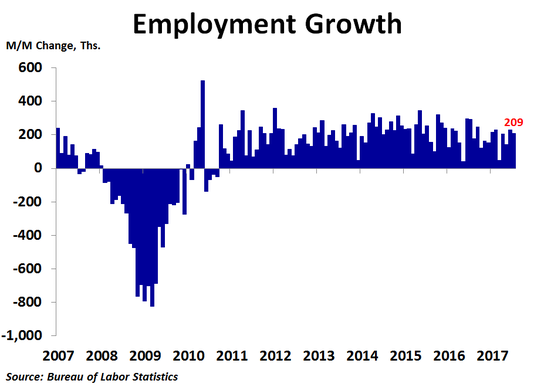

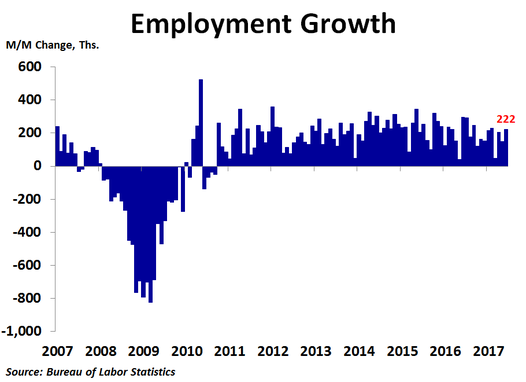

The only industry that lost jobs in July was utilities, and even that was a mild decline of just 900 positions. The fact that only one industry lost jobs in July goes to show how strong today’s report really is.

Even though 349K people entered the labor force in July, the unemployment rate fell from 4.4% to 4.3% as 345K of them found jobs, a remarkable 99% success rate!

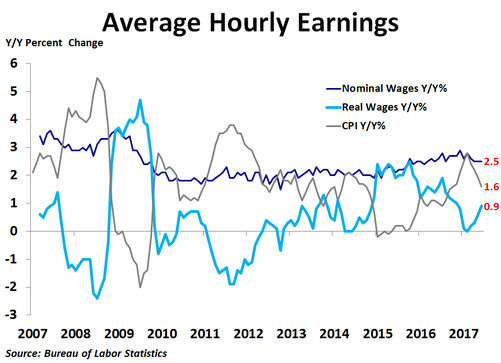

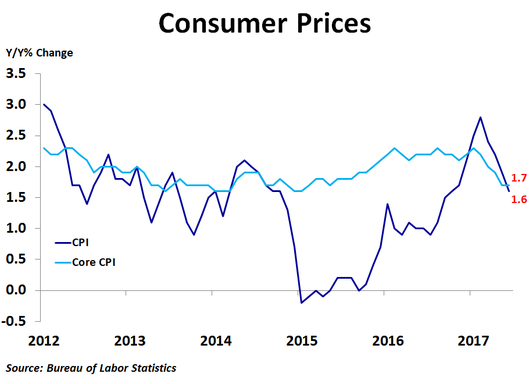

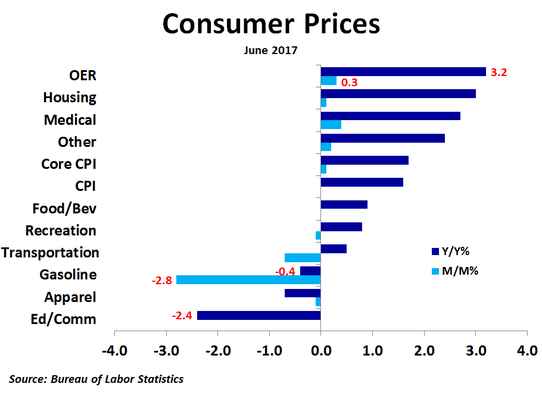

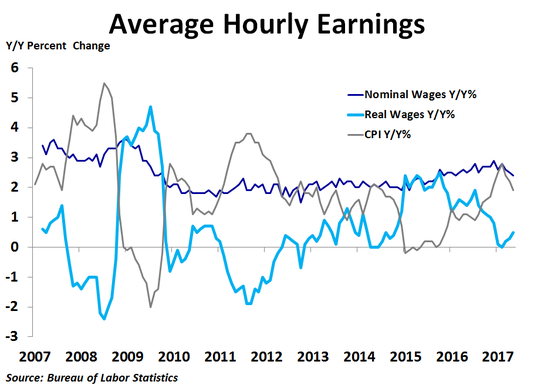

Average hourly earnings rose 0.3% and were up 2.5% from a year ago for the fourth straight month. With inflation cooling recently, real wage growth has rebounded slightly but remains very weak at just 0.9%.

Today’s report may give the hawks more incentive to push for another Fed rate hike soon. Even so, inflation remains well below the Fed’s target, so a rate hike is not necessary.

RSS Feed

RSS Feed