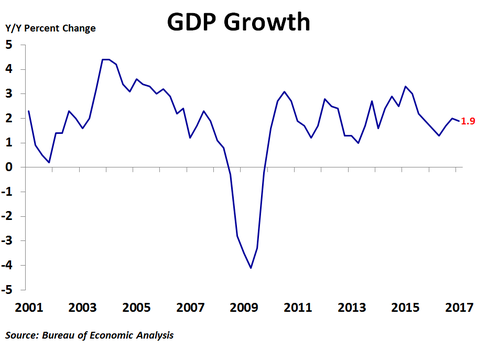

The U.S. economy was very weak in the first quarter, growing at an annualized rate of just 0.7% from the previous quarter, far below the 2.1% pace in the fourth quarter and less than the 1.1% consensus forecast. Compared to a year ago, the economy grew 1.9%, down from the fourth quarter’s 2.0% pace.

Gross private domestic investment drove what little growth there was in the first quarter, rising 4.3% from the previous quarter. Still, this was half the rate of growth seen in the fourth quarter. Non-residential investment rose a strong 9.4%, the most since the last quarter of 2013, driven by a big rebound in investment in structures and solid growth in investment in equipment. Residential investment also had a strong quarter, rising 13.7%, as the housing market continued to sizzle with construction, sales and prices all rising. On the other hand, the change in private inventories subtracted from growth. In a break with recent trends, consumer spending was very weak, rising just 0.3%, the slowest growth since the fourth quarter of 2009. Spending on goods rose just 0.1%, as non-durable goods rose 1.5% but durable goods plunged 2.5%, primarily due to a big pullback in purchases of motor vehicles. This may have been due, in part, to a rise in auto loan rates since the presidential election. However, consumption of services was also weak, rising just 0.4%, the least in four years. Trade contributed a sliver of growth as exports rose slightly more than imports. On the downside, government spending fell 1.7%, as national defense spending plunged 4.0% while state and local government spending fell 1.6%.

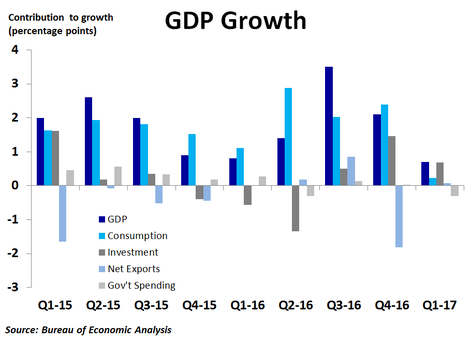

The contributions to growth were as follows: gross private domestic investment 0.69 percentage points (pp), which was weighed down by a lack of inventory building, consumer spending 0.23 pp, trade 0.07 pp and government spending -0.3 pp.

The contributions to growth were as follows: gross private domestic investment 0.69 percentage points (pp), which was weighed down by a lack of inventory building, consumer spending 0.23 pp, trade 0.07 pp and government spending -0.3 pp.

Today’s report is the first look at the overall economy under new President Donald Trump. While growth was very disappointing, it came after relatively strong growth in the second half of last year, and is not much of an aberration from the Obama years. Although the first three months of his administration were lackluster, there were no significant changes to economic policy during this time. The healthcare bill failed and tax reform, trade and infrastructure were not even addressed. Early in Trump’s first term, optimism remains high but uncertainty is widespread.

RSS Feed

RSS Feed