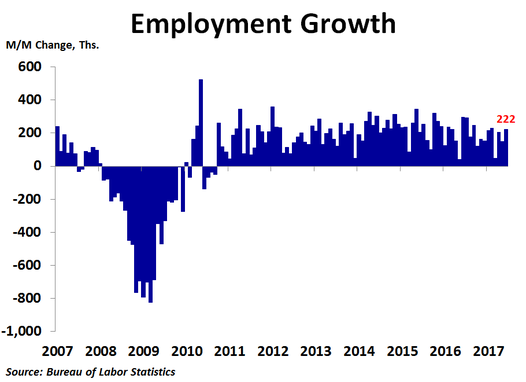

Job growth roared higher in June as the economy added 222K new jobs, much better than May’s 152K increase and much higher than the 170K consensus forecast. Even better, revisions showed 33K more jobs were created in April and 14K more jobs were created in May than previously reported. The rate of job growth held at 1.6% year-over-year.

Healthcare led the way in June with a 59K increase in payrolls, double May’s increase. Leisure and hospitality services followed with a 36K increase after a fairly weak 25K increase in May. Professional and business services added just 35K new positions, one of the lowest readings in the past year, as administrative and waste services saw the weakest job growth since December following a big increase in May. Government was a big surprise as 35K people found new jobs in public service, coming almost exclusively at the local level. The construction industry had a decent month as 16K people found work following three very weak months amid slowing activity in the housing market. Following four straight monthly declines, retail trade finally saw an increase in payrolls in June as the industry added 8K new jobs. Mining and logging had another good month as 8K new jobs were created, the eighth straight increase. After losing 2K jobs in May, manufacturing could only muster a 1K job gain in June as the motor vehicle industry is in a bit of a rut.

On the downside, information services lost 4K more jobs, the ninth straight monthly decline, which is bad news since these are some of the highest paying jobs in the economy. Motor vehicle and parts manufacturing lost 1K jobs as sales continue to dwindle.

The 70K difference in job growth in June versus May was largely due to the big increase in local government jobs and the rebound in healthcare services employment.

On the downside, information services lost 4K more jobs, the ninth straight monthly decline, which is bad news since these are some of the highest paying jobs in the economy. Motor vehicle and parts manufacturing lost 1K jobs as sales continue to dwindle.

The 70K difference in job growth in June versus May was largely due to the big increase in local government jobs and the rebound in healthcare services employment.

Although the unemployment rate rose from 4.3% to 4.4%, it was because 361K people entered the labor force, but only 245K of them found work. Thus, the increase in the unemployment rate was for a good reason as people were more confident about finding jobs.

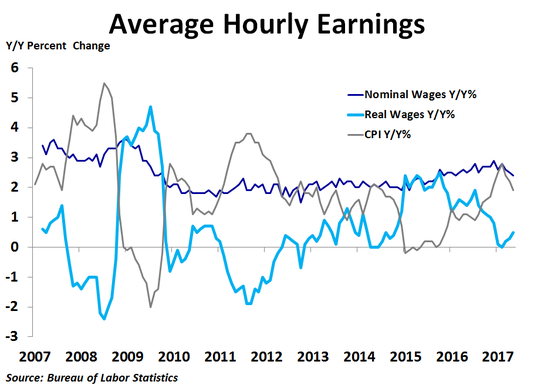

Average hourly earnings rose 0.2% and were up 2.5% from a year ago, down a bit from the 2.9% pace back in December. With inflation cooling recently, real wage growth has rebounded slightly but remains very weak.

Today’s report will give the hawks more incentive to push for another Fed rate hike soon. Even so, inflation remains well below the Fed’s target, so a rate hike is not necessary.

Average hourly earnings rose 0.2% and were up 2.5% from a year ago, down a bit from the 2.9% pace back in December. With inflation cooling recently, real wage growth has rebounded slightly but remains very weak.

Today’s report will give the hawks more incentive to push for another Fed rate hike soon. Even so, inflation remains well below the Fed’s target, so a rate hike is not necessary.

RSS Feed

RSS Feed