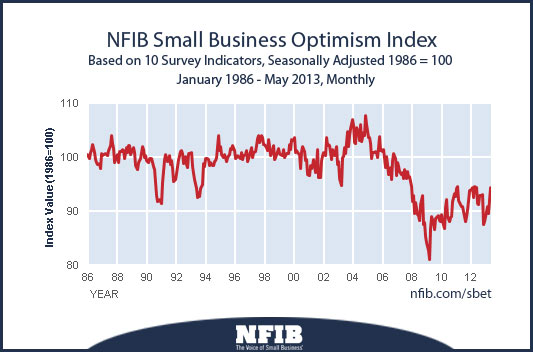

According to the National Federation of Independent Businesses, small businesses are the most optimistic in a year, as the index rose to 94.4 in May from 92.1 in April (see chart below). The biggest contribution to the increase was a 10 point rise in the share of respondents that expect the economy to improve over the next six months to -5% in May, up from -15% in April. An increase in sales expectations and expansion plans also supported the rise in optimism. Meanwhile, plans to make capital outlays remained unchanged while plans to increase hiring actually deteriorated by five percentage points.

Despite the increase in the overall index, the labor market picture for small businesses remains worrisome. The overall economy added 175K jobs in May, but small business current job openings were virtually unchanged while hiring plans remain muted, with only 5% of small businesses planning to increase employment over the next three months. This is certainly not sitting well with policymakers who have been trying to goose the economy with unprecedented stimulus.

The good news is that small business owners see a brighter economic outlook, as the -5% reading for this component was the best since October. Steady, albeit less-than-desired job growth, along with a resurgence in the housing and stock markets, are giving small businesses a boost of confidence. As a result, the outlook for sales has also improved, with 8% of businesses expecting stronger sales over the next three months, the highest reading in over a year. In turn, the outlook for earnings has also improved to the strongest reading in nearly a year, although on net, more firms expect lower earnings in the next three months. At the same time, the share of respondents expecting higher prices over the next three months fell to the lowest level since the end of 2011, suggesting inflation remains a non-issue, justifying the Fed's plan to keep interest rates low. The recent uptrend in compensation plans is good news for employees, but is slight enough that the Fed need not worry about a wage-price spiral at present.

Another piece of good news from the report is the fact that credit conditions continue to improve. The share of respondents expecting credit to be harder to obtain fell to just 6%, matching the March reading as the lowest since before the financial crisis. While the balance of firms are still expecting more difficult credit conditions, the decline in the share of firms with such an outlook is very good news because the lack of credit, especially for small businesses, has been a major impediment to economic and job growth during the recovery. Easier access to credit will help to grease the wheels of the small business sector, which accounts for a significant share of job creation.

Still, small businesses continue to worry about taxes and healthcare reform. Many are still holding the line until the tax situation becomes more clear and there is more clarity on all of the new laws, regulations and health plan premium costs. The implementation of the Affordable Care Act is likely to be rather turbulent for a time. This could throw a wrench into the recovery for a little while, and it must be kept in mind as small businesses and all decision makers plan their strategies for the next few years.

Despite the increase in the overall index, the labor market picture for small businesses remains worrisome. The overall economy added 175K jobs in May, but small business current job openings were virtually unchanged while hiring plans remain muted, with only 5% of small businesses planning to increase employment over the next three months. This is certainly not sitting well with policymakers who have been trying to goose the economy with unprecedented stimulus.

The good news is that small business owners see a brighter economic outlook, as the -5% reading for this component was the best since October. Steady, albeit less-than-desired job growth, along with a resurgence in the housing and stock markets, are giving small businesses a boost of confidence. As a result, the outlook for sales has also improved, with 8% of businesses expecting stronger sales over the next three months, the highest reading in over a year. In turn, the outlook for earnings has also improved to the strongest reading in nearly a year, although on net, more firms expect lower earnings in the next three months. At the same time, the share of respondents expecting higher prices over the next three months fell to the lowest level since the end of 2011, suggesting inflation remains a non-issue, justifying the Fed's plan to keep interest rates low. The recent uptrend in compensation plans is good news for employees, but is slight enough that the Fed need not worry about a wage-price spiral at present.

Another piece of good news from the report is the fact that credit conditions continue to improve. The share of respondents expecting credit to be harder to obtain fell to just 6%, matching the March reading as the lowest since before the financial crisis. While the balance of firms are still expecting more difficult credit conditions, the decline in the share of firms with such an outlook is very good news because the lack of credit, especially for small businesses, has been a major impediment to economic and job growth during the recovery. Easier access to credit will help to grease the wheels of the small business sector, which accounts for a significant share of job creation.

Still, small businesses continue to worry about taxes and healthcare reform. Many are still holding the line until the tax situation becomes more clear and there is more clarity on all of the new laws, regulations and health plan premium costs. The implementation of the Affordable Care Act is likely to be rather turbulent for a time. This could throw a wrench into the recovery for a little while, and it must be kept in mind as small businesses and all decision makers plan their strategies for the next few years.

RSS Feed

RSS Feed