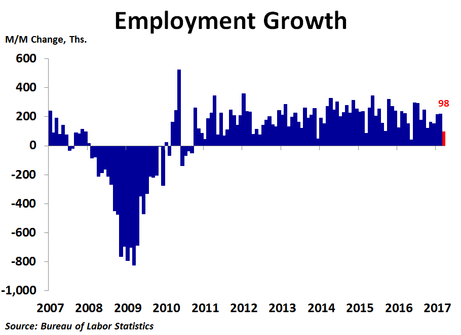

Job growth was very weak in March as the economy generated just 98K new jobs, down significantly from the 219K increase in February, and far below the 175K consensus forecast. In addition, revisions showed 38K fewer jobs were created in January and February. The rate of job growth slipped to 1.5% year-over-year, the slowest in four years.

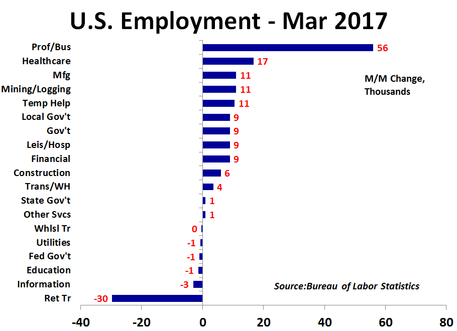

In this very weak report, only professional and business services saw any real strength, adding 56K new positions, driven largely by administrative and support services. Healthcare was a very distant second, creating just 17K new jobs, the fewest in three years. Manufacturing put 11K more people to work, which is a decent month for the industry but less than half the jobs created in February. Mining and logging did have a very good month as 11K more people found employment.

On the downside, by far the biggest disappointment in today’s report is another massive 30K decline in retail trade employment following a 31K plunge in February, which was the biggest drop since December 2009. Many big box retailers are trimming staff in the wake of greater competition from online sales. Although construction added 6K jobs, it was a far cry from the strength seen during the last several months. This, along with much slower job growth in healthcare and a loss in education jobs following a big gain in February, are the main reasons for the big miss in today’s report.

On the downside, by far the biggest disappointment in today’s report is another massive 30K decline in retail trade employment following a 31K plunge in February, which was the biggest drop since December 2009. Many big box retailers are trimming staff in the wake of greater competition from online sales. Although construction added 6K jobs, it was a far cry from the strength seen during the last several months. This, along with much slower job growth in healthcare and a loss in education jobs following a big gain in February, are the main reasons for the big miss in today’s report.

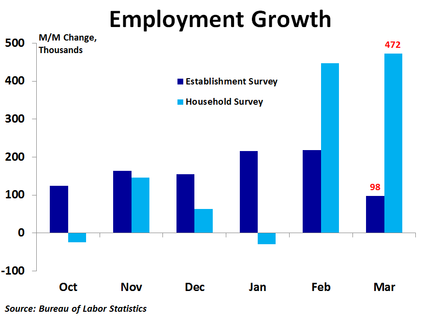

Despite the widespread weakness in hiring in March, the unemployment rate fell to 4.5% from 4.7% as household employment jumped by 472K while only 145K people entered the labor force, meaning the increase in the labor force was fully absorbed, while 326K people who were already in the labor force, but were not working, also found jobs. Job growth as reported in the household survey has been much stronger than that in the establishment survey the last two months, suggesting more job growth has been coming from smaller businesses and self-employment.

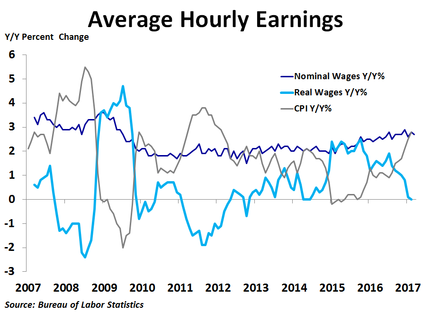

Average hourly earnings rose 0.2% and were up 2.7% from a year ago, a slight decrease from the 2.8% pace in February. However, with inflation moving up recently, real wage growth has cratered and was flat in February.

The stock market reaction to today’s report was muted, partly because weak hiring was offset by a lower unemployment rate, and partly because investors were weighing the consequences of the airstrikes in Syria. Markets will likely be on edge in the coming weeks.

RSS Feed

RSS Feed