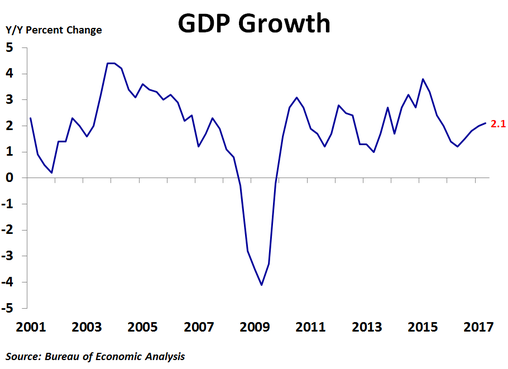

The U.S. economy gained strength in the second quarter, growing at an annualized rate of 2.6% from the previous quarter, far better than the 1.2% pace in the first quarter and in line with the consensus forecast. Compared to a year ago, the economy grew 2.1%, up from the first quarter’s 2.0% pace.

Consumer spending rebounded from a fairly weak first quarter, rising 2.8% from the previous quarter following the first quarter’s tepid 1.9% tally. Spending on goods rose 4.7%, as durable goods spending increased 6.3% and non-durable goods spending rose 3.8%, while spending on services rose just 1.9%. Gross private domestic investment rose 2.0%, but that was coming off a decline in the first quarter. Nonresidential investment rose 5.2%, driven by a strong 8.2% increase in equipment. Spending on structures rose 4.9% while spending on intellectual property inched up by 1.4%. Following a strong first quarter, residential investment fell 6.8%, the biggest decline since the third quarter of 2010. Private inventories actually declined in the second quarter, the first time that has happened since the third quarter of 2011 and certainly a big reason why overall growth was not stronger. Exports rose 4.1% while imports rose just 2.1%, helping to narrow the trade deficit slightly. Government spending rose 0.7%, but it was all at the federal level as national defense spending rose 5.2% while non-defense spending fell 1.9%. Meanwhile, state and local government spending declined 0.2%.

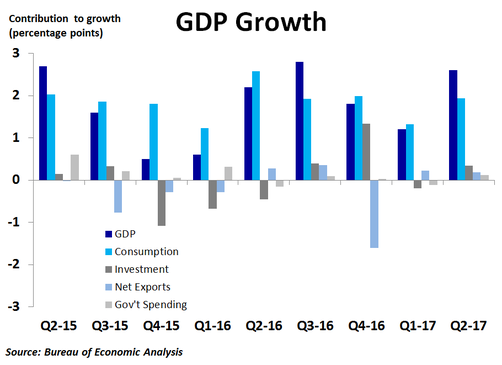

The contributions to growth were as follows: consumer spending 1.93 percentage points (pp), gross private domestic investment 0.34 percentage points (pp), which was weighed down by a decline in inventories, net exports 0.18 pp and government spending 0.12 pp.

The contributions to growth were as follows: consumer spending 1.93 percentage points (pp), gross private domestic investment 0.34 percentage points (pp), which was weighed down by a decline in inventories, net exports 0.18 pp and government spending 0.12 pp.

Today’s report is welcome news following two quarters of fairly weak economic growth, and will certainly be some relief for the Trump administration that appears to be in complete political chaos at the moment. Unfortunately, the vast majority of growth was from consumer spending, while all other parts of the economy contributed very little to growth. It was also disappointing to see one of the economy’s major drivers since the recession, residential investment, take a step back even though mortgage rates have been trending down recently. Should the Federal Reserve either raise the Fed Funds rate or start to trim its balance sheet, mortgage rates could rise and might put a big dent in housing and the economy. Thus, the Fed best tread carefully.

RSS Feed

RSS Feed