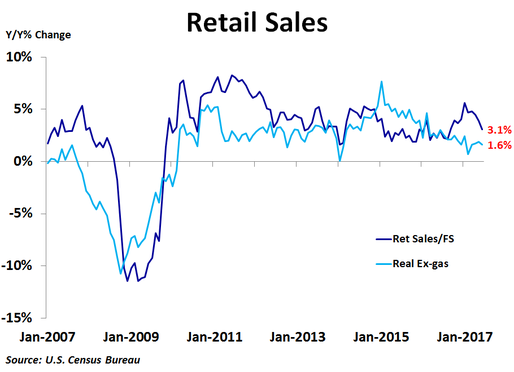

Retail sales fell 0.2% in June from the prior month, missing the consensus forecast of a 0.1% increase, following a 0.1% decrease in May that was revised up from a 0.3% decline. Sales excluding autos and gas missed expectations badly, falling 0.1% compared to expectations of a 0.4% increase. On a year-over-year basis, sales were up just 3.1%, down from the recent peak growth rate of 5.6% reached in January and the least since August.

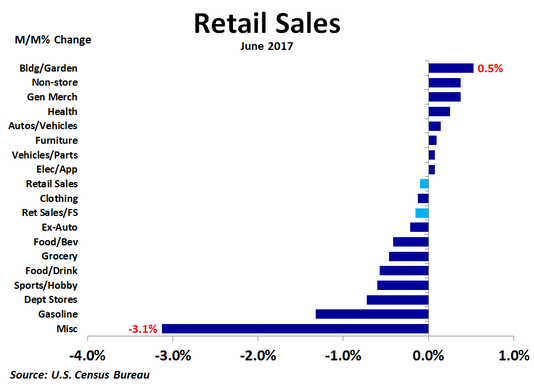

The biggest monthly increase in dollar terms was a $213 million, or 0.4%, increase in general merchandise sales. Non-store sales followed with a $193 million, or 0.4% increase. Building and garden supply stores took the third spot with a $161 million, or 0.5% increase. All three of these categories did better than vehicles, which only saw a $128 million, or 0.1%, rise in sales. The biggest decline in sales came from gasoline stations, where sales fell by $484 million, or 1.3%, as gas prices dropped. The miscellaneous category saw sales fall by $338 million, or 3.1%, the largest percentage drop of any category. Food and drink sales followed with a $324 million, or 0.6%, decline. Department store sales fell by $91 million, or 0.7%, as the industry continues to be challenged by online competitors.

Sales were higher on a year-over-year basis, led by a $4.8 billion, or 5.6%, increase in vehicle sales. Non-store sales were next with a $4.5 billion, or 9.6%, increase. Building and garden supply store sales have also been strong and were up $1.5 billion, or 5.2%, from a year ago. Only two categories were down from a year ago, led by a $528 million, or 6.9%, decline in sports and hobby stores. Department store sales were also down by $518 million, or 4.0%.

Sales were higher on a year-over-year basis, led by a $4.8 billion, or 5.6%, increase in vehicle sales. Non-store sales were next with a $4.5 billion, or 9.6%, increase. Building and garden supply store sales have also been strong and were up $1.5 billion, or 5.2%, from a year ago. Only two categories were down from a year ago, led by a $528 million, or 6.9%, decline in sports and hobby stores. Department store sales were also down by $518 million, or 4.0%.

If we take out the impact of gasoline sales, which are not really an indication of stronger or weaker economic growth but rather due to changing gas prices, ex-gas retail sales were up only 3.2% from a year ago in June, the least since August. If we also adjust for inflation, we see that real ex-gas retail sales were up just 1.6% in June, still on the lower end of the recent range, which has been trending down for two years.

Despite all of the weak May data, the Federal Reserve raised interest rates in June. Today’s retail sales report, along with another month of weaker than expected inflation data for June, suggests the June rate hike was probably not a wise move. If the weakness in housing data that we saw in May continued in June as well, criticism of the Fed may ramp up.

Despite all of the weak May data, the Federal Reserve raised interest rates in June. Today’s retail sales report, along with another month of weaker than expected inflation data for June, suggests the June rate hike was probably not a wise move. If the weakness in housing data that we saw in May continued in June as well, criticism of the Fed may ramp up.

RSS Feed

RSS Feed