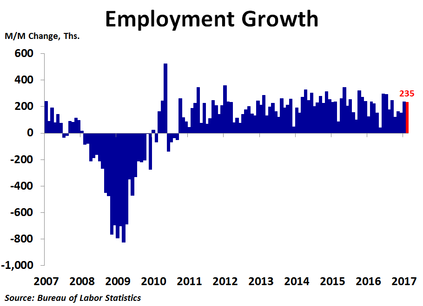

Job growth was strong again in February as the economy generated 235K new jobs, down slightly from the 238K increase in January, but far above the 200K consensus forecast. The rate of job growth held at 1.6% year-over-year for the fourth straight month.

Construction had a monster month, adding 58K new jobs, the most in ten years, most likely due to warmer than normal weather. Professional and business services followed with 37K new positions. Healthcare services had another good month, putting 33K more people to work. Following a loss of 5K jobs in January, education services bounced back with a 29K increase in February. Manufacturing also had a very good month as 28K workers were added to the payrolls, the most in over five years. This was likely the result of expectations for more business friendly policies under President Donald Trump, as well as some deals already made. Mining and logging added 9K jobs as well, the fourth straight monthly increase, which is good news since these jobs are on the higher end of the pay scale. Transportation and warehousing had a nice turnaround, adding 9K jobs after cutting 10K positions in January. Financial services had a weak month, adding just 7K new jobs after adding 32K jobs the month before.

On the downside, by far the biggest disappointment in today’s report is the massive 26K decline in retail trade employment, the biggest drop since December 2012, as many big box retailers are trimming staff in the wake of greater competition from online sales.

The unemployment rate ticked down to 4.7% from 4.8% as household employment jumped by 447K while only 340K people entered the labor force, meaning the increase in the labor force was fully absorbed, while 107K people who were already in the labor force, but were not working, also found jobs.

On the downside, by far the biggest disappointment in today’s report is the massive 26K decline in retail trade employment, the biggest drop since December 2012, as many big box retailers are trimming staff in the wake of greater competition from online sales.

The unemployment rate ticked down to 4.7% from 4.8% as household employment jumped by 447K while only 340K people entered the labor force, meaning the increase in the labor force was fully absorbed, while 107K people who were already in the labor force, but were not working, also found jobs.

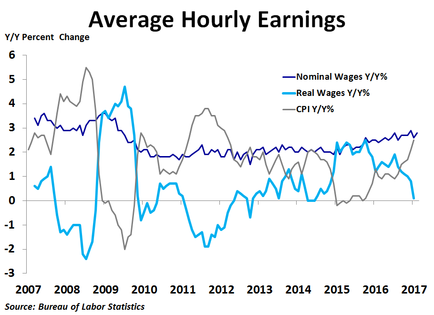

Average hourly earnings rose 0.2% and were up 2.8% from a year ago, a slight increase from the 2.6% pace in January. However, with inflation moving up recently, real wage growth has cratered and was completely flat in January.

The stock market rose mildly early after today’s report as rising employment and wages portend stronger consumer spending, but also higher labor costs. The Fed is expected to raise the Fed Funds rate by a quarter point next week as inflation continues to accelerate. Higher rates could put a dent in the housing and vehicle markets, which may offset any lift from more business-friendly economic policies.

The stock market rose mildly early after today’s report as rising employment and wages portend stronger consumer spending, but also higher labor costs. The Fed is expected to raise the Fed Funds rate by a quarter point next week as inflation continues to accelerate. Higher rates could put a dent in the housing and vehicle markets, which may offset any lift from more business-friendly economic policies.

RSS Feed

RSS Feed